Analyst Expectations For American Express's Future

Author: Benzinga Insights | September 29, 2025 06:02pm

During the last three months, 10 analysts shared their evaluations of American Express (NYSE: AXP), revealing diverse outlooks from bullish to bearish.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

3 |

2 |

5 |

0 |

0 |

| Last 30D |

0 |

0 |

1 |

0 |

0 |

| 1M Ago |

1 |

1 |

0 |

0 |

0 |

| 2M Ago |

0 |

0 |

0 |

0 |

0 |

| 3M Ago |

2 |

1 |

4 |

0 |

0 |

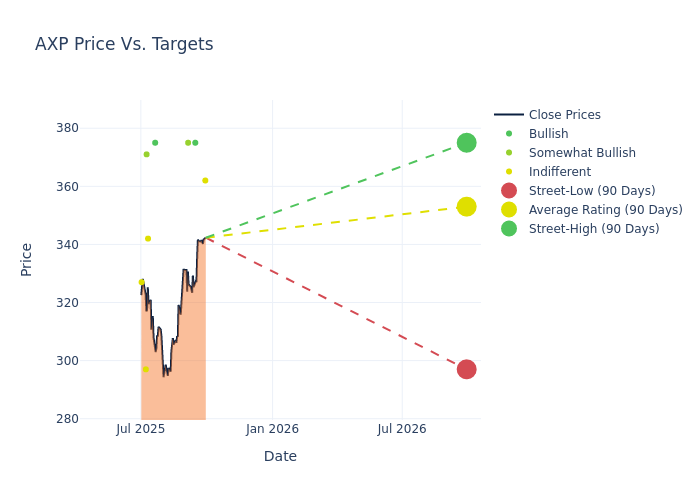

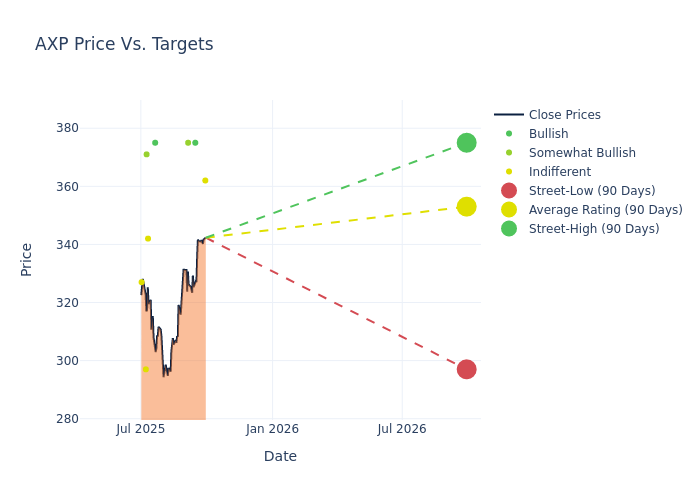

Analysts have set 12-month price targets for American Express, revealing an average target of $347.5, a high estimate of $375.00, and a low estimate of $297.00. This upward trend is apparent, with the current average reflecting a 10.88% increase from the previous average price target of $313.40.

Diving into Analyst Ratings: An In-Depth Exploration

An in-depth analysis of recent analyst actions unveils how financial experts perceive American Express. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Betsy Graseck |

Morgan Stanley |

Raises |

Equal-Weight |

$362.00 |

$311.00 |

| Brian Foran |

Truist Securities |

Raises |

Buy |

$375.00 |

$348.00 |

| Donald Fandetti |

Wells Fargo |

Raises |

Overweight |

$375.00 |

$350.00 |

| Mark Devries |

Deutsche Bank |

Raises |

Buy |

$375.00 |

$371.00 |

| Richard Shane |

JP Morgan |

Raises |

Neutral |

$342.00 |

$260.00 |

| Betsy Graseck |

Morgan Stanley |

Raises |

Equal-Weight |

$311.00 |

$250.00 |

| Sanjay Sakhrani |

Keefe, Bruyette & Woods |

Raises |

Outperform |

$371.00 |

$360.00 |

| Brian Foran |

Truist Securities |

Raises |

Buy |

$340.00 |

$335.00 |

| Terry Ma |

Barclays |

Raises |

Equal-Weight |

$297.00 |

$249.00 |

| Keith Horowitz |

Citigroup |

Raises |

Neutral |

$327.00 |

$300.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to American Express. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of American Express compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of American Express's stock. This analysis reveals shifts in analysts' expectations over time.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of American Express's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on American Express analyst ratings.

Unveiling the Story Behind American Express

American Express is a global financial institution, operating in about 130 countries, that provides consumers and businesses charge and credit card payment products. The company also operates a highly profitable merchant payment network. The firm operates in four segments: US consumer services, US commercial services, international card services, and global merchant and network services. In addition to payment products, the company's commercial business offers expense management tools, consulting services, and business loans.

Financial Insights: American Express

Market Capitalization Analysis: The company's market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Revenue Growth: American Express's remarkable performance in 3M is evident. As of 30 June, 2025, the company achieved an impressive revenue growth rate of 9.32%. This signifies a substantial increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Financials sector.

Net Margin: American Express's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 15.97%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): American Express's ROE excels beyond industry benchmarks, reaching 8.98%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): American Express's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of 0.99%, the company may face hurdles in achieving optimal financial returns.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 1.85.

The Basics of Analyst Ratings

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: AXP