The Analyst Verdict: Stryker In The Eyes Of 5 Experts

Author: Benzinga Insights | September 18, 2025 02:01pm

Providing a diverse range of perspectives from bullish to bearish, 5 analysts have published ratings on Stryker (NYSE:SYK) in the last three months.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

1 |

2 |

2 |

0 |

0 |

| Last 30D |

0 |

0 |

1 |

0 |

0 |

| 1M Ago |

0 |

0 |

0 |

0 |

0 |

| 2M Ago |

1 |

1 |

1 |

0 |

0 |

| 3M Ago |

0 |

1 |

0 |

0 |

0 |

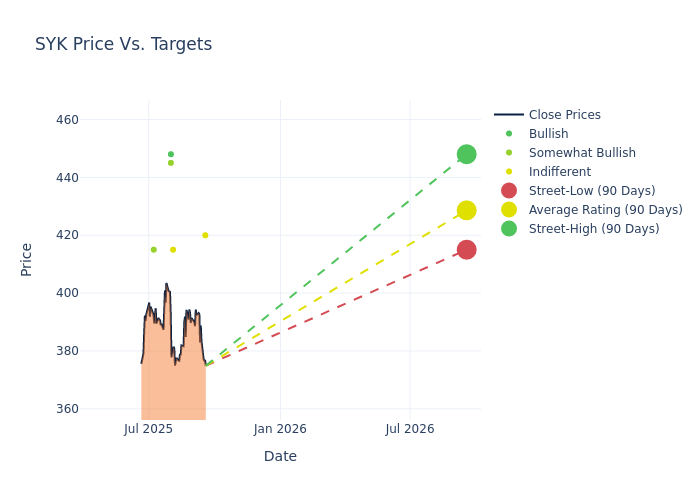

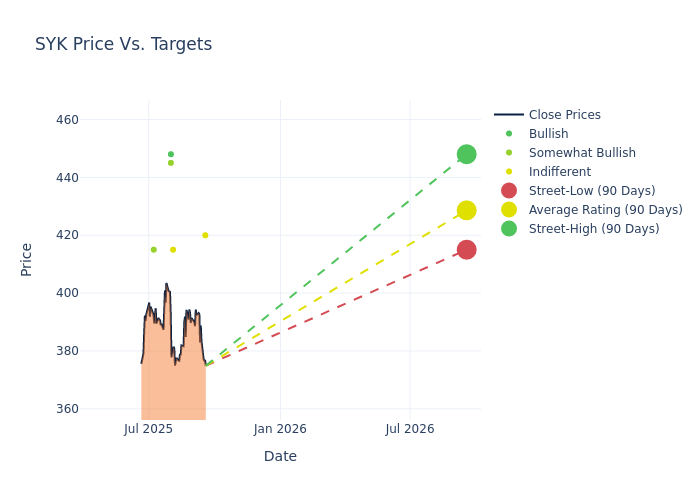

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $428.6, along with a high estimate of $448.00 and a low estimate of $415.00. This current average reflects an increase of 2.23% from the previous average price target of $419.25.

Breaking Down Analyst Ratings: A Detailed Examination

In examining recent analyst actions, we gain insights into how financial experts perceive Stryker. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Ed Ridley-Day |

Rothschild & Co |

Announces |

Neutral |

$420.00 |

- |

| Richard Newitter |

Truist Securities |

Raises |

Hold |

$415.00 |

$410.00 |

| Larry Biegelsen |

Wells Fargo |

Raises |

Overweight |

$445.00 |

$435.00 |

| Mike Matson |

Needham |

Raises |

Buy |

$448.00 |

$442.00 |

| Vijay Kumar |

Evercore ISI Group |

Raises |

Outperform |

$415.00 |

$390.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Stryker. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Stryker compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Stryker's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Stryker's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Stryker analyst ratings.

About Stryker

Stryker designs, manufactures, and markets an array of medical equipment, instruments, consumable supplies, and implantable devices. The product portfolio includes hip and knee replacements, extremities, endoscopy systems, operating room equipment, embolic coils, hospital beds and gurneys, and orthopedic robotics. Stryker remains one of the three largest competitors in reconstructive orthopedic implants and holds the leadership position in operating room equipment. Roughly one-fourth of Stryker's total revenue currently comes from outside the United States.

Stryker's Economic Impact: An Analysis

Market Capitalization: Boasting an elevated market capitalization, the company surpasses industry averages. This signals substantial size and strong market recognition.

Positive Revenue Trend: Examining Stryker's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 11.07% as of 30 June, 2025, showcasing a substantial increase in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Health Care sector.

Net Margin: Stryker's net margin excels beyond industry benchmarks, reaching 14.68%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 4.2%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Stryker's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 1.91%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: Stryker's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.78.

Analyst Ratings: Simplified

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: SYK