Market Whales and Their Recent Bets on CRDO Options

Author: Benzinga Insights | September 17, 2025 03:02pm

Whales with a lot of money to spend have taken a noticeably bullish stance on Credo Technology Group.

Looking at options history for Credo Technology Group (NASDAQ:CRDO) we detected 29 trades.

If we consider the specifics of each trade, it is accurate to state that 41% of the investors opened trades with bullish expectations and 31% with bearish.

From the overall spotted trades, 4 are puts, for a total amount of $359,720 and 25, calls, for a total amount of $3,352,470.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $40.0 to $180.0 for Credo Technology Group over the last 3 months.

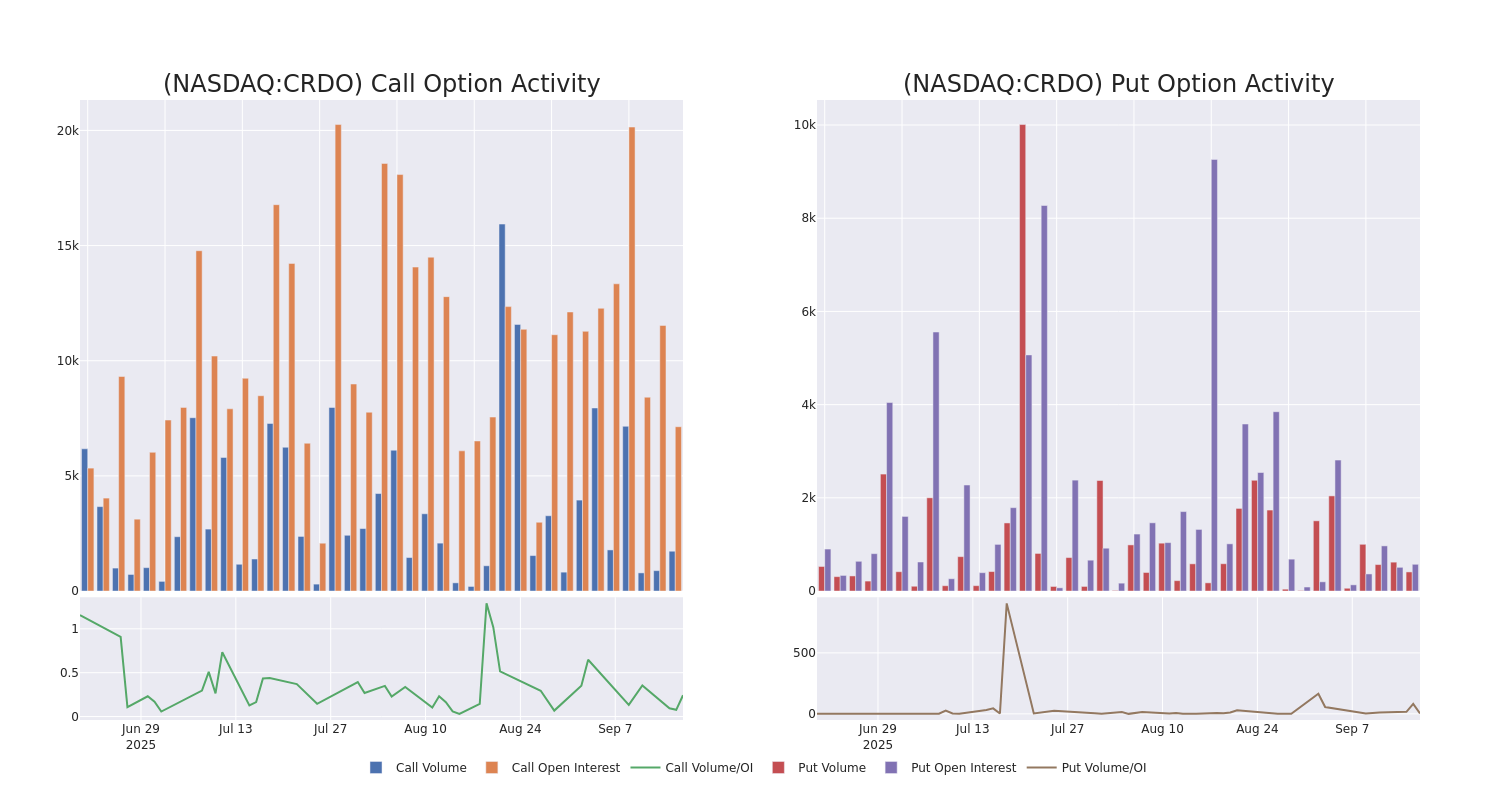

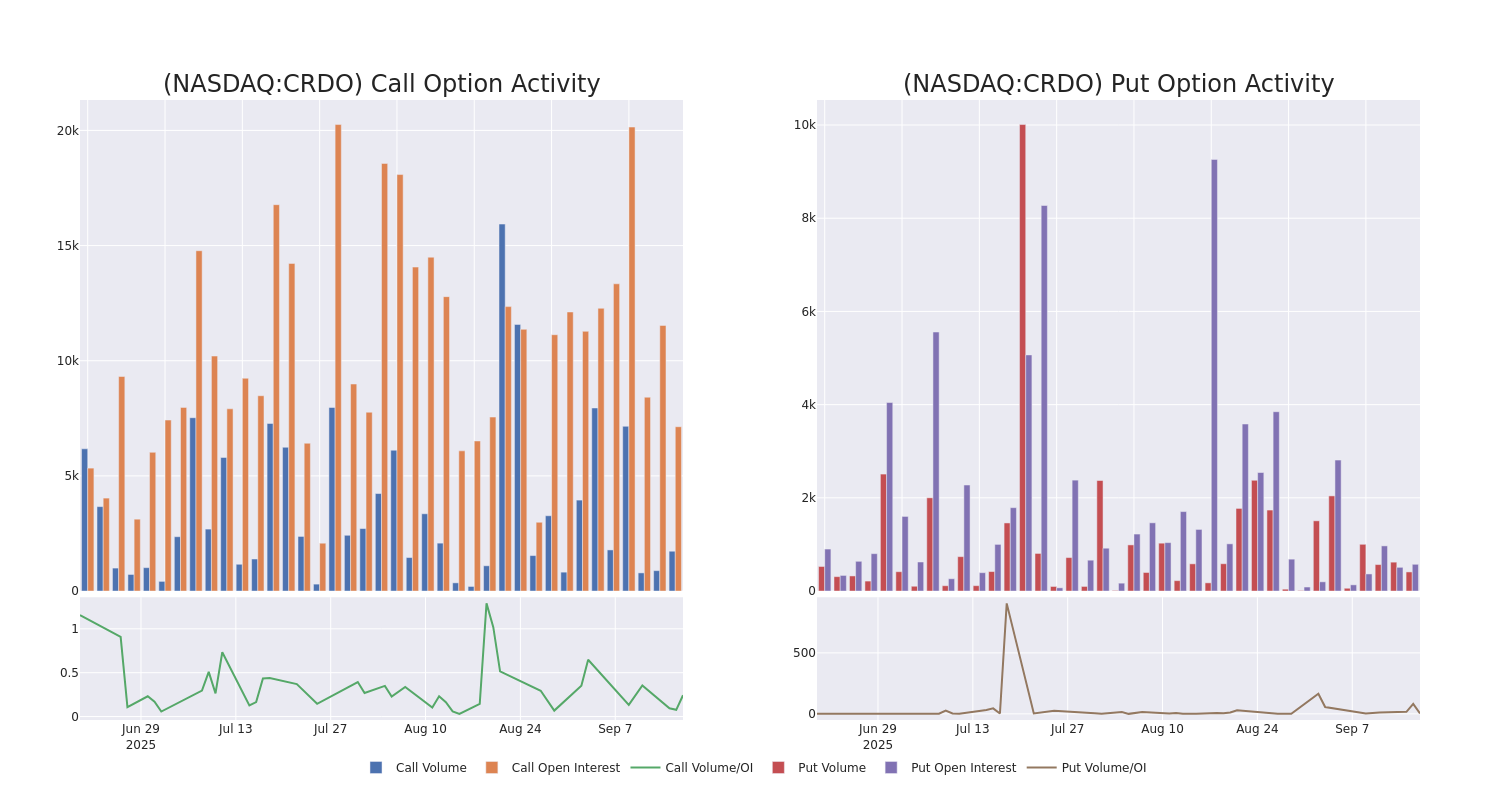

Analyzing Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Credo Technology Group's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Credo Technology Group's substantial trades, within a strike price spectrum from $40.0 to $180.0 over the preceding 30 days.

Credo Technology Group Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| CRDO |

CALL |

TRADE |

NEUTRAL |

10/31/25 |

$13.0 |

$12.3 |

$12.6 |

$170.00 |

$516.6K |

0 |

410 |

| CRDO |

CALL |

SWEEP |

BEARISH |

11/21/25 |

$97.6 |

$97.1 |

$97.1 |

$65.00 |

$485.5K |

410 |

50 |

| CRDO |

CALL |

TRADE |

BULLISH |

10/17/25 |

$10.0 |

$9.7 |

$10.0 |

$170.00 |

$410.0K |

484 |

414 |

| CRDO |

CALL |

SWEEP |

BULLISH |

01/16/26 |

$52.6 |

$51.9 |

$52.59 |

$120.00 |

$194.6K |

856 |

141 |

| CRDO |

CALL |

SWEEP |

BULLISH |

01/16/26 |

$50.2 |

$49.5 |

$50.2 |

$120.00 |

$185.7K |

856 |

104 |

About Credo Technology Group

