Behind the Scenes of Deere's Latest Options Trends

Author: Benzinga Insights | September 10, 2025 11:01am

Investors with a lot of money to spend have taken a bullish stance on Deere (NYSE:DE).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with DE, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 19 uncommon options trades for Deere.

This isn't normal.

The overall sentiment of these big-money traders is split between 57% bullish and 36%, bearish.

Out of all of the special options we uncovered, 15 are puts, for a total amount of $1,367,839, and 4 are calls, for a total amount of $355,441.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $450.0 and $500.0 for Deere, spanning the last three months.

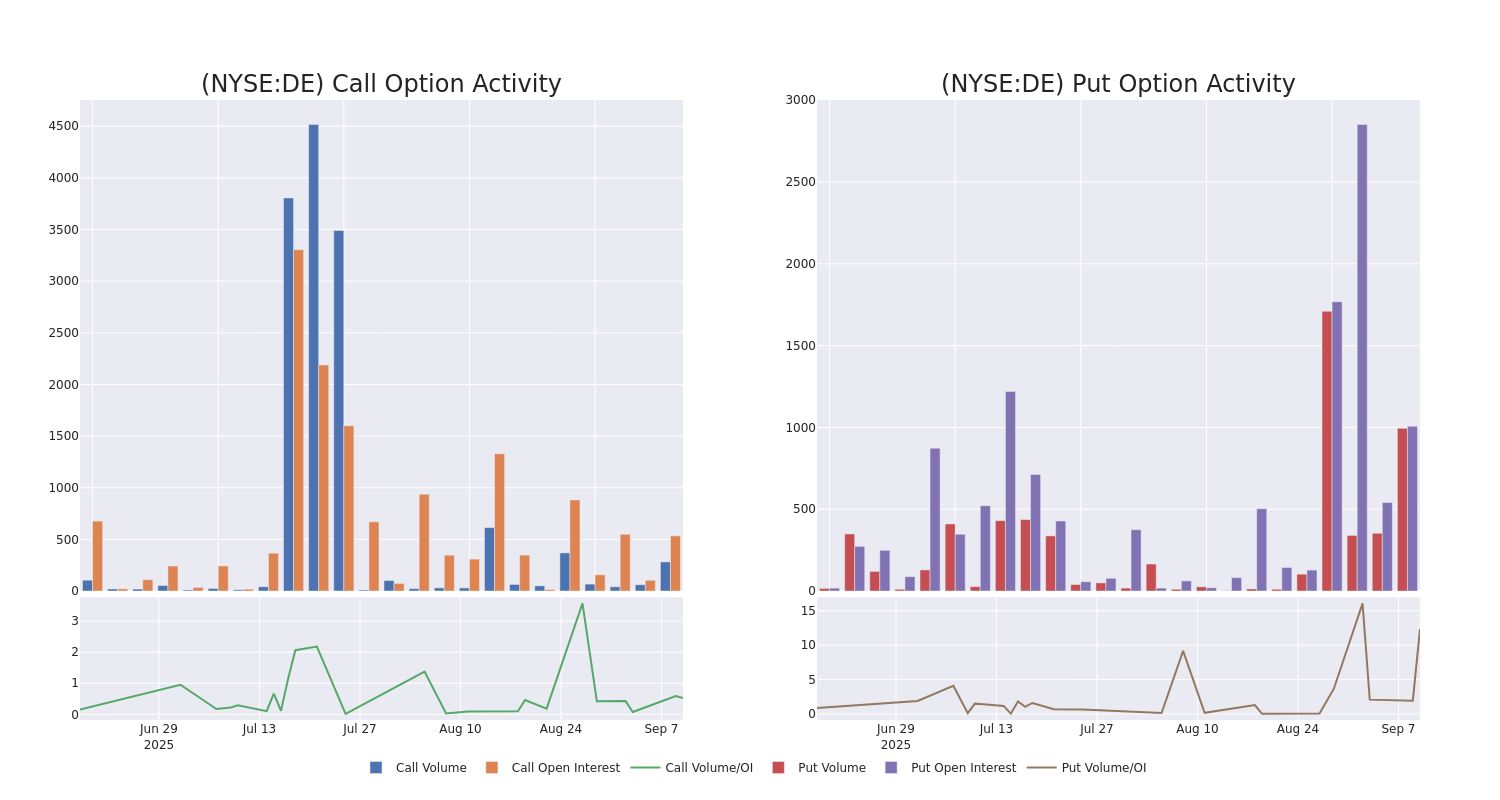

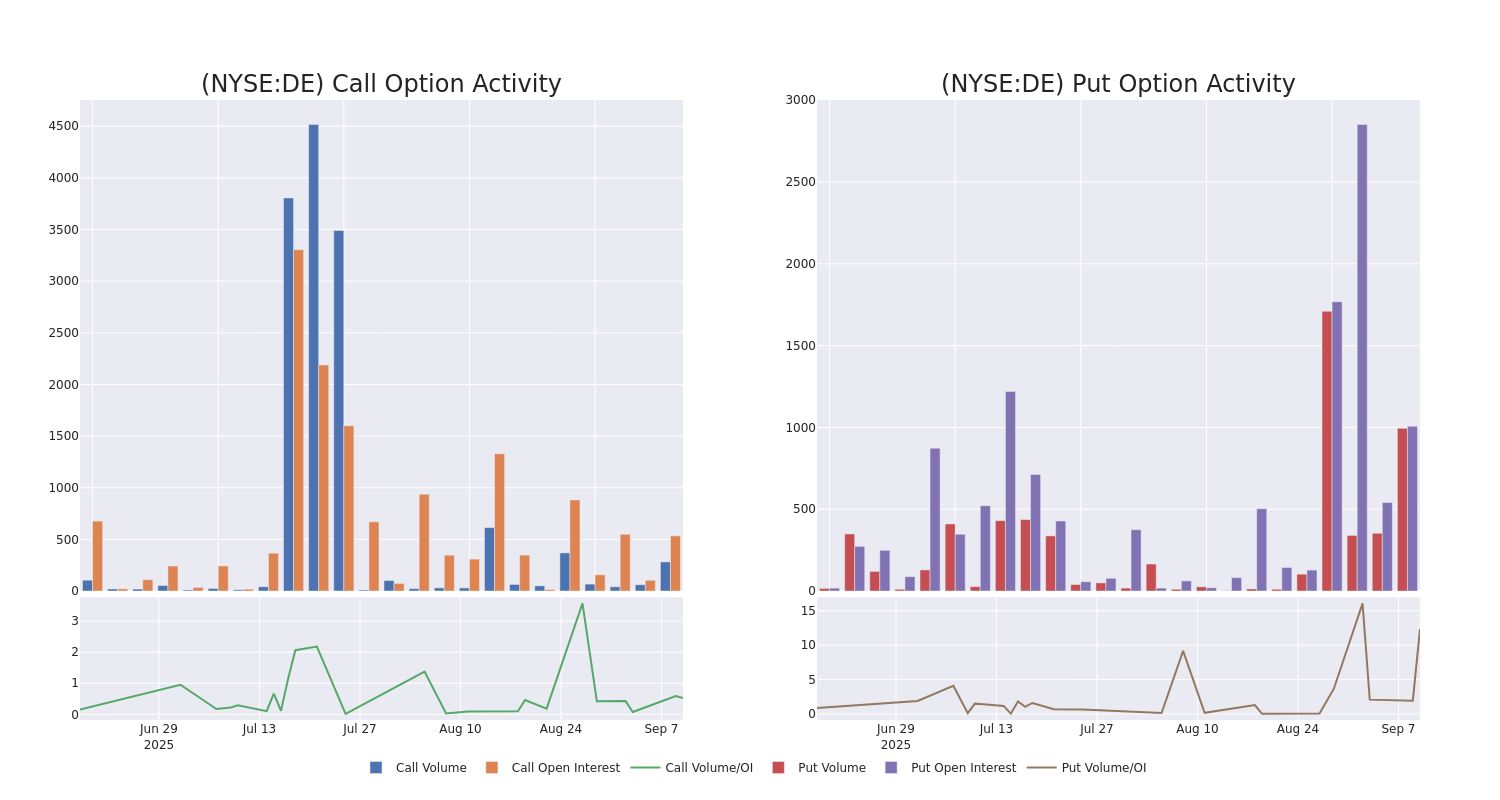

Insights into Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Deere's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Deere's whale activity within a strike price range from $450.0 to $500.0 in the last 30 days.

Deere Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| DE |

CALL |

SWEEP |

BEARISH |

10/17/25 |

$12.85 |

$12.5 |

$12.5 |

$480.00 |

$207.5K |

133 |

166 |

| DE |

PUT |

TRADE |

BULLISH |

12/19/25 |

$37.2 |

$34.8 |

$34.85 |

$500.00 |

$118.4K |

310 |

102 |

| DE |

PUT |

SWEEP |

BULLISH |

12/19/25 |

$37.3 |

$34.6 |

$34.6 |

$500.00 |

$114.1K |

310 |

33 |

| DE |

PUT |

SWEEP |

BULLISH |

06/18/26 |

$31.3 |

$27.8 |

$27.8 |

$450.00 |

$110.9K |

147 |

0 |

| DE |

PUT |

SWEEP |

BULLISH |

12/19/25 |

$30.45 |

$28.85 |

$28.85 |

$490.00 |

$103.8K |

321 |

36 |

About Deere

