Check Point Software's Earnings Outlook

Author: Benzinga Insights | October 27, 2025 12:03pm

Check Point Software (NASDAQ:CHKP) will release its quarterly earnings report on Tuesday, 2025-10-28. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate Check Point Software to report an earnings per share (EPS) of $2.30.

Check Point Software bulls will hope to hear the company announce they've not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

Earnings Track Record

Last quarter the company beat EPS by $0.14, which was followed by a 0.25% drop in the share price the next day.

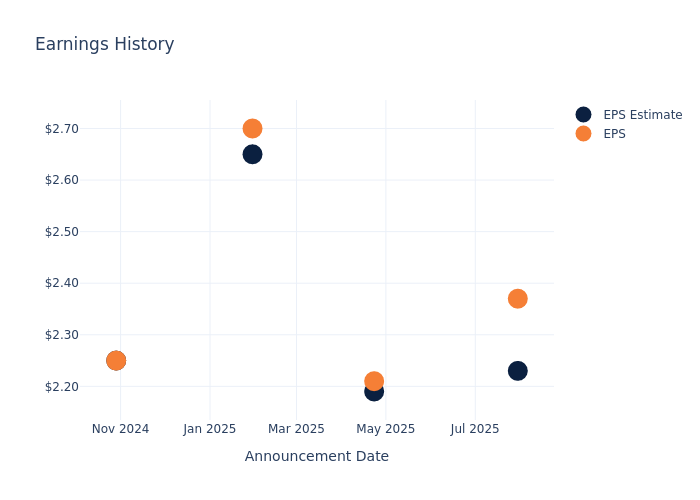

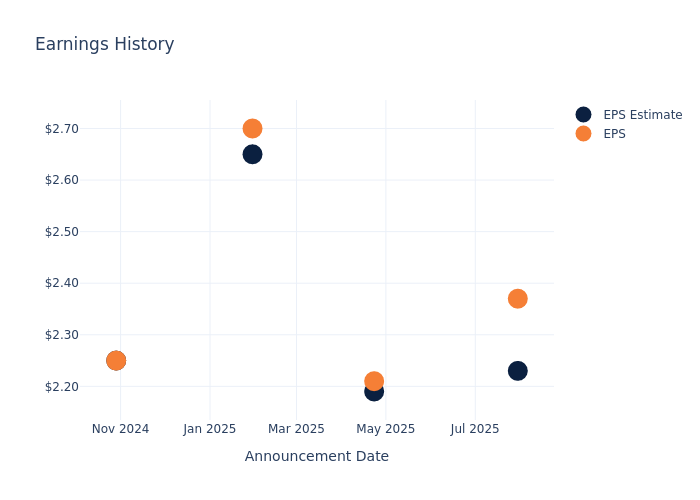

Here's a look at Check Point Software's past performance and the resulting price change:

| Quarter |

Q2 2025 |

Q1 2025 |

Q4 2024 |

Q3 2024 |

| EPS Estimate |

2.23 |

2.19 |

2.65 |

2.25 |

| EPS Actual |

2.37 |

2.21 |

2.70 |

2.25 |

| Price Change % |

0.00 |

2.00 |

0.00 |

-2.00 |

Check Point Software Share Price Analysis

Shares of Check Point Software were trading at $192.0 as of October 24. Over the last 52-week period, shares are up 8.15%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

To track all earnings releases for Check Point Software visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: CHKP