Credo Technology Group Holding Ltd delivers high-speed solutions to break bandwidth barriers on every wired connection in the data infrastructure market. It provides secure, high-speed connectivity solutions that deliver improved power and cost efficiency as data rates and corresponding bandwidth requirements increase exponentially throughout the data infrastructure market. It has a geographic presence in Hong Kong, the United States, Mainland China, Taiwan, and the Rest of the World.

Having examined the options trading patterns of Credo Technology Group, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Credo Technology Group

- With a volume of 2,343,293, the price of CRDO is down -0.47% at $163.65.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 75 days.

What Analysts Are Saying About Credo Technology Group

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $153.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Barclays has decided to maintain their Overweight rating on Credo Technology Group, which currently sits at a price target of $165.

* Consistent in their evaluation, an analyst from Needham keeps a Buy rating on Credo Technology Group with a target price of $150.

* An analyst from Stifel has decided to maintain their Buy rating on Credo Technology Group, which currently sits at a price target of $130.

* Consistent in their evaluation, an analyst from TD Cowen keeps a Buy rating on Credo Technology Group with a target price of $160.

* An analyst from Roth Capital has decided to maintain their Buy rating on Credo Technology Group, which currently sits at a price target of $160.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Credo Technology Group, Benzinga Pro gives you real-time options trades alerts.

Posted In: CRDO