West Pharmaceutical Servs's Earnings Outlook

Author: Benzinga Insights | October 22, 2025 11:02am

West Pharmaceutical Servs (NYSE:WST) is preparing to release its quarterly earnings on Thursday, 2025-10-23. Here's a brief overview of what investors should keep in mind before the announcement.

Analysts expect West Pharmaceutical Servs to report an earnings per share (EPS) of $1.68.

West Pharmaceutical Servs bulls will hope to hear the company announce they've not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

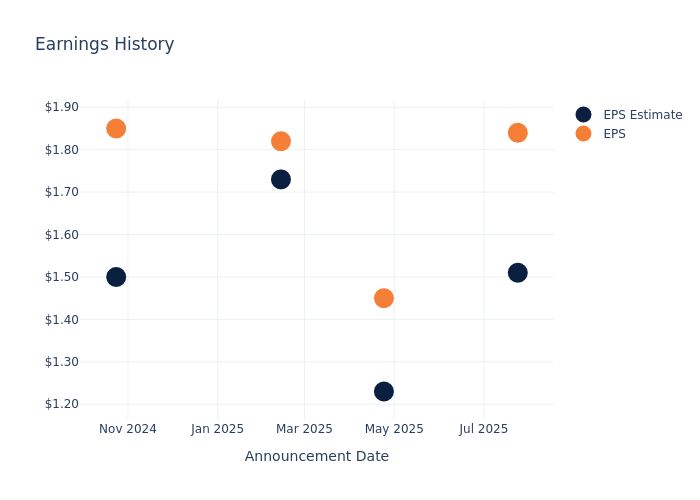

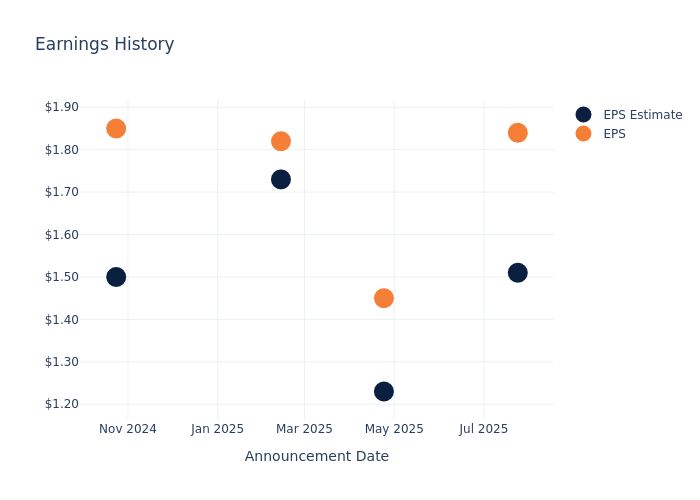

Earnings History Snapshot

The company's EPS beat by $0.33 in the last quarter, leading to a 5.59% drop in the share price on the following day.

Here's a look at West Pharmaceutical Servs's past performance and the resulting price change:

| Quarter |

Q2 2025 |

Q1 2025 |

Q4 2024 |

Q3 2024 |

| EPS Estimate |

1.51 |

1.23 |

1.73 |

1.50 |

| EPS Actual |

1.84 |

1.45 |

1.82 |

1.85 |

| Price Change % |

-6.00 |

2.00 |

8.00 |

-7.00 |

Performance of West Pharmaceutical Servs Shares

Shares of West Pharmaceutical Servs were trading at $279.39 as of October 21. Over the last 52-week period, shares are down 15.42%. Given that these returns are generally negative, long-term shareholders are likely bearish going into this earnings release.

Analyst Opinions on West Pharmaceutical Servs

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on West Pharmaceutical Servs.

The consensus rating for West Pharmaceutical Servs is Buy, based on 5 analyst ratings. With an average one-year price target of $303.2, there's a potential 8.52% upside.

Peer Ratings Overview

In this analysis, we delve into the analyst ratings and average 1-year price targets of Waters, Illumina and Tempus AI, three key industry players, offering insights into their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Waters, with an average 1-year price target of $346.0, suggesting a potential 23.84% upside.

- Analysts currently favor an Neutral trajectory for Illumina, with an average 1-year price target of $108.29, suggesting a potential 61.24% downside.

- Analysts currently favor an Buy trajectory for Tempus AI, with an average 1-year price target of $91.33, suggesting a potential 67.31% downside.

Peer Analysis Summary

In the peer analysis summary, key metrics for Waters, Illumina and Tempus AI are highlighted, providing an understanding of their respective standings within the industry and offering insights into their market positions and comparative performance.

| Company |

Consensus |

Revenue Growth |

Gross Profit |

Return on Equity |

| West Pharmaceutical Servs |

Buy |

9.17% |

$273.90M |

4.70% |

| Waters |

Neutral |

8.86% |

$449.93M |

7.14% |

| Illumina |

Neutral |

-4.77% |

$695M |

10.16% |

| Tempus AI |

Buy |

89.57% |

$195.04M |

-13.48% |

Key Takeaway:

West Pharmaceutical Servs ranks at the top for Revenue Growth and Gross Profit among its peers. It is in the middle for Consensus and Return on Equity.

Delving into West Pharmaceutical Servs's Background

West Pharmaceutical Services is based in Pennsylvania and is a key supplier to firms in the pharmaceutical, biotechnology, and generic drug industries. West sells elastomer-based packaging components (including stoppers, seals, and plungers), nonglass containment solutions, and auto-injectors for injectable drugs, which include large-molecule biologics, peptides such as GLP-1 receptor agonists, and small-molecule drugs. The company reports in two segments: proprietary products (about 80% of total revenue) and contract-manufactured products (about 20% of total revenue). It generates approximately 55% of its revenue from international markets and 45% from the United States.

West Pharmaceutical Servs's Financial Performance

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Growth: West Pharmaceutical Servs's remarkable performance in 3 months is evident. As of 30 June, 2025, the company achieved an impressive revenue growth rate of 9.17%. This signifies a substantial increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Health Care sector.

Net Margin: West Pharmaceutical Servs's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 17.2% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): West Pharmaceutical Servs's ROE stands out, surpassing industry averages. With an impressive ROE of 4.7%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): West Pharmaceutical Servs's ROA excels beyond industry benchmarks, reaching 3.48%. This signifies efficient management of assets and strong financial health.

Debt Management: West Pharmaceutical Servs's debt-to-equity ratio is below the industry average. With a ratio of 0.1, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

To track all earnings releases for West Pharmaceutical Servs visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: WST