A Glimpse Into The Expert Outlook On Netflix Through 21 Analysts

Author: Benzinga Insights | October 03, 2025 06:00pm

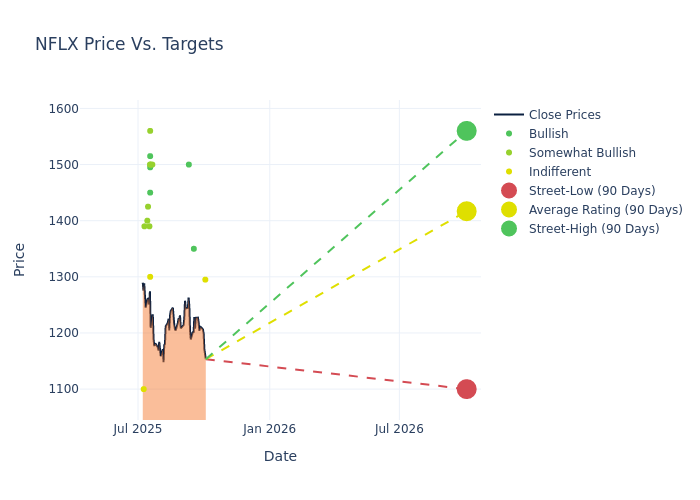

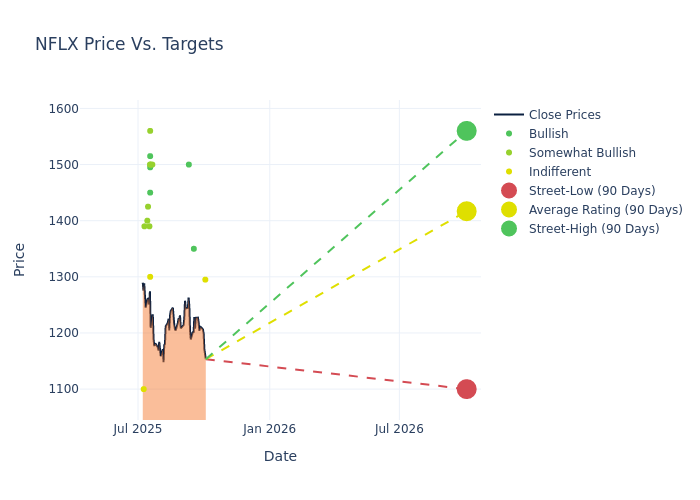

Across the recent three months, 21 analysts have shared their insights on Netflix (NASDAQ:NFLX), expressing a variety of opinions spanning from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

7 |

9 |

5 |

0 |

0 |

| Last 30D |

0 |

0 |

1 |

0 |

0 |

| 1M Ago |

2 |

0 |

0 |

0 |

0 |

| 2M Ago |

0 |

0 |

0 |

0 |

0 |

| 3M Ago |

5 |

9 |

4 |

0 |

0 |

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $1402.38, a high estimate of $1560.00, and a low estimate of $1100.00. Surpassing the previous average price target of $1289.52, the current average has increased by 8.75%.

Decoding Analyst Ratings: A Detailed Look

A clear picture of Netflix's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Jason Bazinet |

Citigroup |

Raises |

Neutral |

$1295.00 |

$1280.00 |

| Alan Gould |

Loop Capital |

Raises |

Buy |

$1350.00 |

$1150.00 |

| Laura Martin |

Needham |

Maintains |

Buy |

$1500.00 |

$1500.00 |

| Vikram Kesavabhotla |

Baird |

Raises |

Outperform |

$1500.00 |

$1300.00 |

| Steven Cahall |

Wells Fargo |

Raises |

Overweight |

$1560.00 |

$1500.00 |

| John Hodulik |

UBS |

Raises |

Buy |

$1495.00 |

$1450.00 |

| Doug Anmuth |

JP Morgan |

Raises |

Neutral |

$1300.00 |

$1230.00 |

| John Blackledge |

TD Cowen |

Raises |

Buy |

$1450.00 |

$1440.00 |

| Barton Crockett |

Rosenblatt |

Raises |

Buy |

$1515.00 |

$1514.00 |

| Matt Farrell |

Piper Sandler |

Raises |

Overweight |

$1500.00 |

$1400.00 |

| Benjamin Swinburne |

Morgan Stanley |

Raises |

Overweight |

$1500.00 |

$1450.00 |

| Laura Martin |

Needham |

Maintains |

Buy |

$1500.00 |

$1500.00 |

| Laurent Yoon |

Bernstein |

Raises |

Outperform |

$1390.00 |

$1200.00 |

| Alan Gould |

Loop Capital |

Raises |

Hold |

$1150.00 |

$1000.00 |

| Brian Pitz |

BMO Capital |

Raises |

Outperform |

$1425.00 |

$1200.00 |

| Michael Pachter |

Wedbush |

Maintains |

Outperform |

$1400.00 |

$1400.00 |

| Matt Farrell |

Piper Sandler |

Raises |

Overweight |

$1400.00 |

$1150.00 |

| Doug Anmuth |

JP Morgan |

Raises |

Neutral |

$1230.00 |

$1220.00 |

| Laura Martin |

Needham |

Raises |

Buy |

$1500.00 |

$1126.00 |

| Justin Patterson |

Keybanc |

Raises |

Overweight |

$1390.00 |

$1070.00 |

| Kannan Venkateshwar |

Barclays |

Raises |

Equal-Weight |

$1100.00 |

$1000.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Netflix. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Netflix compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Netflix's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Capture valuable insights into Netflix's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Netflix analyst ratings.

All You Need to Know About Netflix

Netflix's relatively simple business model involves only one business, its streaming service. It has the biggest television entertainment subscriber base in both the United States and the collective international market, with more than 300 million subscribers globally. Netflix has exposure to nearly the entire global population outside of China. The firm has traditionally avoided a regular slate of live programming or sports content, instead focusing on on-demand access to episodic television, movies, and documentaries. The firm introduced ad-supported subscription plans in 2022, giving the firm exposure to the advertising market in addition to the subscription fees that have historically accounted for nearly all its revenue.

Netflix's Economic Impact: An Analysis

Market Capitalization: Surpassing industry standards, the company's market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Revenue Growth: Netflix's remarkable performance in 3M is evident. As of 30 June, 2025, the company achieved an impressive revenue growth rate of 15.9%. This signifies a substantial increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Communication Services sector.

Net Margin: Netflix's net margin excels beyond industry benchmarks, reaching 28.21%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Netflix's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 12.76% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 5.94%, the company showcases effective utilization of assets.

Debt Management: With a below-average debt-to-equity ratio of 0.58, Netflix adopts a prudent financial strategy, indicating a balanced approach to debt management.

Analyst Ratings: Simplified

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: NFLX