Beyond The Numbers: 7 Analysts Discuss Vertex Stock

Author: Benzinga Insights | November 04, 2025 06:44am

Vertex (NASDAQ:VERX) has been analyzed by 7 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

2 |

2 |

3 |

0 |

0 |

| Last 30D |

1 |

0 |

0 |

0 |

0 |

| 1M Ago |

0 |

0 |

1 |

0 |

0 |

| 2M Ago |

0 |

1 |

0 |

0 |

0 |

| 3M Ago |

1 |

1 |

2 |

0 |

0 |

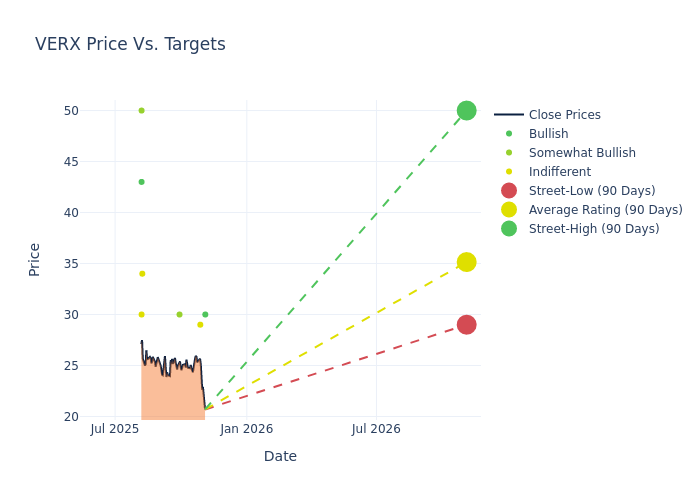

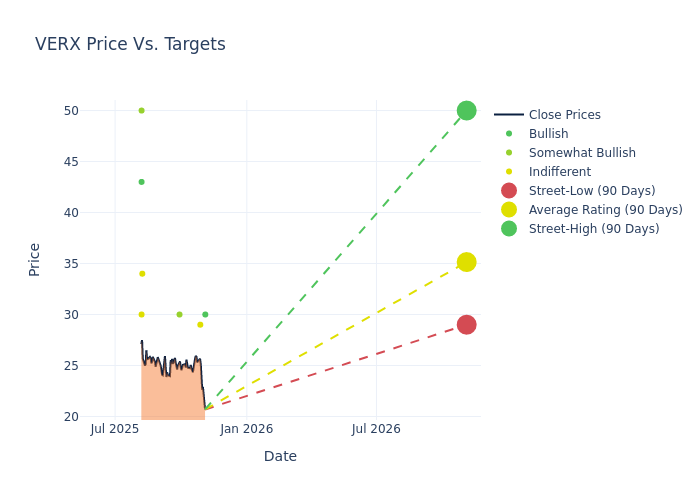

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $35.14, a high estimate of $50.00, and a low estimate of $29.00. This current average represents a 19.53% decrease from the previous average price target of $43.67.

Diving into Analyst Ratings: An In-Depth Exploration

A comprehensive examination of how financial experts perceive Vertex is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Joshua Reilly |

Needham |

Lowers |

Buy |

$30.00 |

$40.00 |

| Steven Enders |

Citigroup |

Lowers |

Neutral |

$29.00 |

$31.00 |

| Brett Huff |

Stephens & Co. |

Announces |

Overweight |

$30.00 |

- |

| Brad Sills |

B of A Securities |

Lowers |

Neutral |

$34.00 |

$42.00 |

| Adam Hotchkiss |

Goldman Sachs |

Lowers |

Buy |

$43.00 |

$50.00 |

| Patrick Walravens |

JMP Securities |

Lowers |

Market Outperform |

$50.00 |

$61.00 |

| Daniel Jester |

BMO Capital |

Lowers |

Market Perform |

$30.00 |

$38.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Vertex. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Vertex compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Vertex's stock. This examination reveals shifts in analysts' expectations over time.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Vertex's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Vertex analyst ratings.

All You Need to Know About Vertex

Vertex Inc is a provider of tax technology and services. Its software, content, and services help customers stay in compliance with indirect taxes that occur in taxing jurisdictions all over the world. Vertex provides cloud-based and on-premise solutions to specific industries for every line of tax, including income, sales, consumer use, value-added, and payroll. The company offers solutions such as tax determination, Tax Data Management, document management, and compliance and reporting among others. The company derives revenue from software subscriptions.

Financial Insights: Vertex

Market Capitalization Analysis: Below industry benchmarks, the company's market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: Vertex's remarkable performance in 3M is evident. As of 30 June, 2025, the company achieved an impressive revenue growth rate of 14.56%. This signifies a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Information Technology sector.

Net Margin: Vertex's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of -0.52%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Vertex's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of -0.43%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): Vertex's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of -0.08%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: Vertex's debt-to-equity ratio surpasses industry norms, standing at 1.42. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

Analyst Ratings: Simplified

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: VERX