The Analyst Verdict: Teradyne In The Eyes Of 7 Experts

Author: Benzinga Insights | October 09, 2025 05:01pm

7 analysts have shared their evaluations of Teradyne (NASDAQ:TER) during the recent three months, expressing a mix of bullish and bearish perspectives.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

2 |

1 |

3 |

0 |

1 |

| Last 30D |

0 |

0 |

0 |

0 |

1 |

| 1M Ago |

0 |

1 |

0 |

0 |

0 |

| 2M Ago |

0 |

0 |

0 |

0 |

0 |

| 3M Ago |

2 |

0 |

3 |

0 |

0 |

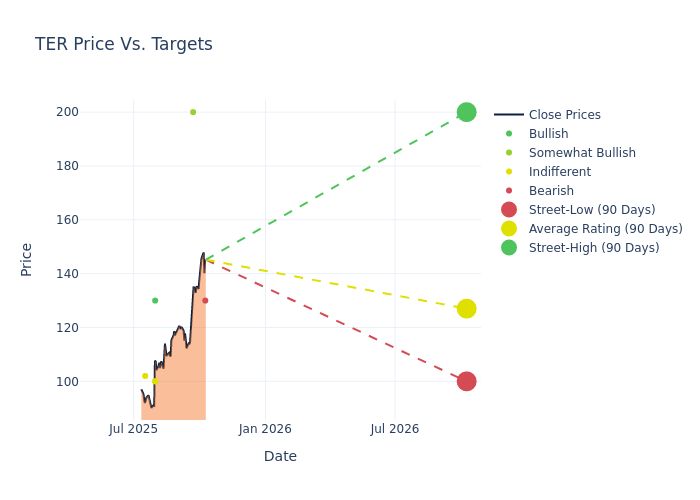

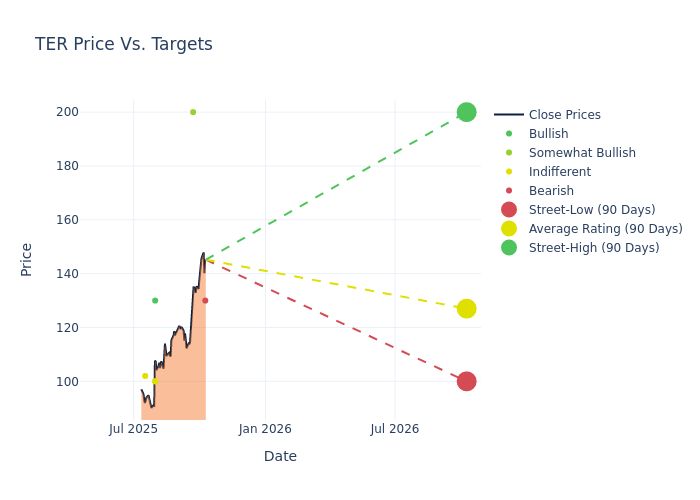

Analysts have set 12-month price targets for Teradyne, revealing an average target of $126.0, a high estimate of $200.00, and a low estimate of $100.00. Marking an increase of 26.9%, the current average surpasses the previous average price target of $99.29.

Diving into Analyst Ratings: An In-Depth Exploration

In examining recent analyst actions, we gain insights into how financial experts perceive Teradyne. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| James Schneider |

Goldman Sachs |

Raises |

Sell |

$130.00 |

$85.00 |

| Mehdi Hosseini |

Susquehanna |

Raises |

Positive |

$200.00 |

$133.00 |

| Brian Chin |

Stifel |

Raises |

Hold |

$100.00 |

$85.00 |

| Timothy Arcuri |

UBS |

Raises |

Buy |

$130.00 |

$120.00 |

| Joseph Moore |

Morgan Stanley |

Raises |

Equal-Weight |

$100.00 |

$74.00 |

| Timothy Arcuri |

UBS |

Raises |

Buy |

$120.00 |

$110.00 |

| Samik Chatterjee |

JP Morgan |

Raises |

Neutral |

$102.00 |

$88.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Teradyne. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Teradyne compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Teradyne's stock. This examination reveals shifts in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Teradyne's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Teradyne analyst ratings.

Delving into Teradyne's Background

Teradyne provides testing equipment, including automated test equipment for semiconductors, system testing for hard disk drives, circuit boards, and electronics systems and wireless testing for devices. The firm entered the industrial automation market in 2015, into which it sells collaborative and autonomous robots for factory applications. Teradyne serves numerous end markets and geographies directly and indirectly with its products, but its most significant exposure is to semiconductor testing. Teradyne serves vertically integrated, fabless, and foundry chipmakers with its equipment.

Financial Insights: Teradyne

Market Capitalization Analysis: The company's market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Revenue Growth: Teradyne's revenue growth over a period of 3M has faced challenges. As of 30 June, 2025, the company experienced a revenue decline of approximately -10.7%. This indicates a decrease in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Information Technology sector.

Net Margin: Teradyne's net margin excels beyond industry benchmarks, reaching 12.02%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 2.78%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Teradyne's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 2.1%, the company showcases efficient use of assets and strong financial health.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.03.

The Significance of Analyst Ratings Explained

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: TER