Assessing Apple's Performance Against Competitors In Technology Hardware, Storage & Peripherals Industry

Author: Benzinga Insights | November 11, 2025 10:01am

In the fast-paced and cutthroat world of business, conducting thorough company analysis is essential for investors and industry experts. In this article, we will undertake a comprehensive industry comparison, evaluating Apple (NASDAQ:AAPL) in comparison to its major competitors within the Technology Hardware, Storage & Peripherals industry. By analyzing crucial financial metrics, market position, and growth potential, our objective is to provide valuable insights for investors and offer a deeper understanding of company's performance in the industry.

Apple Background

Apple is among the largest companies in the world, with a broad portfolio of hardware and software products targeted at consumers and businesses. Apple's iPhone makes up a majority of the firm sales, and Apple's other products like Mac, iPad, and Watch are designed around the iPhone as the focal point of an expansive software ecosystem. Apple has progressively worked to add new applications, like streaming video, subscription bundles, and augmented reality. The firm designs its own software and semiconductors while working with subcontractors like Foxconn and TSMC to build its products and chips. Slightly less than half of Apple's sales come directly through its flagship stores, with a majority of sales coming indirectly through partnerships and distribution.

| Company |

P/E |

P/B |

P/S |

ROE |

EBITDA (in billions) |

Gross Profit (in billions) |

Revenue Growth |

| Apple Inc |

36.12 |

53.99 |

9.71 |

39.36% |

$35.55 |

$48.34 |

7.94% |

| Western Digital Corp |

24.54 |

10.12 |

6.26 |

20.57% |

$1.48 |

$1.23 |

27.4% |

| Hewlett Packard Enterprise Co |

28.09 |

1.29 |

0.96 |

1.14% |

$1.11 |

$2.67 |

18.5% |

| Pure Storage Inc |

225.54 |

23.04 |

9.40 |

3.68% |

$0.09 |

$0.6 |

12.73% |

| Super Micro Computer Inc |

31.65 |

3.68 |

1.21 |

2.62% |

$0.25 |

$0.47 |

-15.49% |

| NetApp Inc |

19.91 |

23.03 |

3.53 |

23.13% |

$0.38 |

$1.1 |

1.17% |

| Logitech International SA |

27.73 |

8.60 |

3.91 |

7.99% |

$0.22 |

$0.51 |

6.27% |

| Diebold Nixdorf Inc |

48.15 |

2.11 |

0.66 |

3.73% |

$0.11 |

$0.25 |

1.95% |

| Average |

57.94 |

10.27 |

3.7 |

8.98% |

$0.52 |

$0.98 |

7.5% |

After examining Apple, the following trends can be inferred:

-

The Price to Earnings ratio of 36.12 is 0.62x lower than the industry average, indicating potential undervaluation for the stock.

-

With a Price to Book ratio of 53.99, which is 5.26x the industry average, Apple might be considered overvalued in terms of its book value, as it is trading at a higher multiple compared to its industry peers.

-

The stock's relatively high Price to Sales ratio of 9.71, surpassing the industry average by 2.62x, may indicate an aspect of overvaluation in terms of sales performance.

-

With a Return on Equity (ROE) of 39.36% that is 30.38% above the industry average, it appears that the company exhibits efficient use of equity to generate profits.

-

The Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) of $35.55 Billion is 68.37x above the industry average, highlighting stronger profitability and robust cash flow generation.

-

The company has higher gross profit of $48.34 Billion, which indicates 49.33x above the industry average, indicating stronger profitability and higher earnings from its core operations.

-

The company is experiencing remarkable revenue growth, with a rate of 7.94%, outperforming the industry average of 7.5%.

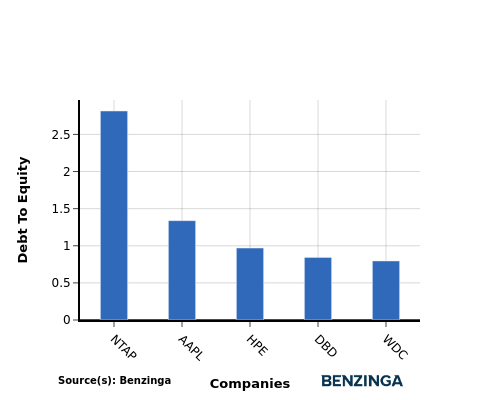

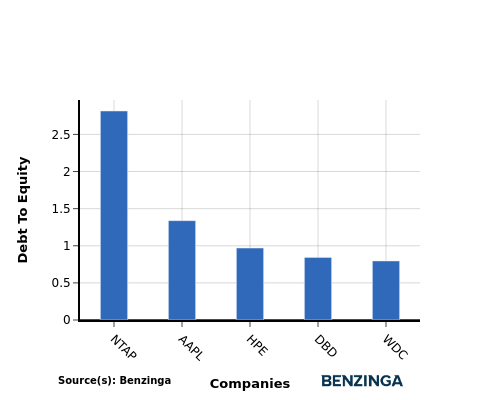

Debt To Equity Ratio

The debt-to-equity (D/E) ratio is a key indicator of a company's financial health and its reliance on debt financing.

Considering the debt-to-equity ratio in industry comparisons allows for a concise evaluation of a company's financial health and risk profile, aiding in informed decision-making.

When comparing Apple with its top 4 peers based on the Debt-to-Equity ratio, the following insights can be observed:

-

When compared to its top 4 peers, Apple has a moderate debt-to-equity ratio of 1.34.

-

This implies that the company maintains a balanced financial structure with a reasonable level of debt and an appropriate reliance on equity financing.

Key Takeaways

For Apple in the Technology Hardware, Storage & Peripherals industry, the PE ratio is low compared to peers, indicating potential undervaluation. The PB and PS ratios are high, suggesting overvaluation relative to industry standards. In terms of ROE, EBITDA, gross profit, and revenue growth, Apple demonstrates strong performance compared to its industry peers, reflecting robust financial health and growth potential.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: AAPL