10 Analysts Assess East West Bancorp: What You Need To Know

Author: Benzinga Insights | September 25, 2025 03:01pm

In the latest quarter, 10 analysts provided ratings for East West Bancorp (NASDAQ: EWBC), showcasing a mix of bullish and bearish perspectives.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

4 |

4 |

2 |

0 |

0 |

| Last 30D |

1 |

0 |

0 |

0 |

0 |

| 1M Ago |

1 |

1 |

1 |

0 |

0 |

| 2M Ago |

0 |

0 |

0 |

0 |

0 |

| 3M Ago |

2 |

3 |

1 |

0 |

0 |

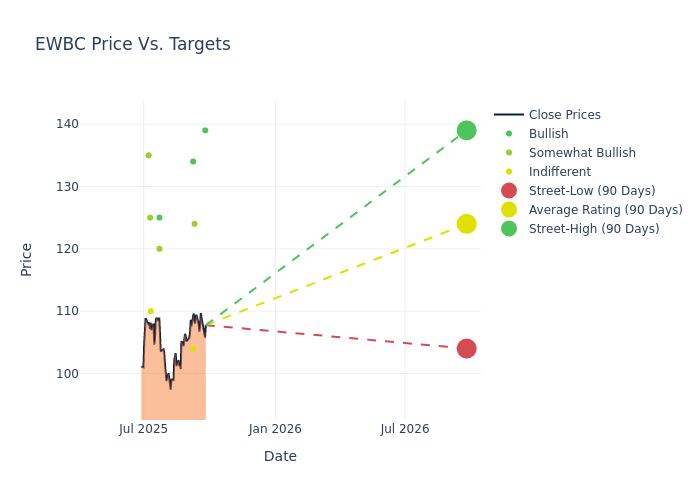

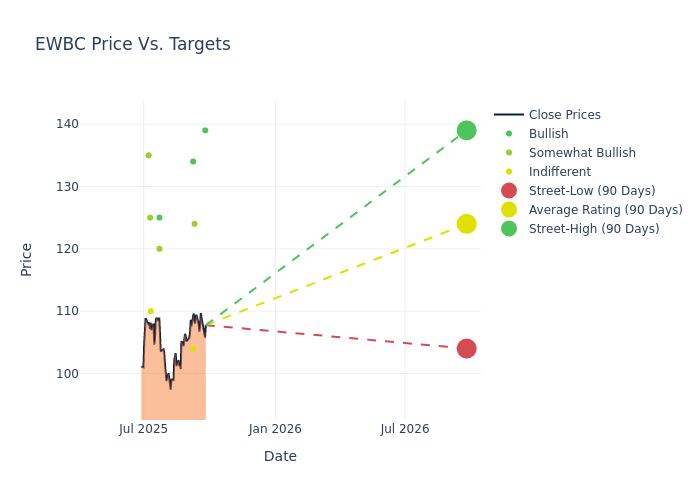

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $123.2, a high estimate of $139.00, and a low estimate of $104.00. This upward trend is evident, with the current average reflecting a 14.48% increase from the previous average price target of $107.62.

Deciphering Analyst Ratings: An In-Depth Analysis

The analysis of recent analyst actions sheds light on the perception of East West Bancorp by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Janet Lee |

TD Cowen |

Announces |

Buy |

$139.00 |

- |

| Dave Rochester |

Cantor Fitzgerald |

Announces |

Overweight |

$124.00 |

- |

| Matthew Clark |

Piper Sandler |

Raises |

Neutral |

$104.00 |

$100.00 |

| Benjamin Gerlinger |

Citigroup |

Raises |

Buy |

$134.00 |

$124.00 |

| Christopher Mcgratty |

Keefe, Bruyette & Woods |

Raises |

Outperform |

$120.00 |

$110.00 |

| Gary Tenner |

DA Davidson |

Raises |

Buy |

$125.00 |

$115.00 |

| Brandon King |

Truist Securities |

Raises |

Hold |

$110.00 |

$102.00 |

| Timur Braziler |

Wells Fargo |

Raises |

Overweight |

$125.00 |

$100.00 |

| Jared Shaw |

Barclays |

Raises |

Overweight |

$135.00 |

$110.00 |

| Benjamin Gerlinger |

Citigroup |

Raises |

Buy |

$116.00 |

$100.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to East West Bancorp. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of East West Bancorp compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for East West Bancorp's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of East West Bancorp's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on East West Bancorp analyst ratings.

All You Need to Know About East West Bancorp

East West Bancorp Inc operates in U.S. and Asia. The Bank provides range of personal and commercial banking services to individuals and businesses. In addition to offering traditional deposit products that include personal and business checking and savings accounts, money market, and time deposits, the Bank also offers foreign exchange, treasury management and wealth management services. The Bank has three operating segments, (1) Consumer and Business Banking, (2) Commercial Banking and (3) Treasury and Other. The company generates the majority of its revenue from the Commercial banking segment.

East West Bancorp: Delving into Financials

Market Capitalization Highlights: Above the industry average, the company's market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Revenue Growth: Over the 3M period, East West Bancorp showcased positive performance, achieving a revenue growth rate of 10.96% as of 30 June, 2025. This reflects a substantial increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Financials sector.

Net Margin: East West Bancorp's net margin is impressive, surpassing industry averages. With a net margin of 44.71%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 3.85%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 0.4%, the company showcases effective utilization of assets.

Debt Management: East West Bancorp's debt-to-equity ratio is below the industry average at 0.44, reflecting a lower dependency on debt financing and a more conservative financial approach.

The Basics of Analyst Ratings

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: EWBC