Outfront Media Stock: A Deep Dive Into Analyst Perspectives (4 Ratings)

Author: Benzinga Insights | September 23, 2025 03:00pm

Analysts' ratings for Outfront Media (NYSE:OUT) over the last quarter vary from bullish to bearish, as provided by 4 analysts.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

0 |

3 |

1 |

0 |

0 |

| Last 30D |

0 |

1 |

0 |

0 |

0 |

| 1M Ago |

0 |

0 |

0 |

0 |

0 |

| 2M Ago |

0 |

2 |

1 |

0 |

0 |

| 3M Ago |

0 |

0 |

0 |

0 |

0 |

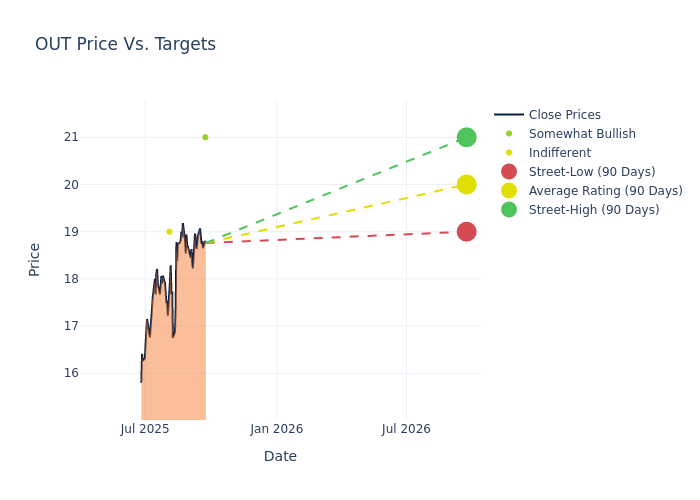

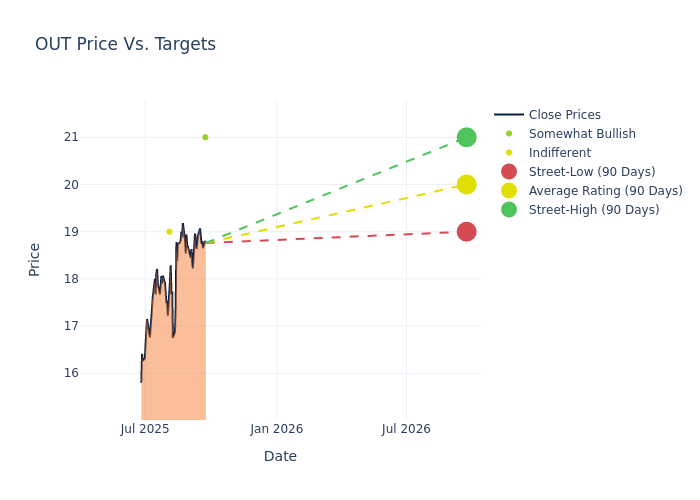

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $20.5, with a high estimate of $21.00 and a low estimate of $19.00. This current average reflects an increase of 2.5% from the previous average price target of $20.00.

Deciphering Analyst Ratings: An In-Depth Analysis

The standing of Outfront Media among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Patrick Sholl |

Barrington Research |

Maintains |

Outperform |

$21.00 |

$21.00 |

| Patrick Sholl |

Barrington Research |

Maintains |

Outperform |

$21.00 |

$21.00 |

| Patrick Sholl |

Barrington Research |

Maintains |

Outperform |

$21.00 |

$21.00 |

| Benjamin Swinburne |

Morgan Stanley |

Raises |

Equal-Weight |

$19.00 |

$17.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Outfront Media. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Outfront Media compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Outfront Media's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Outfront Media's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Outfront Media analyst ratings.

Delving into Outfront Media's Background

Outfront Media Inc is a real estate investment trust involved in the ownership of advertising space on its portfolio of billboards and transit displays. The Company generates revenue in the form of rental income by allowing other companies to advertise on its properties and structures under short-term contracts. Outfront Media segments its operations into the United States and International units. Although it also owns assets in Canada and Latin America, the company derives the vast majority of its revenue from billboard advertising agreements in the U.S. Roughly half of the U.S. division's revenue comes from its displays in the New York City and Los Angeles markets. Outfront Media's customers include entities within the retail, television, healthcare, and entertainment industries.

A Deep Dive into Outfront Media's Financials

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Revenue Challenges: Outfront Media's revenue growth over 3M faced difficulties. As of 30 June, 2025, the company experienced a decline of approximately -3.58%. This indicates a decrease in top-line earnings. When compared to others in the Real Estate sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Outfront Media's net margin is below industry averages, indicating potential challenges in maintaining strong profitability. With a net margin of 3.76%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Outfront Media's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 3.13%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): Outfront Media's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 0.34%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: With a high debt-to-equity ratio of 7.54, Outfront Media faces challenges in effectively managing its debt levels, indicating potential financial strain.

The Core of Analyst Ratings: What Every Investor Should Know

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: OUT