Broadcom Unusual Options Activity

Author: Benzinga Insights | October 16, 2025 11:01am

Deep-pocketed investors have adopted a bullish approach towards Broadcom (NASDAQ:AVGO), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in AVGO usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 67 extraordinary options activities for Broadcom. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 43% leaning bullish and 35% bearish. Among these notable options, 17 are puts, totaling $947,818, and 50 are calls, amounting to $4,357,269.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $125.0 to $500.0 for Broadcom over the last 3 months.

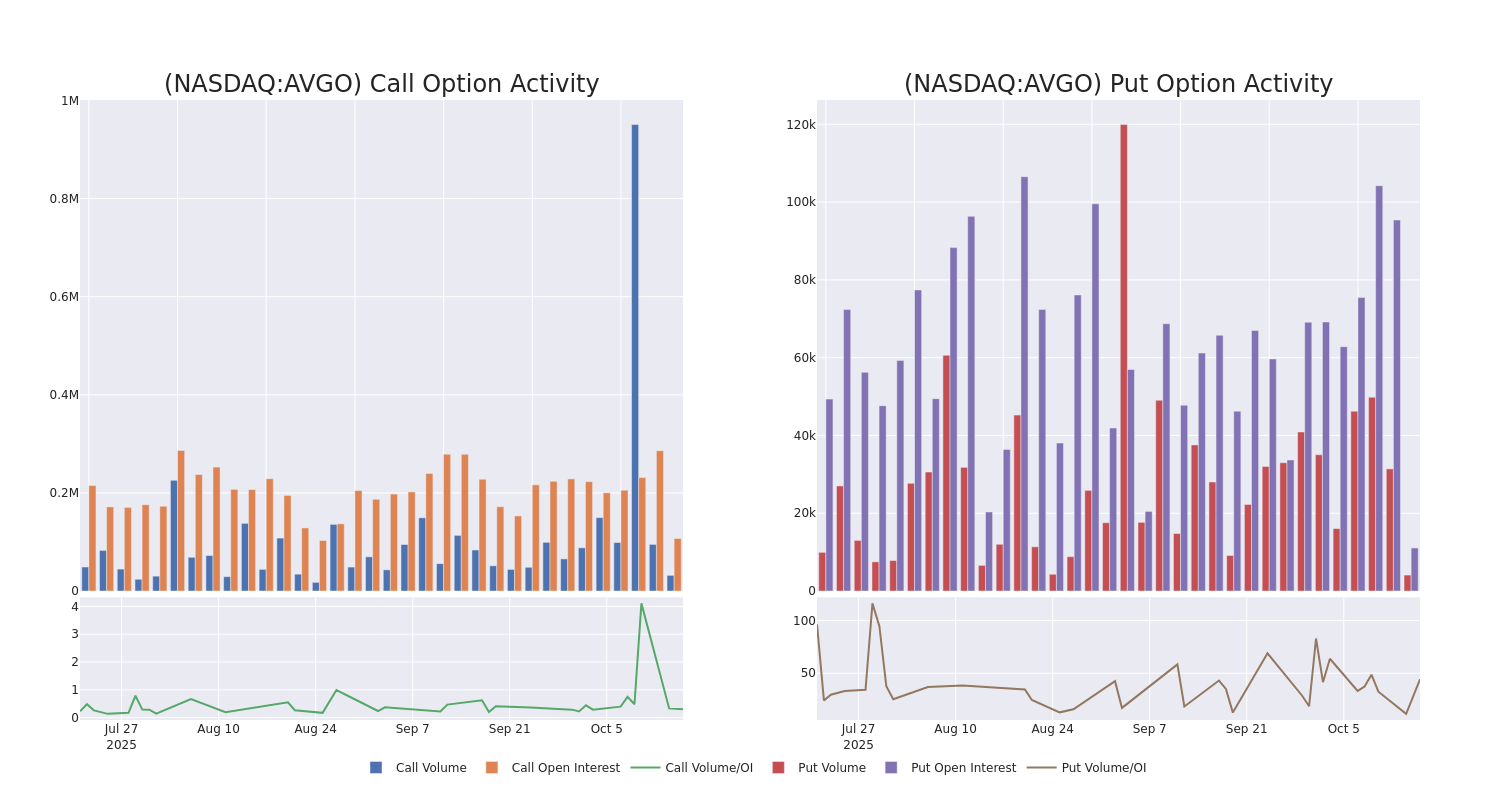

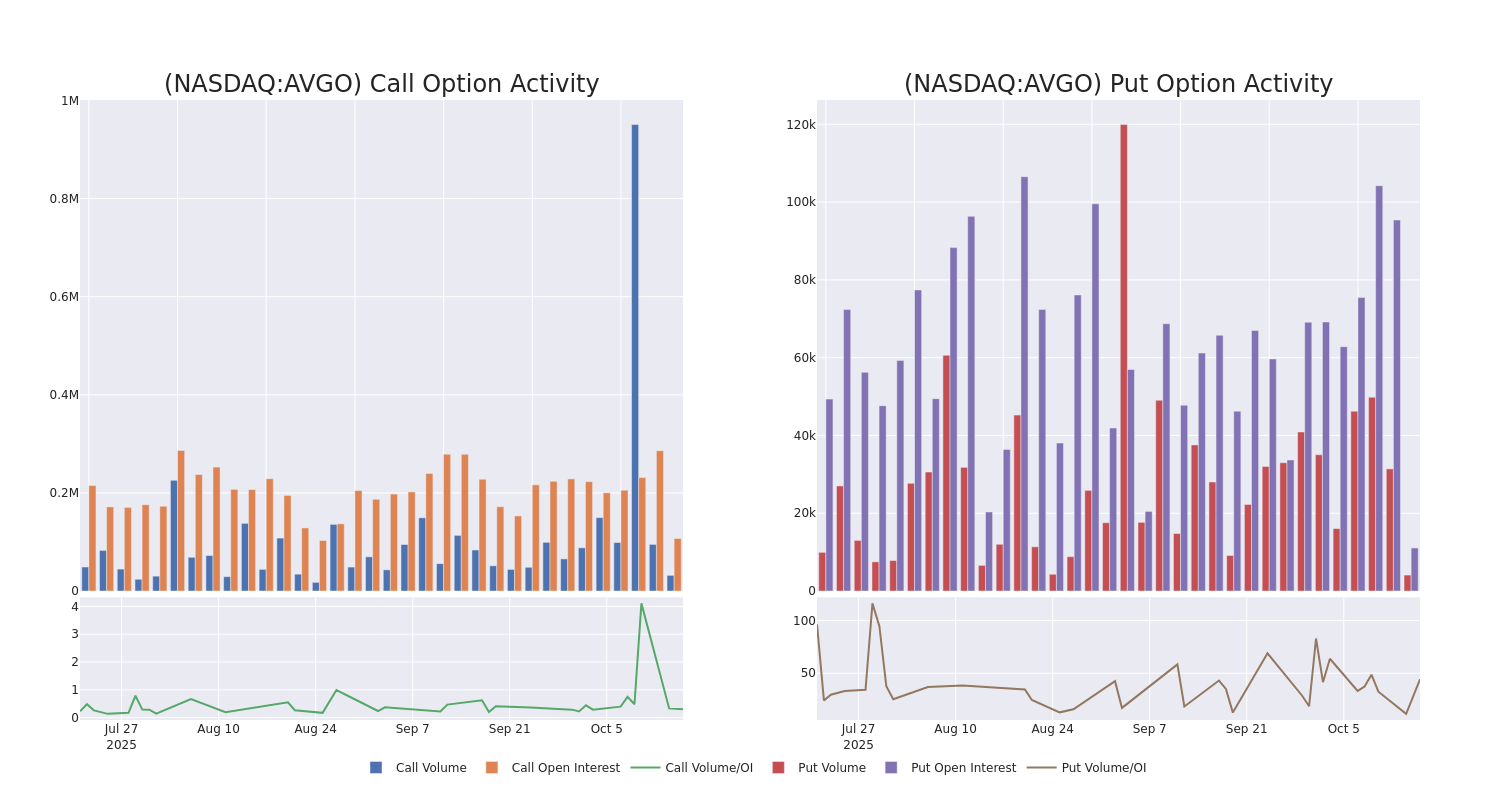

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Broadcom's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Broadcom's whale trades within a strike price range from $125.0 to $500.0 in the last 30 days.

Broadcom 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| AVGO |

CALL |

SWEEP |

BULLISH |

01/16/26 |

$5.35 |

$5.35 |

$5.35 |

$500.00 |

$513.0K |

7.8K |

6.3K |

| AVGO |

CALL |

TRADE |

BULLISH |

02/20/26 |

$115.0 |

$115.0 |

$115.0 |

$250.00 |

$322.0K |

698 |

28 |

| AVGO |

CALL |

SWEEP |

BULLISH |

01/16/26 |

$5.15 |

$5.05 |

$5.15 |

$500.00 |

$237.9K |

7.8K |

1.2K |

| AVGO |

PUT |

SWEEP |

BEARISH |

12/19/25 |

$17.3 |

$17.25 |

$17.3 |

$330.00 |

$166.0K |

5.1K |

350 |

| AVGO |

CALL |

SWEEP |

BULLISH |

01/16/26 |

$5.15 |

$5.1 |

$5.15 |

$500.00 |

$157.1K |

7.8K |

2.0K |

About Broadcom

