Where Dow Stands With Analysts

Author: Benzinga Insights | October 02, 2025 03:00pm

In the preceding three months, 14 analysts have released ratings for Dow (NYSE:DOW), presenting a wide array of perspectives from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

0 |

2 |

12 |

0 |

0 |

| Last 30D |

0 |

0 |

1 |

0 |

0 |

| 1M Ago |

0 |

1 |

1 |

0 |

0 |

| 2M Ago |

0 |

0 |

2 |

0 |

0 |

| 3M Ago |

0 |

1 |

8 |

0 |

0 |

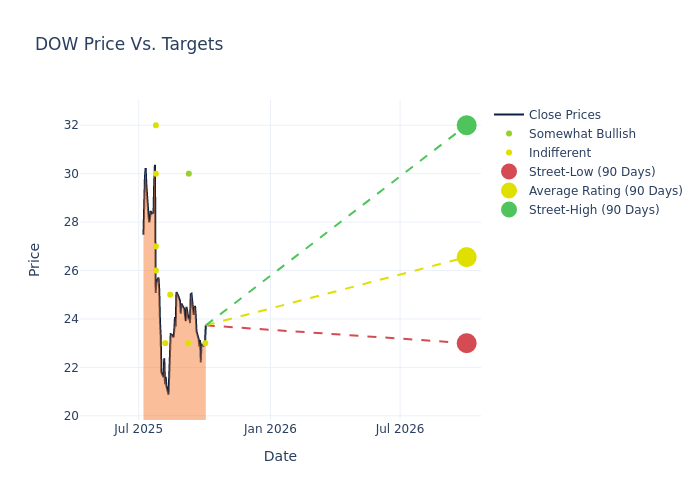

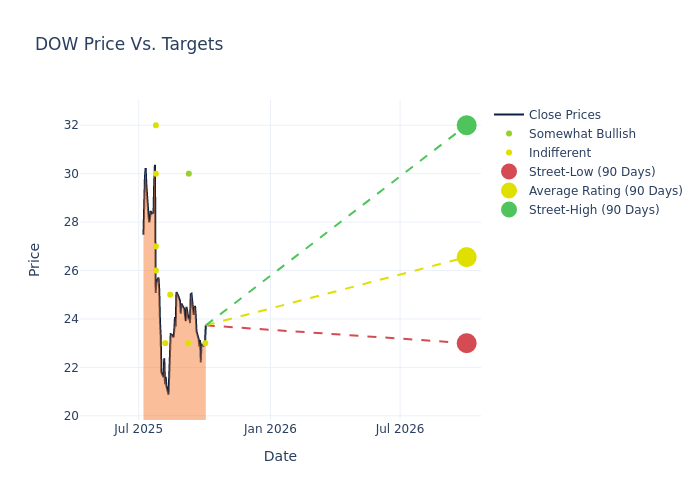

The 12-month price targets, analyzed by analysts, offer insights with an average target of $26.71, a high estimate of $32.00, and a low estimate of $23.00. Highlighting a 13.64% decrease, the current average has fallen from the previous average price target of $30.93.

Analyzing Analyst Ratings: A Detailed Breakdown

The standing of Dow among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Patrick Cunningham |

Citigroup |

Lowers |

Neutral |

$23.00 |

$24.00 |

| Michael Sison |

Wells Fargo |

Lowers |

Overweight |

$30.00 |

$32.00 |

| Laurence Alexander |

Jefferies |

Lowers |

Hold |

$23.00 |

$28.00 |

| Steve Byrne |

B of A Securities |

Maintains |

Neutral |

$25.00 |

$25.00 |

| Joshua Spector |

UBS |

Lowers |

Neutral |

$23.00 |

$25.00 |

| Patrick Cunningham |

Citigroup |

Lowers |

Neutral |

$24.00 |

$28.00 |

| John Roberts |

Mizuho |

Lowers |

Neutral |

$30.00 |

$31.00 |

| Joshua Spector |

UBS |

Lowers |

Neutral |

$25.00 |

$26.00 |

| Michael Sison |

Wells Fargo |

Lowers |

Overweight |

$32.00 |

$35.00 |

| Arun Viswanathan |

RBC Capital |

Lowers |

Sector Perform |

$26.00 |

$30.00 |

| Vincent Andrews |

Morgan Stanley |

Lowers |

Equal-Weight |

$27.00 |

$35.00 |

| Eric Boyes |

Evercore ISI Group |

Lowers |

In-Line |

$32.00 |

$56.00 |

| Joshua Spector |

UBS |

Lowers |

Neutral |

$26.00 |

$28.00 |

| Patrick Cunningham |

Citigroup |

Lowers |

Neutral |

$28.00 |

$30.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Dow. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Dow compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Dow's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Dow's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Dow analyst ratings.

Unveiling the Story Behind Dow

Dow Chemical is a diversified global chemicals producer, formed in 2019 as a result of the DowDuPont merger and subsequent separations. The firm is a leading producer of several chemicals, including polyethylene, ethylene oxide, and silicone rubber. Its products have numerous applications in both consumer and industrial end markets.

Dow's Financial Performance

Market Capitalization: Surpassing industry standards, the company's market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Negative Revenue Trend: Examining Dow's financials over 3M reveals challenges. As of 30 June, 2025, the company experienced a decline of approximately -7.43% in revenue growth, reflecting a decrease in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Materials sector.

Net Margin: Dow's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive -8.3% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Dow's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of -4.93%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): Dow's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of -1.44%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: Dow's debt-to-equity ratio is below the industry average at 1.05, reflecting a lower dependency on debt financing and a more conservative financial approach.

Analyst Ratings: What Are They?

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: DOW