Earnings Outlook For Toro

Author: Benzinga Insights | September 03, 2025 10:00am

Toro (NYSE:TTC) will release its quarterly earnings report on Thursday, 2025-09-04. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate Toro to report an earnings per share (EPS) of $1.22.

The market awaits Toro's announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It's important for new investors to understand that guidance can be a significant driver of stock prices.

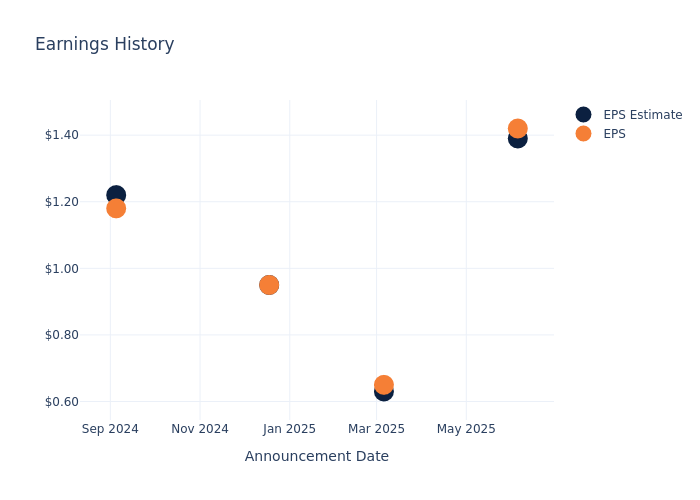

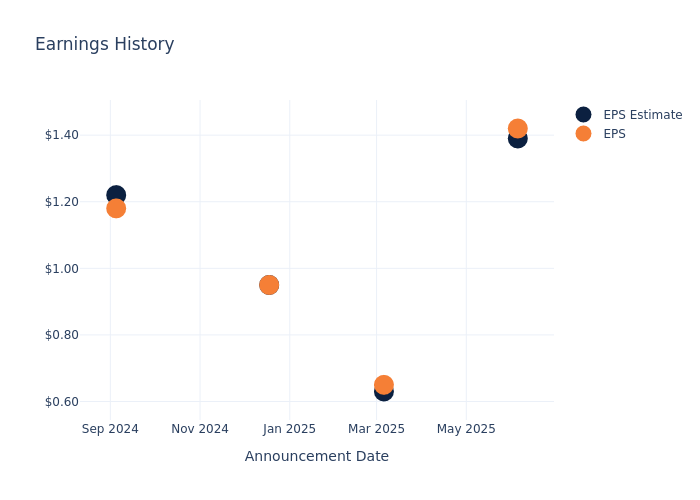

Performance in Previous Earnings

During the last quarter, the company reported an EPS beat by $0.03, leading to a 6.53% drop in the share price on the subsequent day.

Here's a look at Toro's past performance and the resulting price change:

| Quarter |

Q2 2025 |

Q1 2025 |

Q4 2024 |

Q3 2024 |

| EPS Estimate |

1.39 |

0.63 |

0.95 |

1.22 |

| EPS Actual |

1.42 |

0.65 |

0.95 |

1.18 |

| Price Change % |

-7.000000000000001% |

-1.0% |

-0.0% |

0.0% |

Performance of Toro Shares

Shares of Toro were trading at $81.44 as of September 02. Over the last 52-week period, shares are down 1.18%. Given that these returns are generally negative, long-term shareholders are likely bearish going into this earnings release.

Analyst Opinions on Toro

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Toro.

The consensus rating for Toro is Neutral, based on 5 analyst ratings. With an average one-year price target of $84.2, there's a potential 3.39% upside.

Analyzing Analyst Ratings Among Peers

In this analysis, we delve into the analyst ratings and average 1-year price targets of AGCO, Alamo Group and CNH Industrial, three key industry players, offering insights into their relative performance expectations and market positioning.

- Analysts currently favor an Outperform trajectory for AGCO, with an average 1-year price target of $127.2, suggesting a potential 56.19% upside.

- Analysts currently favor an Neutral trajectory for Alamo Group, with an average 1-year price target of $242.5, suggesting a potential 197.77% upside.

- Analysts currently favor an Neutral trajectory for CNH Industrial, with an average 1-year price target of $13.17, suggesting a potential 83.83% downside.

Snapshot: Peer Analysis

The peer analysis summary provides a snapshot of key metrics for AGCO, Alamo Group and CNH Industrial, illuminating their respective standings within the industry. These metrics offer valuable insights into their market positions and comparative performance.

| Company |

Consensus |

Revenue Growth |

Gross Profit |

Return on Equity |

| Toro |

Neutral |

-2.31% |

$436.70M |

9.29% |

| AGCO |

Outperform |

-18.84% |

$658.60M |

7.89% |

| Alamo Group |

Neutral |

0.67% |

$108.29M |

2.86% |

| CNH Industrial |

Neutral |

-14.16% |

$1.52B |

2.74% |

Key Takeaway:

Toro ranks in the middle among its peers for revenue growth, with a slight decline. It is at the top for gross profit, indicating strong performance in this area. However, its return on equity is lower compared to its peers, placing it in the bottom half. Overall, Toro's performance is relatively stable compared to its peers.

All You Need to Know About Toro

The Toro Co manufactures turf maintenance and landscaping equipment. The company produces reel and rotary riding products, trim cutting and walking mowers, greens rollers, turf sprayer equipment, underground irrigation systems, heavy-duty walk-behind mowers, and sprinkler systems used for professional turf and landscape maintenance and construction. Its products are marketed through a network of distributors and dealers to predominantly professional users maintaining turfs and sports fields such as golf courses. Its operating segments are Professional which generates a substantial part of its revenue, and Residential segment. The company also produces snow plowers and ice management products. Its key revenue generating market is the United States.

Financial Milestones: Toro's Journey

Market Capitalization Analysis: The company's market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Decline in Revenue: Over the 3 months period, Toro faced challenges, resulting in a decline of approximately -2.31% in revenue growth as of 30 April, 2025. This signifies a reduction in the company's top-line earnings. When compared to others in the Industrials sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Toro's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 10.38% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 9.29%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 3.66%, the company showcases effective utilization of assets.

Debt Management: Toro's debt-to-equity ratio is below the industry average at 0.82, reflecting a lower dependency on debt financing and a more conservative financial approach.

To track all earnings releases for Toro visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: TTC