Deep Dive Into Enterprise Prods Partners Stock: Analyst Perspectives (6 Ratings)

Author: Benzinga Insights | July 29, 2025 09:00am

Ratings for Enterprise Prods Partners (NYSE:EPD) were provided by 6 analysts in the past three months, showcasing a mix of bullish and bearish perspectives.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

2 |

3 |

1 |

0 |

0 |

| Last 30D |

1 |

0 |

0 |

0 |

0 |

| 1M Ago |

0 |

2 |

0 |

0 |

0 |

| 2M Ago |

0 |

0 |

1 |

0 |

0 |

| 3M Ago |

1 |

1 |

0 |

0 |

0 |

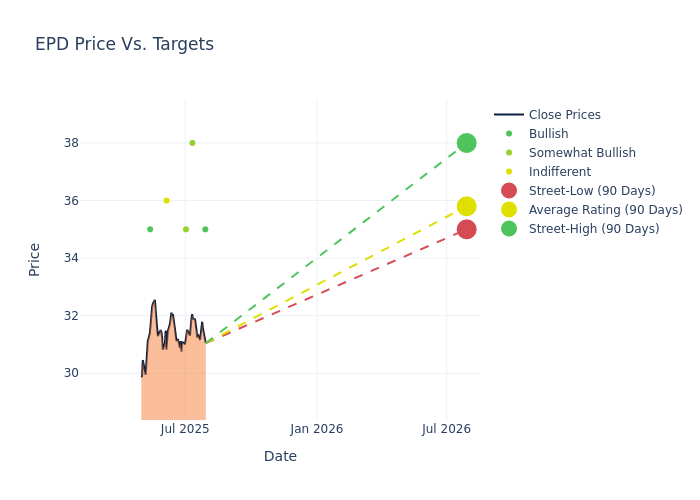

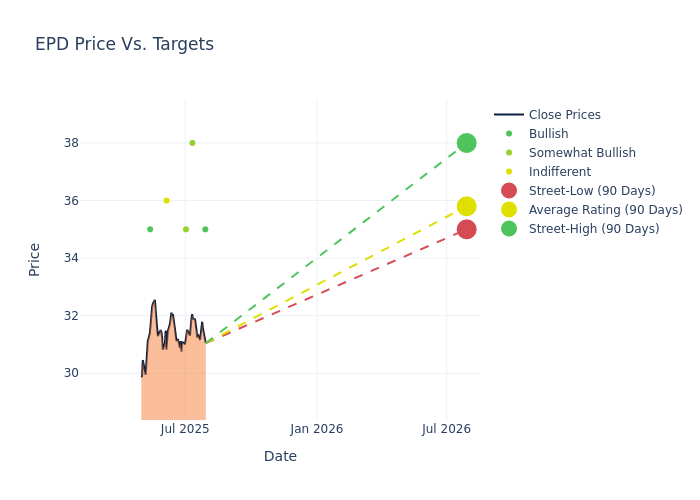

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $35.83, with a high estimate of $38.00 and a low estimate of $35.00. This current average has decreased by 2.29% from the previous average price target of $36.67.

Understanding Analyst Ratings: A Comprehensive Breakdown

The perception of Enterprise Prods Partners by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Selman Akyol |

Stifel |

Lowers |

Buy |

$35.00 |

$36.00 |

| Gabriel Moreen |

Mizuho |

Lowers |

Outperform |

$38.00 |

$39.00 |

| Theresa Chen |

Barclays |

Lowers |

Overweight |

$35.00 |

$36.00 |

| Brandon Bingham |

Scotiabank |

Raises |

Sector Perform |

$36.00 |

$35.00 |

| Theresa Chen |

Barclays |

Lowers |

Overweight |

$36.00 |

$37.00 |

| Spiro Dounis |

Citigroup |

Lowers |

Buy |

$35.00 |

$37.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Enterprise Prods Partners. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Enterprise Prods Partners compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Enterprise Prods Partners's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Enterprise Prods Partners analyst ratings.

Unveiling the Story Behind Enterprise Prods Partners

Enterprise Products Partners is a master limited partnership that transports and processes natural gas, natural gas liquids, crude oil, refined products, and petrochemicals. It is one of the largest midstream companies, with operations servicing most producing regions in the continental US. Enterprise is particularly dominant in the NGL market and is one of the few MLPs that provide midstream services across the full hydrocarbon value chain.

Financial Milestones: Enterprise Prods Partners's Journey

Market Capitalization Analysis: The company's market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Positive Revenue Trend: Examining Enterprise Prods Partners's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 4.45% as of 31 March, 2025, showcasing a substantial increase in top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Energy sector.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of 8.95%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): Enterprise Prods Partners's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 4.79%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): Enterprise Prods Partners's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 1.81% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 1.09.

Understanding the Relevance of Analyst Ratings

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: EPD