A Glimpse Into The Expert Outlook On Uber Technologies Through 23 Analysts

Author: Benzinga Insights | September 30, 2025 06:01pm

23 analysts have shared their evaluations of Uber Technologies (NYSE:UBER) during the recent three months, expressing a mix of bullish and bearish perspectives.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

7 |

14 |

2 |

0 |

0 |

| Last 30D |

0 |

1 |

0 |

0 |

0 |

| 1M Ago |

0 |

1 |

0 |

0 |

0 |

| 2M Ago |

2 |

6 |

2 |

0 |

0 |

| 3M Ago |

5 |

6 |

0 |

0 |

0 |

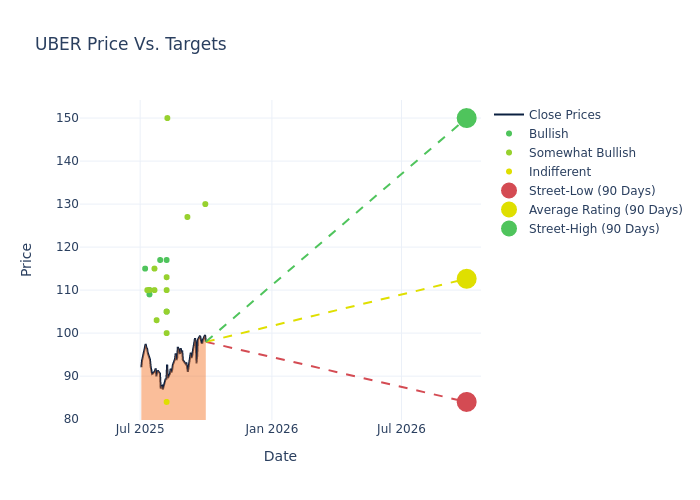

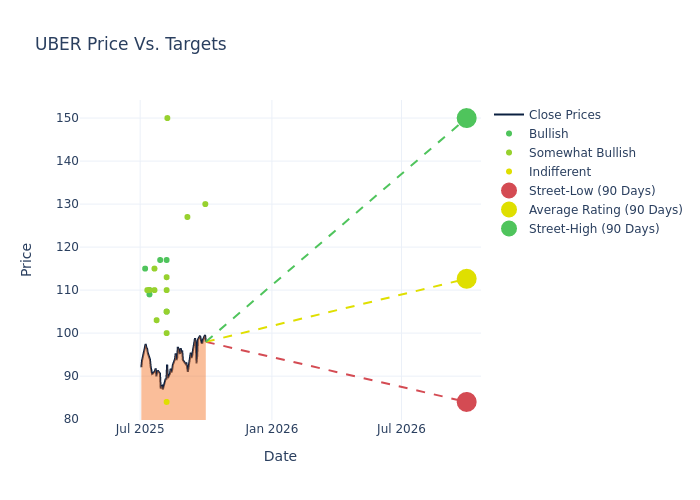

Analysts have recently evaluated Uber Technologies and provided 12-month price targets. The average target is $112.13, accompanied by a high estimate of $150.00 and a low estimate of $84.00. This current average has increased by 11.22% from the previous average price target of $100.82.

Exploring Analyst Ratings: An In-Depth Overview

A comprehensive examination of how financial experts perceive Uber Technologies is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Lloyd Walmsley |

Mizuho |

Announces |

Outperform |

$130.00 |

- |

| Ken Gawrelski |

Wells Fargo |

Raises |

Overweight |

$127.00 |

$119.00 |

| Mark Mahaney |

Evercore ISI Group |

Raises |

Outperform |

$150.00 |

$115.00 |

| Lloyd Walmsley |

UBS |

Raises |

Buy |

$117.00 |

$115.00 |

| Brad Erickson |

RBC Capital |

Raises |

Outperform |

$100.00 |

$94.00 |

| Ken Gawrelski |

Wells Fargo |

Lowers |

Overweight |

$119.00 |

$120.00 |

| Ross Sandler |

Barclays |

Raises |

Overweight |

$110.00 |

$97.00 |

| Josh Beck |

Raymond James |

Raises |

Strong Buy |

$105.00 |

$100.00 |

| Scott Devitt |

Wedbush |

Lowers |

Neutral |

$84.00 |

$85.00 |

| Brian Pitz |

BMO Capital |

Raises |

Outperform |

$113.00 |

$101.00 |

| Shyam Patil |

Susquehanna |

Raises |

Positive |

$105.00 |

$100.00 |

| Scott Devitt |

Wedbush |

Maintains |

Neutral |

$85.00 |

$85.00 |

| Lloyd Walmsley |

UBS |

Raises |

Buy |

$115.00 |

$107.00 |

| Mark Kelley |

Stifel |

Raises |

Buy |

$117.00 |

$110.00 |

| Thomas Champion |

Piper Sandler |

Raises |

Overweight |

$103.00 |

$95.00 |

| Brian Nowak |

Morgan Stanley |

Raises |

Overweight |

$115.00 |

$95.00 |

| Nikhil Devnani |

Bernstein |

Raises |

Outperform |

$110.00 |

$95.00 |

| Rohit Kulkarni |

Roth Capital |

Raises |

Buy |

$110.00 |

$93.00 |

| Justin Patterson |

Keybanc |

Raises |

Overweight |

$110.00 |

$90.00 |

| Bernie McTernan |

Needham |

Raises |

Buy |

$109.00 |

$100.00 |

| Doug Anmuth |

JP Morgan |

Raises |

Overweight |

$110.00 |

$105.00 |

| Justin Post |

B of A Securities |

Raises |

Buy |

$115.00 |

$97.00 |

| Ken Gawrelski |

Wells Fargo |

Raises |

Overweight |

$120.00 |

$100.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Uber Technologies. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Uber Technologies compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Uber Technologies's stock. This comparison reveals trends in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Uber Technologies's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Uber Technologies analyst ratings.

Discovering Uber Technologies: A Closer Look

Uber Technologies is a technology provider that matches riders with drivers, hungry people with restaurants and food couriers, and shippers with carriers. The firm's on-demand technology platform is currently utilized by traditional cars as well as autonomous vehicles, but could eventually be used for additional products and services, such as delivery via drones or electronic vehicle take-off and landing (eVTOL) technology. Uber operates in over 70 countries, with over 180 million users who order rides or food at least once a month.

Understanding the Numbers: Uber Technologies's Finances

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Revenue Growth: Uber Technologies displayed positive results in 3M. As of 30 June, 2025, the company achieved a solid revenue growth rate of approximately 18.23%. This indicates a notable increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: Uber Technologies's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 10.71% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 6.08%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 2.49%, the company showcases effective utilization of assets.

Debt Management: Uber Technologies's debt-to-equity ratio surpasses industry norms, standing at 0.55. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

What Are Analyst Ratings?

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: UBER