Insights into Halozyme Therapeutics's Upcoming Earnings

Author: Benzinga Insights | October 31, 2025 01:02pm

Halozyme Therapeutics (NASDAQ:HALO) will release its quarterly earnings report on Monday, 2025-11-03. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate Halozyme Therapeutics to report an earnings per share (EPS) of $1.57.

Halozyme Therapeutics bulls will hope to hear the company announce they've not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

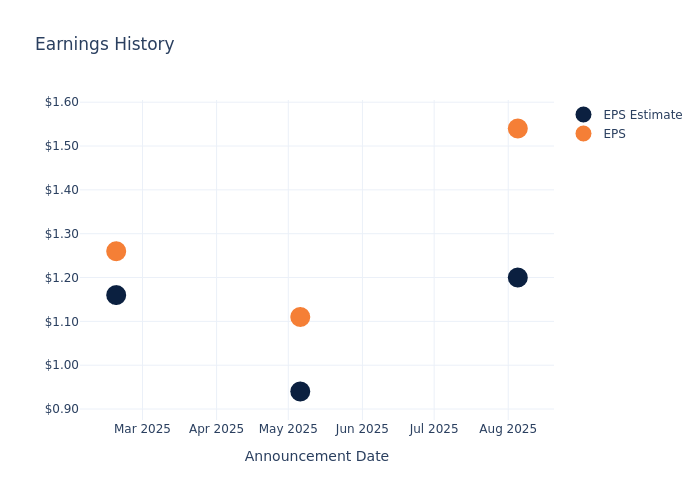

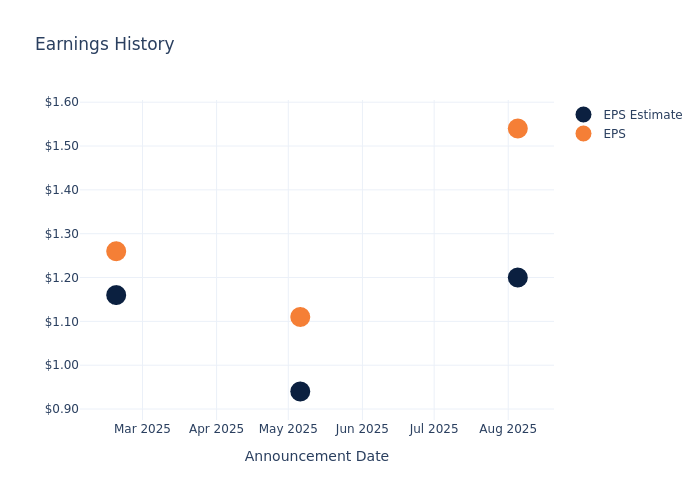

Past Earnings Performance

Last quarter the company beat EPS by $0.34, which was followed by a 2.48% increase in the share price the next day.

Here's a look at Halozyme Therapeutics's past performance and the resulting price change:

| Quarter |

Q2 2025 |

Q1 2025 |

Q4 2024 |

Q3 2024 |

| EPS Estimate |

1.20 |

0.94 |

1.16 |

0.98 |

| EPS Actual |

1.54 |

1.11 |

1.26 |

1.27 |

| Price Change % |

2.00 |

18.00 |

0.00 |

13.00 |

Stock Performance

Shares of Halozyme Therapeutics were trading at $64.63 as of October 30. Over the last 52-week period, shares are up 11.36%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

Analyst Observations about Halozyme Therapeutics

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Halozyme Therapeutics.

Halozyme Therapeutics has received a total of 12 ratings from analysts, with the consensus rating as Buy. With an average one-year price target of $79.42, the consensus suggests a potential 22.88% upside.

Comparing Ratings with Competitors

The analysis below examines the analyst ratings and average 1-year price targets of and Rhythm Pharmaceuticals, three significant industry players, providing valuable insights into their relative performance expectations and market positioning.

- Analysts currently favor an Buy trajectory for Rhythm Pharmaceuticals, with an average 1-year price target of $124.4, suggesting a potential 92.48% upside.

Analysis Summary for Peers

The peer analysis summary outlines pivotal metrics for and Rhythm Pharmaceuticals, demonstrating their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company |

Consensus |

Revenue Growth |

Gross Profit |

Return on Equity |

| Halozyme Therapeutics |

Buy |

40.79% |

$279.36M |

40.53% |

| Rhythm Pharmaceuticals |

Buy |

66.80% |

$42.96M |

-1363.29% |

Key Takeaway:

Halozyme Therapeutics ranks higher than its peers in terms of Revenue Growth and Gross Profit. However, it lags behind in terms of Return on Equity.

Unveiling the Story Behind Halozyme Therapeutics

Halozyme Therapeutics Inc is a biotechnology company focused on developing and commercializing novel oncology therapies. The company seeks to create therapies focused on human enzymes that alter tumors. Halozyme focuses on developing its proprietary products in therapeutic areas with a focus on oncology, and licensing its technology to biopharmaceutical companies to collaboratively develop products. The company's operations are based in the United States, with minimal long-lived assets located internationally.

Understanding the Numbers: Halozyme Therapeutics's Finances

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Growth: Halozyme Therapeutics displayed positive results in 3 months. As of 30 June, 2025, the company achieved a solid revenue growth rate of approximately 40.79%. This indicates a notable increase in the company's top-line earnings. When compared to others in the Health Care sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Halozyme Therapeutics's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 50.71% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Halozyme Therapeutics's ROE stands out, surpassing industry averages. With an impressive ROE of 40.53%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Halozyme Therapeutics's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 7.77%, the company showcases efficient use of assets and strong financial health.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 4.54, caution is advised due to increased financial risk.

To track all earnings releases for Halozyme Therapeutics visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: HALO