A Glimpse Into The Expert Outlook On Haemonetics Through 6 Analysts

Author: Benzinga Insights | August 08, 2025 07:00am

In the preceding three months, 6 analysts have released ratings for Haemonetics (NYSE:HAE), presenting a wide array of perspectives from bullish to bearish.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

2 |

3 |

1 |

0 |

0 |

| Last 30D |

0 |

0 |

1 |

0 |

0 |

| 1M Ago |

2 |

1 |

0 |

0 |

0 |

| 2M Ago |

0 |

1 |

0 |

0 |

0 |

| 3M Ago |

0 |

1 |

0 |

0 |

0 |

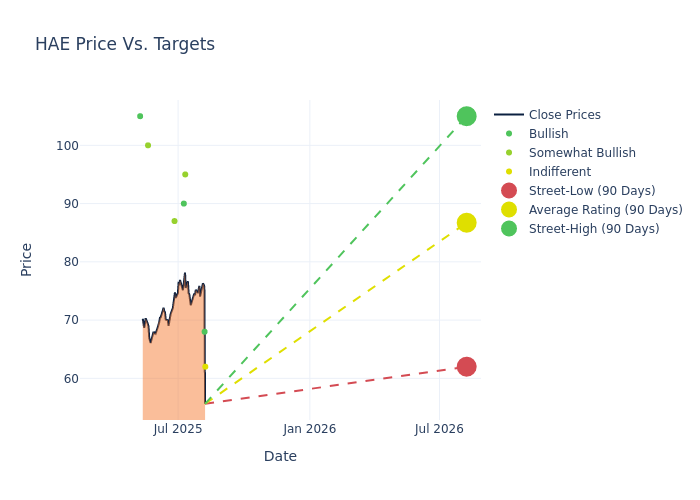

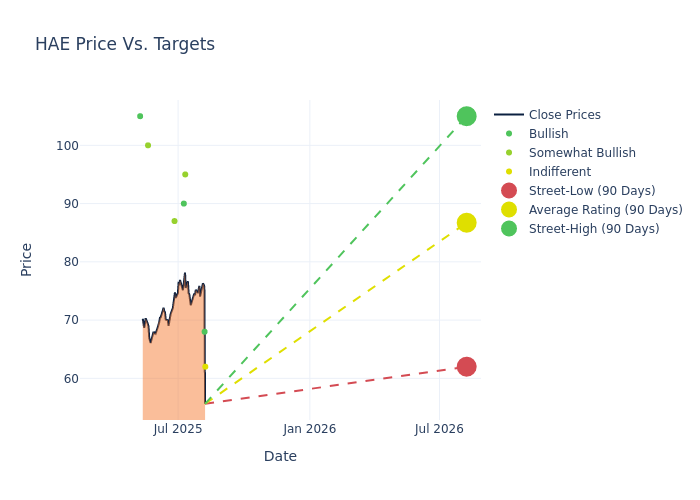

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $83.67, a high estimate of $100.00, and a low estimate of $62.00. Observing a downward trend, the current average is 3.83% lower than the prior average price target of $87.00.

Investigating Analyst Ratings: An Elaborate Study

A clear picture of Haemonetics's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Rohin Patel |

JP Morgan |

Lowers |

Neutral |

$62.00 |

$85.00 |

| Mike Matson |

Needham |

Lowers |

Buy |

$68.00 |

$84.00 |

| Michael Petusky |

Barrington Research |

Maintains |

Outperform |

$95.00 |

$95.00 |

| Joanne Wuensch |

Citigroup |

Raises |

Buy |

$90.00 |

$71.00 |

| David Rescott |

Baird |

Announces |

Outperform |

$87.00 |

- |

| David Turkaly |

JMP Securities |

Maintains |

Market Outperform |

$100.00 |

$100.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Haemonetics. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Haemonetics compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Haemonetics's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Capture valuable insights into Haemonetics's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Haemonetics analyst ratings.

Discovering Haemonetics: A Closer Look

Haemonetics Corp aims to improve patient care and reduce the cost of healthcare by providing medical products and solutions in the blood and plasma component collection, surgical suite, and hospital transfusion service spaces. As such, the company operates under three segments: plasma, blood center, and hospital. The company primarily emphasizes its plasma and hospital segments due to their robust growth potential, whereas the blood center segment tends to be constrained by higher competition. Product revenue is driven by demand for disposable blood component collection and processing sets and the related equipment needed for proper functionality.

Haemonetics's Economic Impact: An Analysis

Market Capitalization: Indicating a reduced size compared to industry averages, the company's market capitalization poses unique challenges.

Revenue Growth: Haemonetics's revenue growth over a period of 3M has faced challenges. As of 31 March, 2025, the company experienced a revenue decline of approximately -3.7%. This indicates a decrease in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Health Care sector.

Net Margin: Haemonetics's net margin excels beyond industry benchmarks, reaching 17.54%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Haemonetics's ROE excels beyond industry benchmarks, reaching 6.71%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Haemonetics's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 2.33%, the company showcases efficient use of assets and strong financial health.

Debt Management: With a high debt-to-equity ratio of 1.49, Haemonetics faces challenges in effectively managing its debt levels, indicating potential financial strain.

The Basics of Analyst Ratings

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: HAE