Assessing BlackRock: Insights From 10 Financial Analysts

Author: Benzinga Insights | October 15, 2025 09:01am

Across the recent three months, 10 analysts have shared their insights on BlackRock (NYSE:BLK), expressing a variety of opinions spanning from bullish to bearish.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

4 |

6 |

0 |

0 |

0 |

| Last 30D |

1 |

0 |

0 |

0 |

0 |

| 1M Ago |

3 |

5 |

0 |

0 |

0 |

| 2M Ago |

0 |

1 |

0 |

0 |

0 |

| 3M Ago |

0 |

0 |

0 |

0 |

0 |

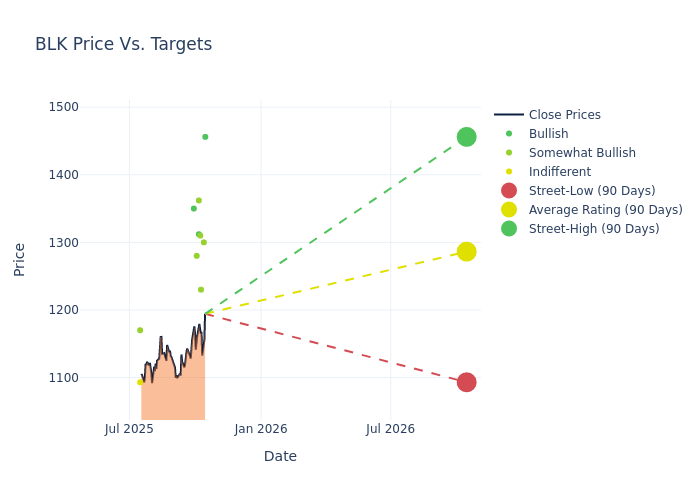

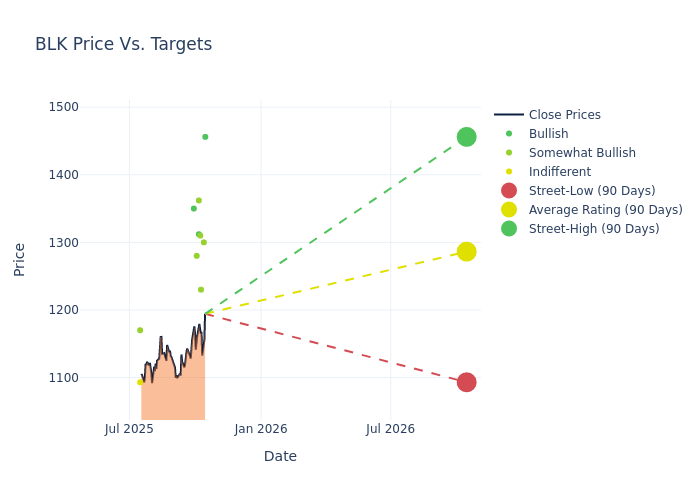

In the assessment of 12-month price targets, analysts unveil insights for BlackRock, presenting an average target of $1319.6, a high estimate of $1456.00, and a low estimate of $1200.00. This upward trend is evident, with the current average reflecting a 7.97% increase from the previous average price target of $1222.22.

Diving into Analyst Ratings: An In-Depth Exploration

A clear picture of BlackRock's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Craig Siegenthaler |

B of A Securities |

Raises |

Buy |

$1456.00 |

$1394.00 |

| Kyle Voigt |

Keefe, Bruyette & Woods |

Raises |

Outperform |

$1300.00 |

$1215.00 |

| Glenn Schorr |

Evercore ISI Group |

Raises |

Outperform |

$1230.00 |

$1200.00 |

| Benjamin Budish |

Barclays |

Raises |

Overweight |

$1310.00 |

$1210.00 |

| Alexander Blostein |

Goldman Sachs |

Raises |

Buy |

$1312.00 |

$1163.00 |

| Mike Cyprys |

Morgan Stanley |

Raises |

Overweight |

$1362.00 |

$1224.00 |

| James Fotheringham |

BMO Capital |

Announces |

Outperform |

$1280.00 |

- |

| Craig Siegenthaler |

B of A Securities |

Raises |

Buy |

$1396.00 |

$1224.00 |

| Christopher Allen |

Citigroup |

Raises |

Buy |

$1350.00 |

$1200.00 |

| Glenn Schorr |

Evercore ISI Group |

Raises |

Outperform |

$1200.00 |

$1170.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to BlackRock. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of BlackRock compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of BlackRock's stock. This comparison reveals trends in analysts' expectations over time.

For valuable insights into BlackRock's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on BlackRock analyst ratings.

Unveiling the Story Behind BlackRock

BlackRock is the largest asset manager in the world, with $12.528 trillion in assets under management at the end of June 2025. Its product mix is diverse, with 54% of managed assets in equity strategies, 25% in fixed income, 8% in multi-asset classes, 8% in money market funds, and 5% in alternatives. Passive strategies account for two-thirds of long-term AUM, with the company's ETF platform maintaining a leading market share domestically and on a global basis. Product distribution is weighted more toward institutional clients, which, by our calculations, account for around 80% of AUM. BlackRock is geographically diverse, with clients in more than 100 countries and more than one-third of managed assets coming from investors domiciled outside the US and Canada.

Unraveling the Financial Story of BlackRock

Market Capitalization Analysis: The company's market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Positive Revenue Trend: Examining BlackRock's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 12.86% as of 30 June, 2025, showcasing a substantial increase in top-line earnings. When compared to others in the Financials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: BlackRock's net margin excels beyond industry benchmarks, reaching 29.37%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): BlackRock's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 3.28%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): BlackRock's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 1.1%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: BlackRock's debt-to-equity ratio is below the industry average. With a ratio of 0.3, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Understanding the Relevance of Analyst Ratings

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: BLK