Beyond The Numbers: 4 Analysts Discuss First Financial Bancorp Stock

Author: Benzinga Insights | August 19, 2025 03:03pm

Providing a diverse range of perspectives from bullish to bearish, 4 analysts have published ratings on First Financial Bancorp (NASDAQ:FFBC) in the last three months.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

0 |

1 |

3 |

0 |

0 |

| Last 30D |

0 |

0 |

0 |

0 |

0 |

| 1M Ago |

0 |

0 |

1 |

0 |

0 |

| 2M Ago |

0 |

1 |

2 |

0 |

0 |

| 3M Ago |

0 |

0 |

0 |

0 |

0 |

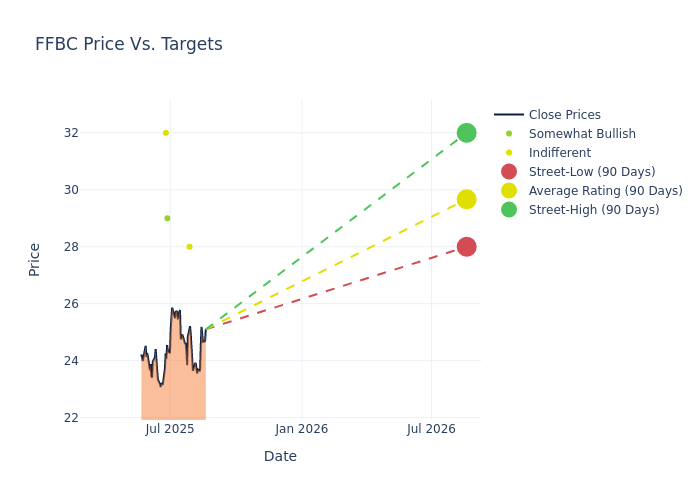

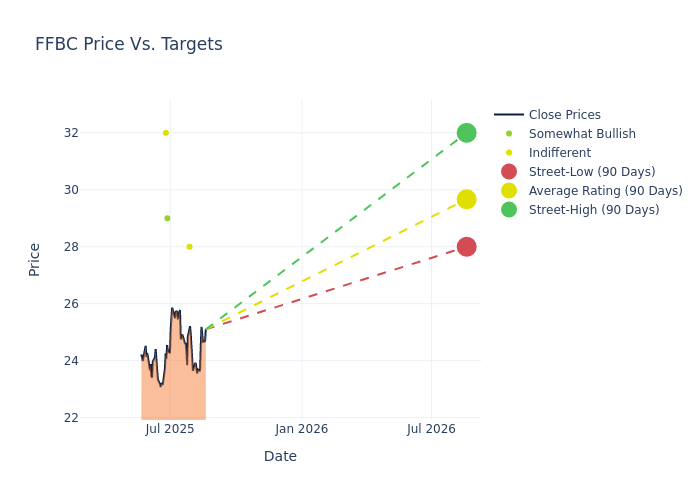

In the assessment of 12-month price targets, analysts unveil insights for First Financial Bancorp, presenting an average target of $29.0, a high estimate of $32.00, and a low estimate of $27.00. This current average has increased by 2.65% from the previous average price target of $28.25.

Deciphering Analyst Ratings: An In-Depth Analysis

In examining recent analyst actions, we gain insights into how financial experts perceive First Financial Bancorp. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Jon Arfstrom |

RBC Capital |

Raises |

Sector Perform |

$28.00 |

$27.00 |

| Terry McEvoy |

Stephens & Co. |

Maintains |

Overweight |

$29.00 |

$29.00 |

| Christopher Mcgratty |

Keefe, Bruyette & Woods |

Raises |

Market Perform |

$32.00 |

$30.00 |

| Karl Shepard |

RBC Capital |

Maintains |

Sector Perform |

$27.00 |

$27.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to First Financial Bancorp. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of First Financial Bancorp compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for First Financial Bancorp's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into First Financial Bancorp's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on First Financial Bancorp analyst ratings.

Delving into First Financial Bancorp's Background

First Financial Bancorp is a mid-sized, regional bank holding company. It engages in the business of commercial banking and other banking and banking-related activities through its subsidiary. The range of banking services provided to individuals and businesses includes commercial lending, real estate lending and consumer financing. Real estate loans are loans secured by a mortgage lien on the real property of the borrower, which may either be residential property or commercial property. In addition, it offers deposit products that include interest-bearing and noninterest-bearing accounts, time deposits and cash management services for commercial customers. A full range of trust and wealth management services is also provided through First Financial's Wealth Management line of business.

Understanding the Numbers: First Financial Bancorp's Finances

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Over the 3M period, First Financial Bancorp showcased positive performance, achieving a revenue growth rate of 5.36% as of 30 June, 2025. This reflects a substantial increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Financials sector.

Net Margin: First Financial Bancorp's net margin is impressive, surpassing industry averages. With a net margin of 30.93%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): First Financial Bancorp's ROE stands out, surpassing industry averages. With an impressive ROE of 2.77%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): First Financial Bancorp's ROA excels beyond industry benchmarks, reaching 0.38%. This signifies efficient management of assets and strong financial health.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 0.4, caution is advised due to increased financial risk.

Analyst Ratings: Simplified

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: FFBC