What the Options Market Tells Us About Royal Caribbean Gr

Author: Benzinga Insights | October 08, 2025 02:01pm

Deep-pocketed investors have adopted a bullish approach towards Royal Caribbean Gr (NYSE:RCL), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in RCL usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 8 extraordinary options activities for Royal Caribbean Gr. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 25% leaning bullish and 25% bearish. Among these notable options, 6 are puts, totaling $271,275, and 2 are calls, amounting to $68,475.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $300.0 to $350.0 for Royal Caribbean Gr over the recent three months.

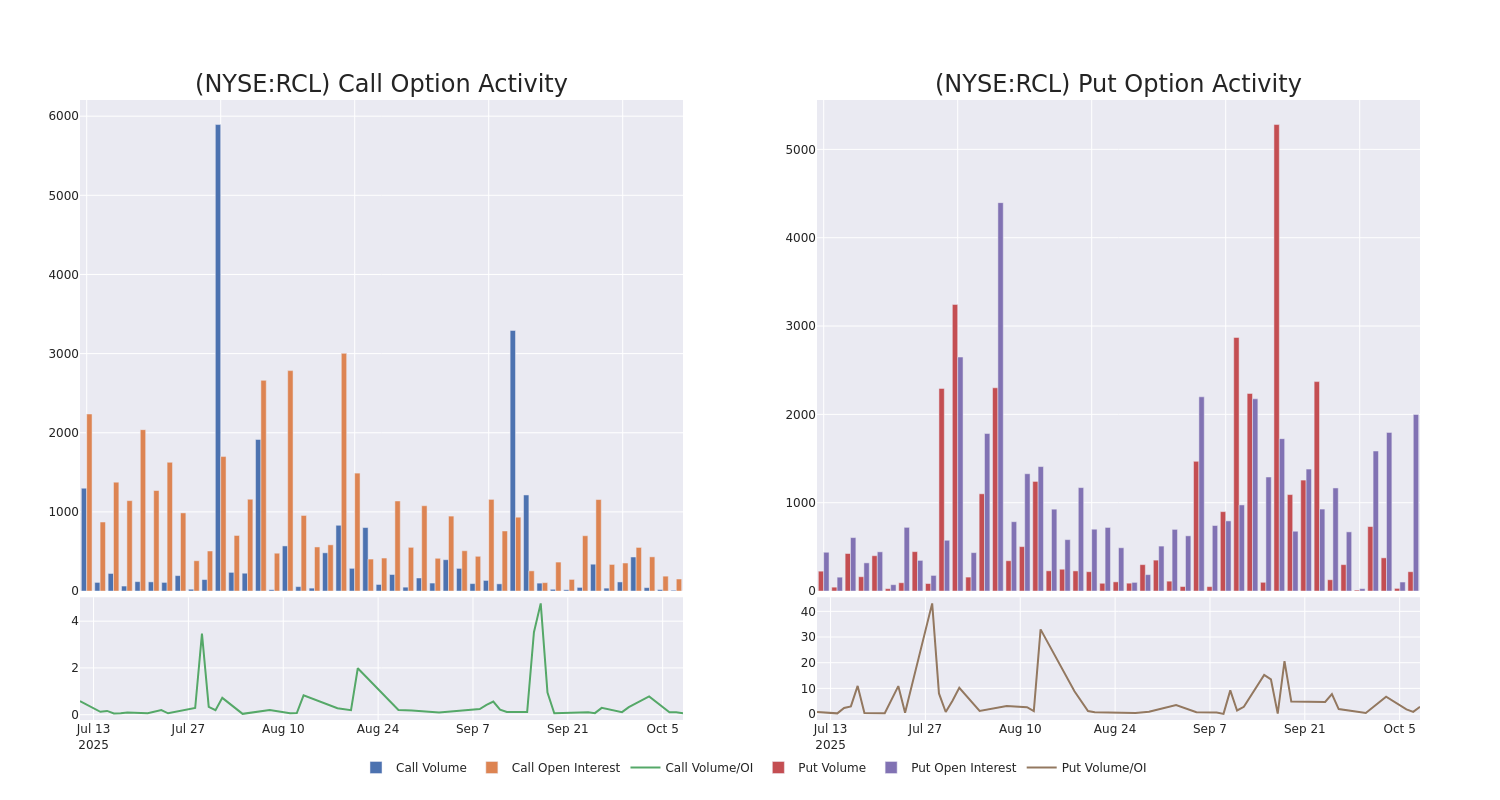

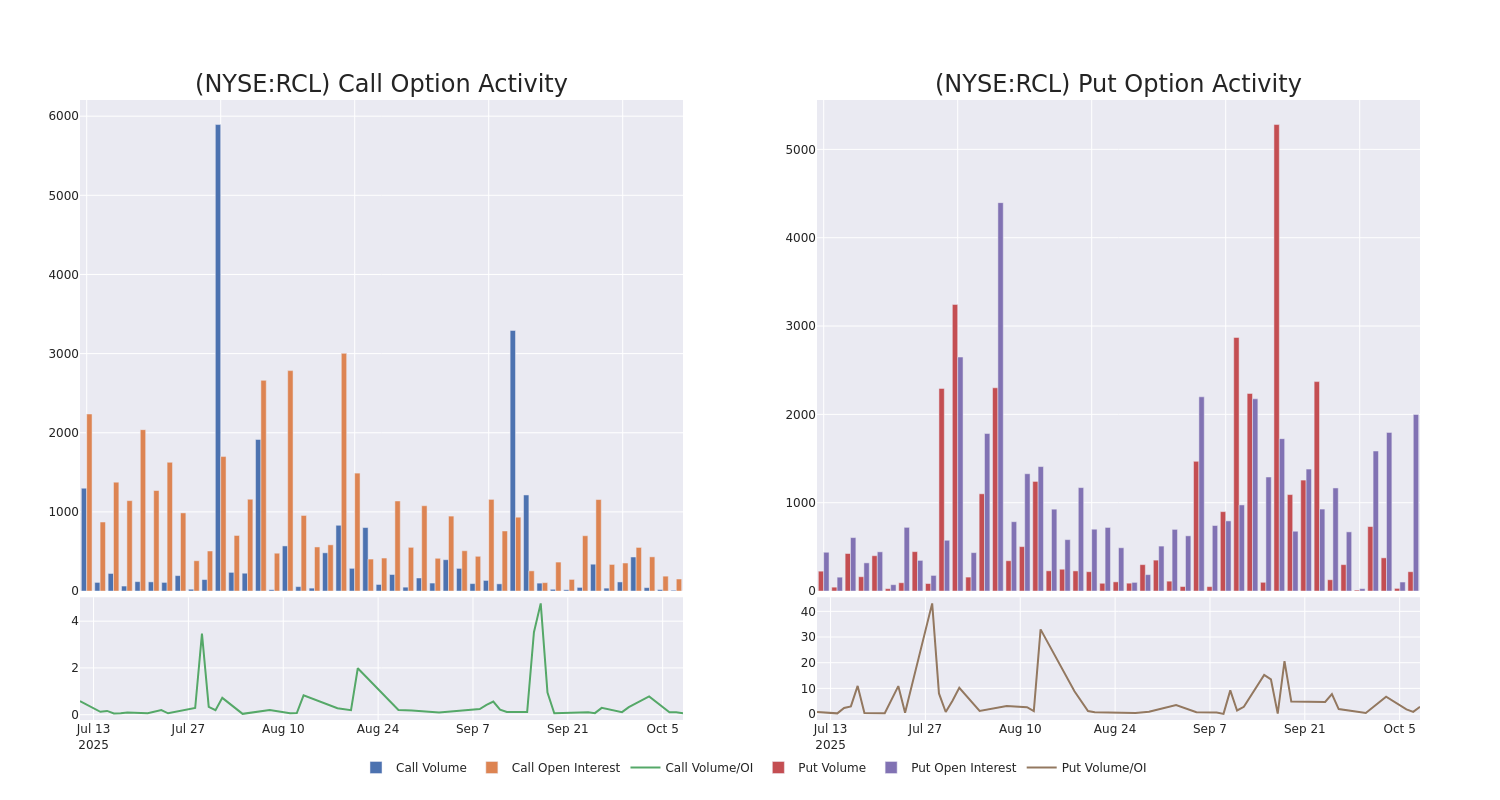

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Royal Caribbean Gr's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Royal Caribbean Gr's whale trades within a strike price range from $300.0 to $350.0 in the last 30 days.

Royal Caribbean Gr 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| RCL |

PUT |

SWEEP |

BULLISH |

10/17/25 |

$41.35 |

$40.2 |

$40.2 |

$350.00 |

$80.4K |

553 |

21 |

| RCL |

PUT |

SWEEP |

BEARISH |

11/21/25 |

$16.8 |

$16.75 |

$16.75 |

$310.00 |

$53.6K |

65 |

45 |

| RCL |

PUT |

TRADE |

NEUTRAL |

11/21/25 |

$25.35 |

$24.5 |

$24.95 |

$320.00 |

$42.4K |

113 |

5 |

| RCL |

CALL |

TRADE |

BULLISH |

01/15/27 |

$49.5 |

$47.9 |

$49.5 |

$330.00 |

$39.6K |

104 |

8 |

| RCL |

PUT |

TRADE |

NEUTRAL |

11/21/25 |

$19.75 |

$18.8 |

$19.3 |

$310.00 |

$38.6K |

65 |

78 |

About Royal Caribbean Gr

Royal Caribbean is the world's second-largest cruise company by revenues, operating 68 ships across five global and partner brands in the cruise vacation industry. Brands the company operates include Royal Caribbean International, Celebrity Cruises, and Silversea. The company also has a 50% investment in a joint venture that operates TUI Cruises and Hapag-Lloyd Cruises. The selection of brands in the portfolio allows Royal to compete on the basis of innovation, quality of ships and service, variety of itineraries, choice of destinations, and price. The company completed the divestiture of its Azamara brand in 2021 and plans to launch its new Celebrity River Cruise brand in 2027.

In light of the recent options history for Royal Caribbean Gr, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Royal Caribbean Gr

- Currently trading with a volume of 967,366, the RCL's price is down by -1.66%, now at $309.51.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 20 days.

What Analysts Are Saying About Royal Caribbean Gr

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $333.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Truist Securities has decided to maintain their Hold rating on Royal Caribbean Gr, which currently sits at a price target of $333.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Royal Caribbean Gr options trades with real-time alerts from Benzinga Pro.

Posted In: RCL