A Glimpse Into The Expert Outlook On Celestica Through 9 Analysts

Author: Benzinga Insights | September 08, 2025 02:00pm

Analysts' ratings for Celestica (NYSE:CLS) over the last quarter vary from bullish to bearish, as provided by 9 analysts.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

1 |

5 |

3 |

0 |

0 |

| Last 30D |

0 |

1 |

0 |

0 |

0 |

| 1M Ago |

0 |

0 |

0 |

0 |

0 |

| 2M Ago |

1 |

3 |

3 |

0 |

0 |

| 3M Ago |

0 |

1 |

0 |

0 |

0 |

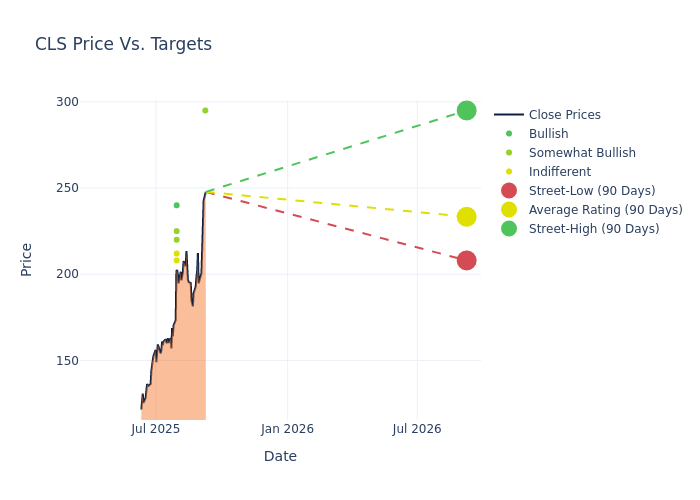

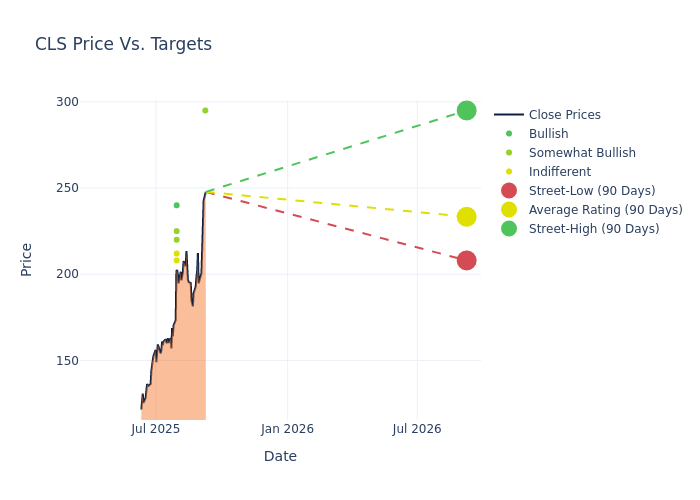

Analysts have recently evaluated Celestica and provided 12-month price targets. The average target is $209.78, accompanied by a high estimate of $295.00 and a low estimate of $146.00. This current average has increased by 40.32% from the previous average price target of $149.50.

Investigating Analyst Ratings: An Elaborate Study

In examining recent analyst actions, we gain insights into how financial experts perceive Celestica. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Samik Chatterjee |

JP Morgan |

Raises |

Overweight |

$295.00 |

$225.00 |

| Atif Malik |

Citigroup |

Raises |

Neutral |

$212.00 |

$172.00 |

| David Vogt |

UBS |

Raises |

Neutral |

$208.00 |

$101.00 |

| Paul Treiber |

RBC Capital |

Raises |

Outperform |

$225.00 |

$185.00 |

| George Wang |

Barclays |

Raises |

Overweight |

$220.00 |

$146.00 |

| Robert Young |

Canaccord Genuity |

Raises |

Buy |

$240.00 |

$126.00 |

| Atif Malik |

Citigroup |

Announces |

Neutral |

$172.00 |

- |

| Samik Chatterjee |

JP Morgan |

Raises |

Overweight |

$170.00 |

$115.00 |

| George Wang |

Barclays |

Raises |

Overweight |

$146.00 |

$126.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Celestica. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Celestica compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Celestica's stock. This comparison reveals trends in analysts' expectations over time.

To gain a panoramic view of Celestica's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Celestica analyst ratings.

Delving into Celestica's Background

Celestica Inc offers supply chain solutions. The company has two operating and reportable segments: Advanced Technology Solutions (ATS) and Connectivity & Cloud Solutions (CCS). The ATS segment consists of the ATS end market and is comprised of the Aerospace and Defense, Industrial, health tech, and Capital Equipment businesses. Its Capital Equipment business is comprised of the semiconductor, display, and robotics equipment businesses, and the CCS segment consists of Communications and Enterprise end markets, The Enterprise end market is comprised of its servers and storage businesses. The company generates a majority of its revenue from the Connectivity & Cloud Solutions segment.

Key Indicators: Celestica's Financial Health

Market Capitalization Analysis: The company's market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Revenue Growth: Celestica's remarkable performance in 3M is evident. As of 30 June, 2025, the company achieved an impressive revenue growth rate of 20.97%. This signifies a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Information Technology sector.

Net Margin: Celestica's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 7.29% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 12.73%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Celestica's ROA stands out, surpassing industry averages. With an impressive ROA of 3.49%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: With a below-average debt-to-equity ratio of 0.5, Celestica adopts a prudent financial strategy, indicating a balanced approach to debt management.

Analyst Ratings: Simplified

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: CLS