Broadcom is one of the largest semiconductor companies in the world and has also expanded into infrastructure software. Its semiconductors primarily serve computing, wired connectivity, and wireless connectivity. It is primarily a fabless designer but holds some manufacturing in-house, such as for its best-of-breed film bulk acoustic resonator filters that sell into the Apple iPhone. In software, it sells virtualization, infrastructure, and security software to large enterprises, financial institutions, and governments. Broadcom is the product of consolidation. Its businesses are an amalgamation of former companies like legacy Broadcom and Avago Technologies in chips, as well as VMware, Brocade, CA Technologies, and Symantec in software.

Following our analysis of the options activities associated with Broadcom, we pivot to a closer look at the company's own performance.

Current Position of Broadcom

- With a trading volume of 5,528,802, the price of AVGO is up by 3.22%, reaching $362.64.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 56 days from now.

What Analysts Are Saying About Broadcom

In the last month, 5 experts released ratings on this stock with an average target price of $420.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on Broadcom with a target price of $450.

* Maintaining their stance, an analyst from UBS continues to hold a Buy rating for Broadcom, targeting a price of $415.

* Maintaining their stance, an analyst from Deutsche Bank continues to hold a Buy rating for Broadcom, targeting a price of $400.

* Consistent in their evaluation, an analyst from Keybanc keeps a Overweight rating on Broadcom with a target price of $420.

* An analyst from Citigroup has decided to maintain their Buy rating on Broadcom, which currently sits at a price target of $415.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Broadcom, Benzinga Pro gives you real-time options trades alerts.

Posted In: AVGO