Deere is the world's leading manufacturer of agricultural equipment and a major producer of construction machinery. The company is divided into four reporting segments: production & precision agriculture (PPA), small agriculture & turf (SAT), construction & forestry (CF), and financial services (FS), its captive finance subsidiary. The core PPA business is the largest contributor to sales and profits by far. Geographically, Deere sales are 60% US/Canada, 17% Europe, 14% Latin America, and 9% rest of world. Deere goes to market through a robust dealer network that includes over 2,000 dealer locations in North America with reach into over 100 countries. John Deere financial provides retail financing for machinery to its customers and wholesale financing for dealers.

Having examined the options trading patterns of Deere, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Deere

- Currently trading with a volume of 241,337, the DE's price is up by 0.06%, now at $475.9.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 71 days.

What The Experts Say On Deere

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $546.2.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from Truist Securities continues to hold a Buy rating for Deere, targeting a price of $602.

* Maintaining their stance, an analyst from Baird continues to hold a Neutral rating for Deere, targeting a price of $488.

* An analyst from JP Morgan persists with their Neutral rating on Deere, maintaining a target price of $495.

* An analyst from Oppenheimer persists with their Outperform rating on Deere, maintaining a target price of $566.

* Consistent in their evaluation, an analyst from DA Davidson keeps a Buy rating on Deere with a target price of $580.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Deere, Benzinga Pro gives you real-time options trades alerts.

Posted In: DE