The Analyst Verdict: First Majestic Silver In The Eyes Of 4 Experts

Author: Benzinga Insights | October 06, 2025 03:01pm

First Majestic Silver (NYSE:AG) underwent analysis by 4 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

3 |

0 |

1 |

0 |

0 |

| Last 30D |

1 |

0 |

0 |

0 |

0 |

| 1M Ago |

0 |

0 |

0 |

0 |

0 |

| 2M Ago |

1 |

0 |

0 |

0 |

0 |

| 3M Ago |

1 |

0 |

1 |

0 |

0 |

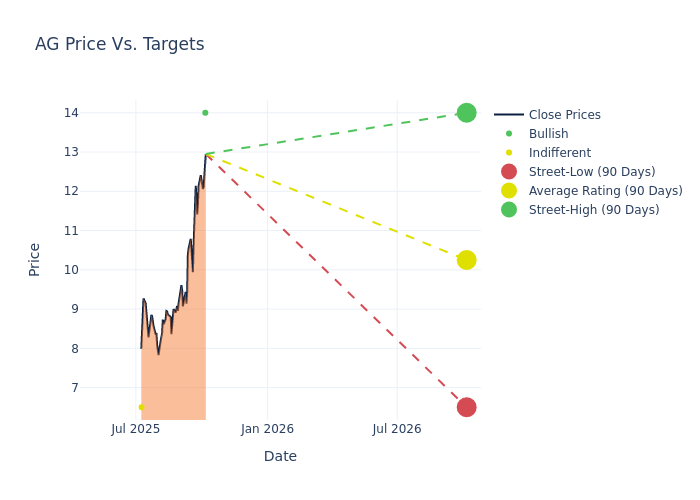

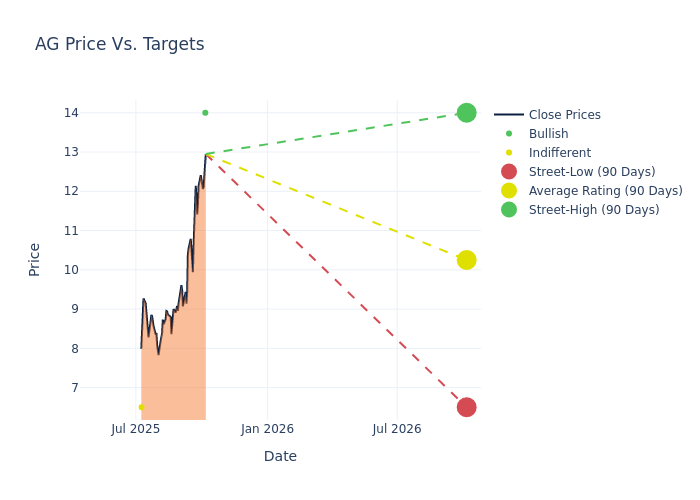

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $11.5, a high estimate of $14.00, and a low estimate of $6.50. Observing a 6.98% increase, the current average has risen from the previous average price target of $10.75.

Exploring Analyst Ratings: An In-Depth Overview

The standing of First Majestic Silver among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Heiko F. Ihle |

HC Wainwright & Co. |

Raises |

Buy |

$14.00 |

$12.75 |

| Heiko F. Ihle |

HC Wainwright & Co. |

Maintains |

Buy |

$12.75 |

$12.75 |

| Heiko Ihle |

HC Wainwright & Co. |

Raises |

Buy |

$12.75 |

$11.50 |

| Ovais Habib |

Scotiabank |

Raises |

Sector Perform |

$6.50 |

$6.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to First Majestic Silver. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of First Majestic Silver compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of First Majestic Silver's stock. This comparison reveals trends in analysts' expectations over time.

For valuable insights into First Majestic Silver's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on First Majestic Silver analyst ratings.

Get to Know First Majestic Silver Better

First Majestic Silver Corp is engaged in the production, development, exploration, and acquisition of mineral properties with a focus on silver and gold production in North America. It owns three producing mines in Mexico consisting of the San Dimas Silver/Gold Mine, the Santa Elena Silver/Gold Mine, and the La Encantada Silver Mine.

Financial Insights: First Majestic Silver

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Revenue Growth: Over the 3M period, First Majestic Silver showcased positive performance, achieving a revenue growth rate of 93.6% as of 30 June, 2025. This reflects a substantial increase in the company's top-line earnings. When compared to others in the Materials sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: First Majestic Silver's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 21.37%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 2.3%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 1.39%, the company showcases effective utilization of assets.

Debt Management: First Majestic Silver's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.09.

Analyst Ratings: What Are They?

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: AG