Decoding Salesforce's Options Activity: What's the Big Picture?

Author: Benzinga Insights | October 14, 2025 11:01am

Deep-pocketed investors have adopted a bullish approach towards Salesforce (NYSE:CRM), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in CRM usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 43 extraordinary options activities for Salesforce. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 37% leaning bullish and 37% bearish. Among these notable options, 4 are puts, totaling $284,235, and 39 are calls, amounting to $3,395,089.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $190.0 to $330.0 for Salesforce over the recent three months.

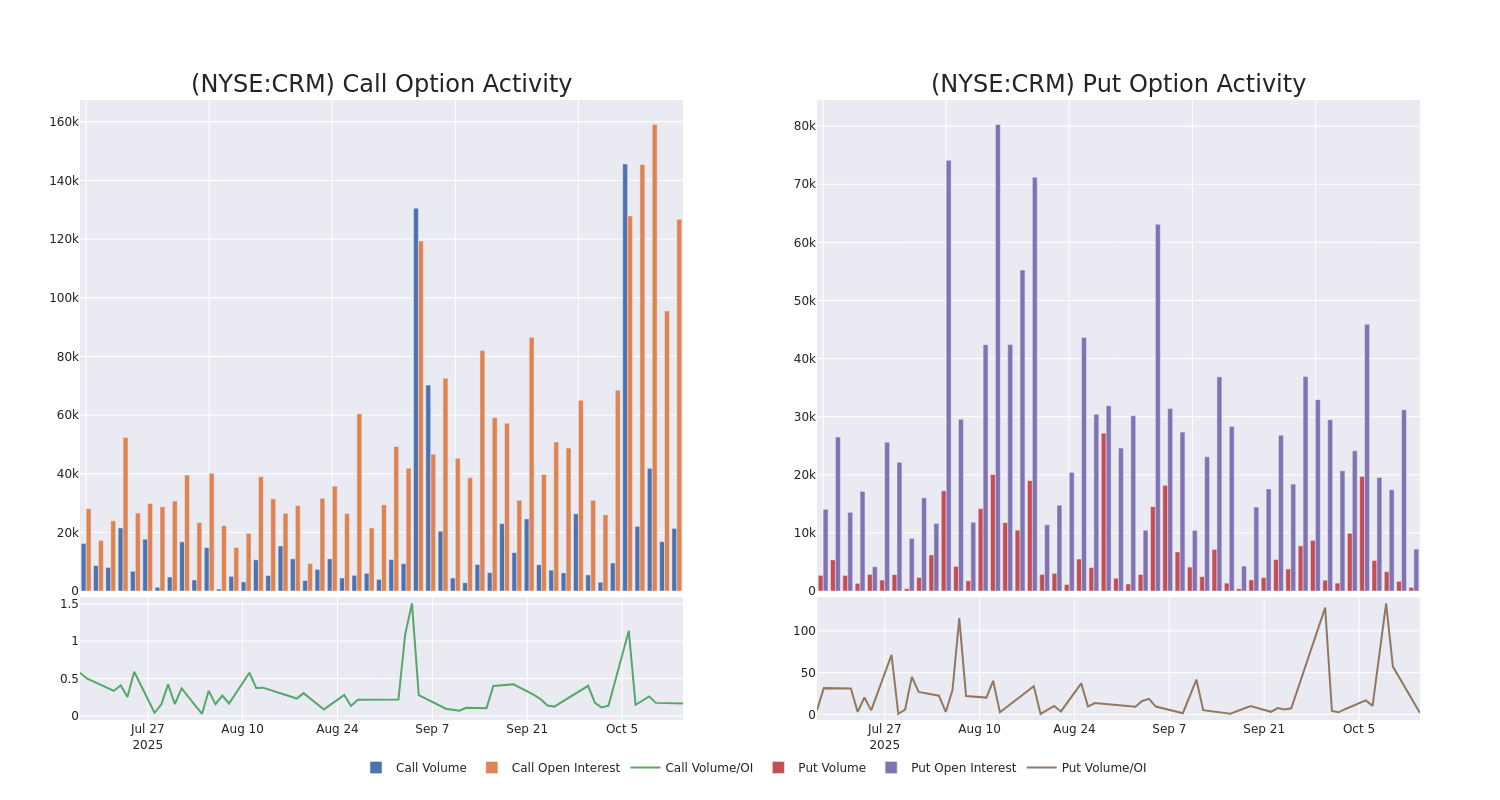

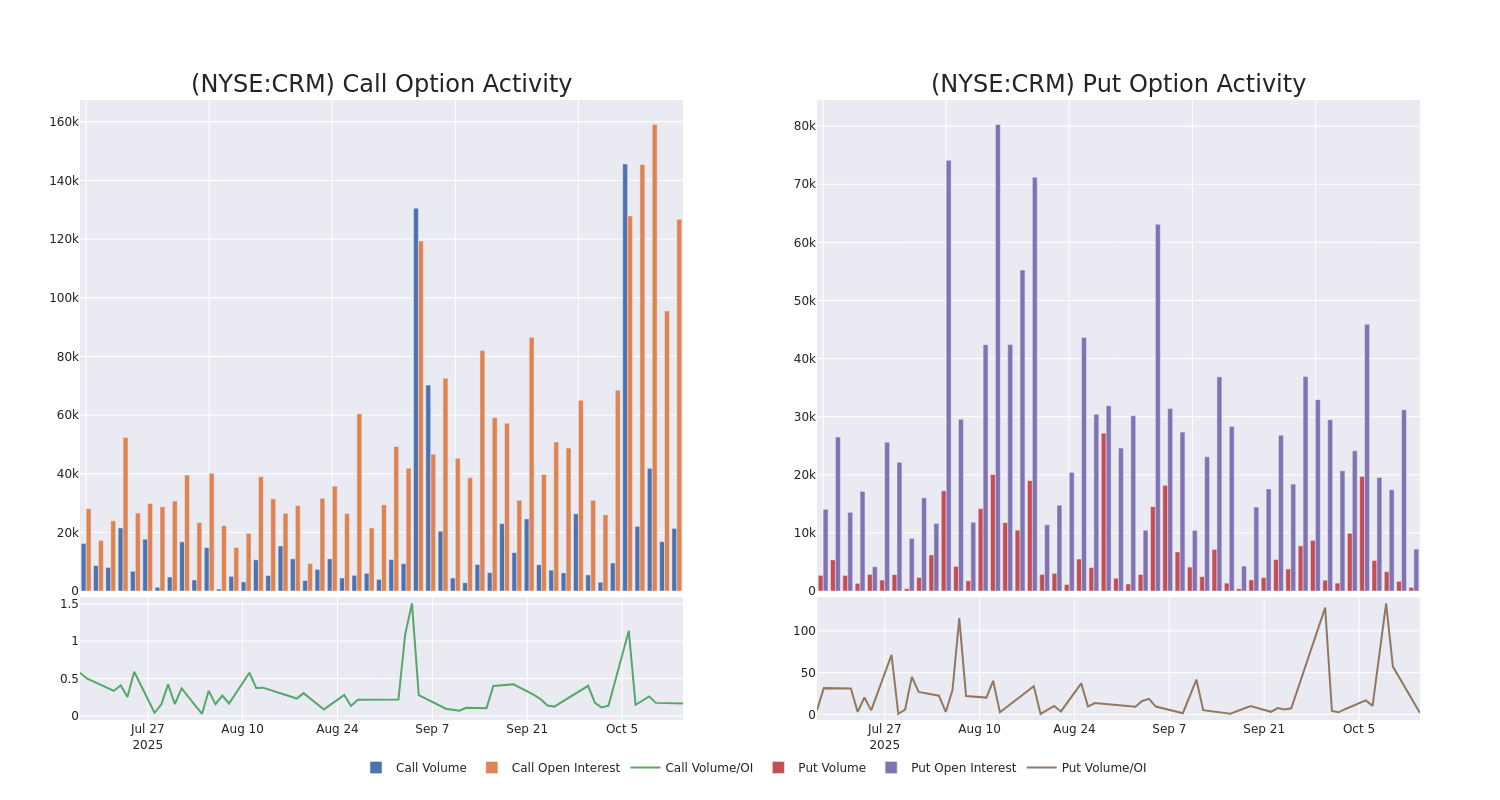

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Salesforce's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Salesforce's whale trades within a strike price range from $190.0 to $330.0 in the last 30 days.

Salesforce 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| CRM |

CALL |

SWEEP |

BULLISH |

10/24/25 |

$9.6 |

$9.4 |

$9.47 |

$240.00 |

$385.9K |

300 |

479 |

| CRM |

CALL |

SWEEP |

BEARISH |

09/18/26 |

$13.55 |

$13.1 |

$13.1 |

$330.00 |

$328.8K |

233 |

252 |

| CRM |

CALL |

SWEEP |

BULLISH |

05/15/26 |

$64.35 |

$64.2 |

$64.35 |

$190.00 |

$270.2K |

25 |

22 |

| CRM |

CALL |

TRADE |

NEUTRAL |

12/19/25 |

$18.75 |

$17.7 |

$18.3 |

$250.00 |

$245.2K |

3.5K |

145 |

| CRM |

CALL |

SWEEP |

NEUTRAL |

02/20/26 |

$52.9 |

$51.7 |

$51.7 |

$200.00 |

$212.3K |

71 |

48 |

About Salesforce

Salesforce provides enterprise cloud computing solutions. The company offers customer relationship management technology that brings companies and customers together. Its Customer 360 platform helps the group deliver a single source of truth, connecting customer data across systems, apps, and devices to help companies sell, service, market, and conduct commerce. It also offers Service Cloud for customer support, Marketing Cloud for digital marketing campaigns, Commerce Cloud as an e-commerce engine, the Salesforce Platform, which allows enterprises to build applications, and other solutions, such as MuleSoft for data integration.

In light of the recent options history for Salesforce, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Salesforce's Current Market Status

- With a volume of 2,634,887, the price of CRM is down -1.96% at $243.88.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 49 days.

Professional Analyst Ratings for Salesforce

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $300.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Stifel persists with their Buy rating on Salesforce, maintaining a target price of $300.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Salesforce with Benzinga Pro for real-time alerts.

Posted In: CRM