In-Depth Examination Of 4 Analyst Recommendations For Apple Hospitality REIT

Author: Benzinga Insights | December 09, 2024 11:01am

Providing a diverse range of perspectives from bullish to bearish, 4 analysts have published ratings on Apple Hospitality REIT (NYSE:APLE) in the last three months.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

0 |

3 |

1 |

0 |

0 |

| Last 30D |

0 |

1 |

0 |

0 |

0 |

| 1M Ago |

0 |

0 |

0 |

0 |

0 |

| 2M Ago |

0 |

1 |

0 |

0 |

0 |

| 3M Ago |

0 |

1 |

1 |

0 |

0 |

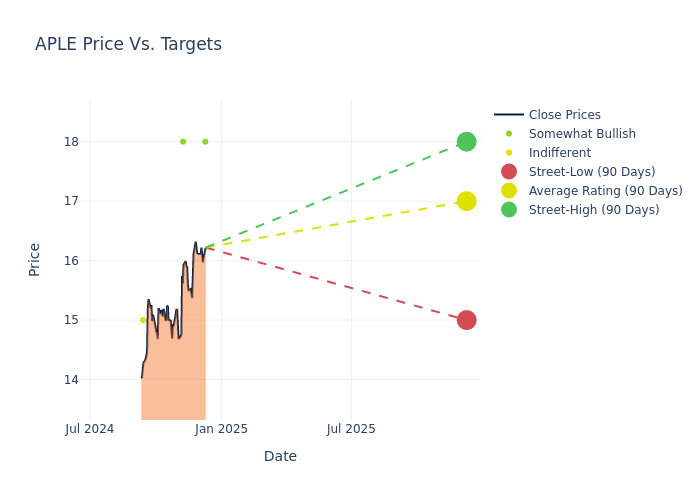

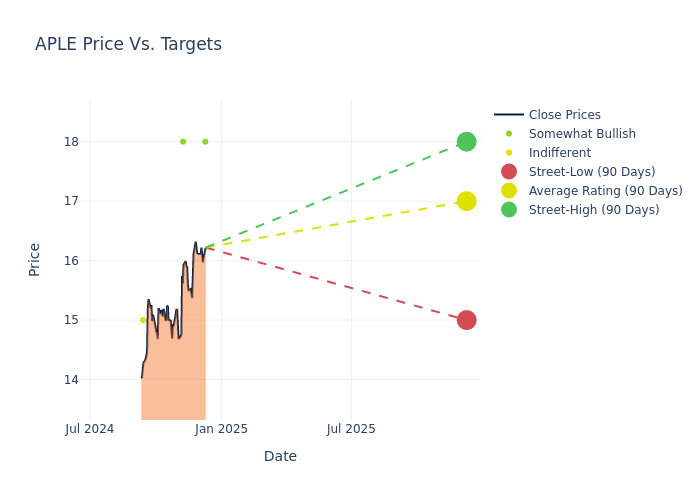

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $17.0, a high estimate of $18.00, and a low estimate of $15.00. Surpassing the previous average price target of $16.67, the current average has increased by 1.98%.

Deciphering Analyst Ratings: An In-Depth Analysis

In examining recent analyst actions, we gain insights into how financial experts perceive Apple Hospitality REIT. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Ari Klein |

BMO Capital |

Announces |

Outperform |

$18.00 |

- |

| Tyler Batory |

Oppenheimer |

Raises |

Outperform |

$18.00 |

$17.00 |

| Tyler Batory |

Oppenheimer |

Maintains |

Outperform |

$17.00 |

$17.00 |

| Dori Kesten |

Wells Fargo |

Lowers |

Equal-Weight |

$15.00 |

$16.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Apple Hospitality REIT. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Apple Hospitality REIT compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Apple Hospitality REIT's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Capture valuable insights into Apple Hospitality REIT's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Apple Hospitality REIT analyst ratings.

Get to Know Apple Hospitality REIT Better

Apple Hospitality REIT Inc is a real estate investment trust that invests in income-producing real estate, majorly in the lodging sector, in the United States. It chiefly invests in upscale service hotels. All of the company's hotels operate under the Marriott or Hilton brands. Apple Hospitality has wholly-owned taxable REIT subsidiaries, which lease all of the company's hotels from wholly-owned qualified REIT subsidiaries. These hotels are managed under separate agreements with various hotel management companies that are unaffiliated with Apple Hospitality. The company derives its income from hotel revenue, its sole segment.

Apple Hospitality REIT: A Financial Overview

Market Capitalization: Boasting an elevated market capitalization, the company surpasses industry averages. This signals substantial size and strong market recognition.

Revenue Growth: Apple Hospitality REIT displayed positive results in 3 months. As of 30 September, 2024, the company achieved a solid revenue growth rate of approximately 5.75%. This indicates a notable increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Real Estate sector.

Net Margin: Apple Hospitality REIT's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 14.85%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Apple Hospitality REIT's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 1.7%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Apple Hospitality REIT's ROA stands out, surpassing industry averages. With an impressive ROA of 1.11%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.49.

Analyst Ratings: Simplified

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: APLE