Analyst Expectations For Equifax's Future

Author: Benzinga Insights | September 15, 2025 09:01am

In the last three months, 15 analysts have published ratings on Equifax (NYSE:EFX), offering a diverse range of perspectives from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

5 |

6 |

4 |

0 |

0 |

| Last 30D |

1 |

0 |

0 |

0 |

0 |

| 1M Ago |

0 |

0 |

0 |

0 |

0 |

| 2M Ago |

2 |

4 |

2 |

0 |

0 |

| 3M Ago |

2 |

2 |

2 |

0 |

0 |

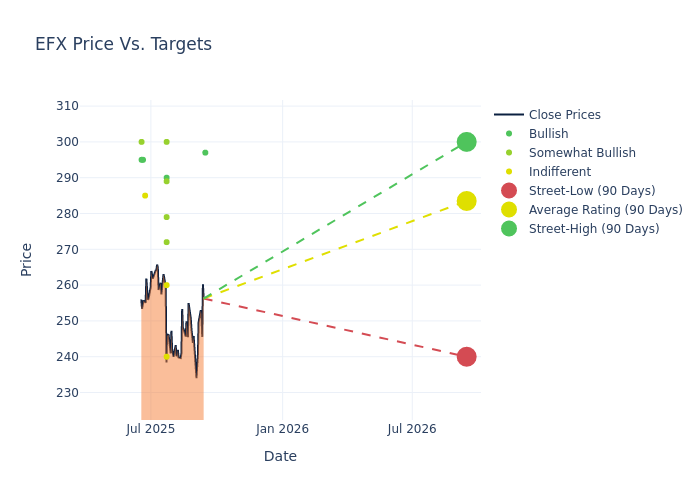

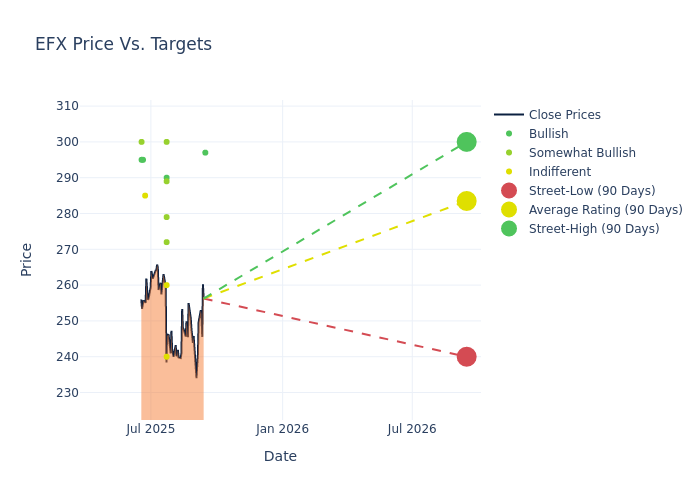

In the assessment of 12-month price targets, analysts unveil insights for Equifax, presenting an average target of $284.67, a high estimate of $310.00, and a low estimate of $240.00. Highlighting a 2.96% decrease, the current average has fallen from the previous average price target of $293.36.

Analyzing Analyst Ratings: A Detailed Breakdown

In examining recent analyst actions, we gain insights into how financial experts perceive Equifax. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Kevin Mcveigh |

UBS |

Raises |

Buy |

$297.00 |

$287.00 |

| Arthur Truslove |

Citigroup |

Lowers |

Buy |

$290.00 |

$294.00 |

| Kevin Mcveigh |

UBS |

Lowers |

Buy |

$278.00 |

$315.00 |

| Owen Lau |

Oppenheimer |

Lowers |

Outperform |

$279.00 |

$296.00 |

| Jeffrey Silber |

BMO Capital |

Lowers |

Market Perform |

$260.00 |

$280.00 |

| Andrew Steinerman |

JP Morgan |

Lowers |

Overweight |

$272.00 |

$277.00 |

| Jason Haas |

Wells Fargo |

Lowers |

Overweight |

$300.00 |

$310.00 |

| Jeffrey Meuler |

Baird |

Lowers |

Outperform |

$289.00 |

$310.00 |

| Manav Patnaik |

Barclays |

Lowers |

Equal-Weight |

$240.00 |

$260.00 |

| Ryan Griffin |

BMO Capital |

Announces |

Market Perform |

$280.00 |

- |

| Jason Haas |

Wells Fargo |

Raises |

Overweight |

$310.00 |

$306.00 |

| Heather Balsky |

B of A Securities |

Lowers |

Neutral |

$285.00 |

$300.00 |

| Mayank Tandon |

Needham |

Maintains |

Buy |

$295.00 |

$295.00 |

| Shlomo Rosenbaum |

Stifel |

Raises |

Buy |

$295.00 |

$277.00 |

| Ashish Sabadra |

RBC Capital |

Maintains |

Outperform |

$300.00 |

$300.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Equifax. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Equifax compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Equifax's stock. This comparison reveals trends in analysts' expectations over time.

Capture valuable insights into Equifax's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Equifax analyst ratings.

About Equifax

Along with Experian and TransUnion, Equifax is one of the leading credit bureaus in the United States. Equifax's credit reports provide credit histories on millions of consumers, and the firm's services are critical to lenders' credit decisions. In addition, over 40% of the firm's revenue comes from workforce solutions, which provides income verification and employer human resources services. Equifax generates about 20%-25% of its revenue from outside the United States.

Equifax: Delving into Financials

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Revenue Growth: Equifax displayed positive results in 3M. As of 30 June, 2025, the company achieved a solid revenue growth rate of approximately 7.44%. This indicates a notable increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: Equifax's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 12.45%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Equifax's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 3.79%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): Equifax's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of 1.61%, the company may face hurdles in achieving optimal financial performance.

Debt Management: Equifax's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.96.

The Significance of Analyst Ratings Explained

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: EFX