Earnings Preview: Grid Dynamics Holdings

Author: Benzinga Insights | July 30, 2025 04:02pm

Grid Dynamics Holdings (NASDAQ:GDYN) is set to give its latest quarterly earnings report on Thursday, 2025-07-31. Here's what investors need to know before the announcement.

Analysts estimate that Grid Dynamics Holdings will report an earnings per share (EPS) of $0.07.

Anticipation surrounds Grid Dynamics Holdings's announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

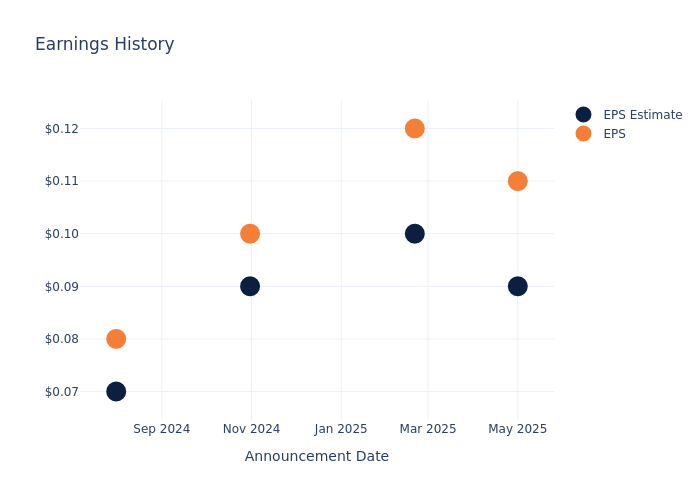

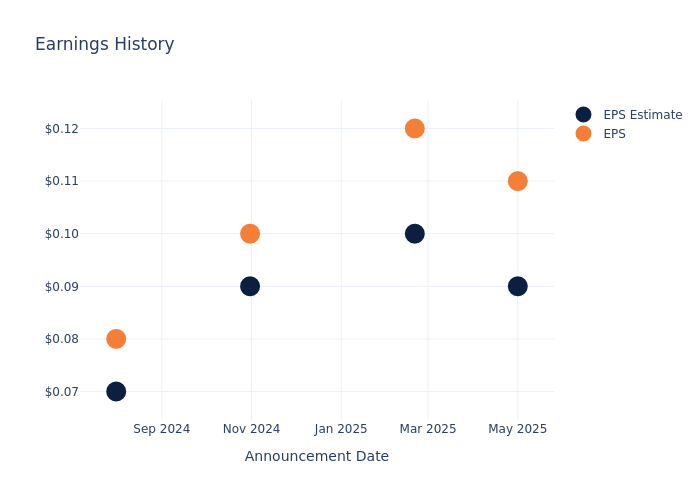

Past Earnings Performance

Last quarter the company beat EPS by $0.02, which was followed by a 3.12% drop in the share price the next day.

Here's a look at Grid Dynamics Holdings's past performance and the resulting price change:

| Quarter |

Q1 2025 |

Q4 2024 |

Q3 2024 |

Q2 2024 |

| EPS Estimate |

0.09 |

0.10 |

0.09 |

0.07 |

| EPS Actual |

0.11 |

0.12 |

0.10 |

0.08 |

| Price Change % |

-3.0% |

4.0% |

-4.0% |

13.0% |

Performance of Grid Dynamics Holdings Shares

Shares of Grid Dynamics Holdings were trading at $9.91 as of July 29. Over the last 52-week period, shares are down 21.14%. Given that these returns are generally negative, long-term shareholders are likely unhappy going into this earnings release.

Analyst Insights on Grid Dynamics Holdings

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Grid Dynamics Holdings.

The consensus rating for Grid Dynamics Holdings is Buy, derived from 1 analyst ratings. An average one-year price target of $20.0 implies a potential 101.82% upside.

Peer Ratings Overview

The analysis below examines the analyst ratings and average 1-year price targets of and Grid Dynamics Holdings, three significant industry players, providing valuable insights into their relative performance expectations and market positioning.

Overview of Peer Analysis

The peer analysis summary offers a detailed examination of key metrics for and Grid Dynamics Holdings, providing valuable insights into their respective standings within the industry and their market positions and comparative performance.

| Company |

Consensus |

Revenue Growth |

Gross Profit |

Return on Equity |

| Grid Dynamics Holdings |

Buy |

25.81% |

$37.00M |

0.56% |

Key Takeaway:

Grid Dynamics Holdings is positioned at the bottom for Revenue Growth among its peers, with a growth rate of 25.81%. In terms of Gross Profit, it is also at the bottom with $37.00M. However, it is at the top for Return on Equity with a rate of 0.56%. Overall, Grid Dynamics Holdings shows mixed performance compared to its peers.

Delving into Grid Dynamics Holdings's Background

Grid Dynamics Holdings Inc is a provider of technology consulting, platform and product engineering, and advanced analytics services. The company delivers tailored solutions in several industry verticals like Tech, Media and Telecom, Retail, Finance and Consumer Packaged goods (CPG)/manufacturing. The company derives maximum revenue from Retails. Geographically company earns revenue from North America, Europe and other regions.

Grid Dynamics Holdings: Financial Performance Dissected

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Revenue Growth: Over the 3 months period, Grid Dynamics Holdings showcased positive performance, achieving a revenue growth rate of 25.81% as of 31 March, 2025. This reflects a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Information Technology sector.

Net Margin: Grid Dynamics Holdings's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 2.9% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Grid Dynamics Holdings's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 0.56%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of 0.49%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.02.

To track all earnings releases for Grid Dynamics Holdings visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: GDYN