Why Micron, Broadcom And Lam Research Shares Are Moving Higher Thursday

Author: Adam Eckert | May 23, 2024 09:04am

Several semiconductor stocks including Micron Technology Inc (NASDAQ:MU), Broadcom Inc (NASDAQ:AVGO) and Lam Research Corp (NASDAQ:LRCX) are trading higher Thursday in sympathy with NVIDIA Corp (NASDAQ:NVDA), which jumped after reporting earnings for the first quarter.

What Happened With NVDA: Nvidia beat analyst estimates for the first quarter on the top and bottom lines, reporting revenue of $26.044 billion versus analyst estimates of $24.646 billion and earnings of $6.12 per share versus estimates of $5.59 per share.

Nvidia also issued upbeat guidance, forecasting second-quarter revenue of $28 billion, plus or minus 2%, versus estimates of $26.64 billion, according to data from Benzinga Pro.

"The next industrial revolution has begun — companies and countries are partnering with NVIDIA to shift the trillion-dollar traditional data centers to accelerated computing and build a new type of data center — AI factories — to produce a new commodity: artificial intelligence," said Jensen Huang, founder and CEO of Nvidia. "AI will bring significant productivity gains to nearly every industry and help companies be more cost- and energy-efficient, while expanding revenue opportunities."

Nvidia also announced a 10-for-1 forward stock split, effective June 7, and increased its dividend 150% to 1 cent per share on a post-split basis.

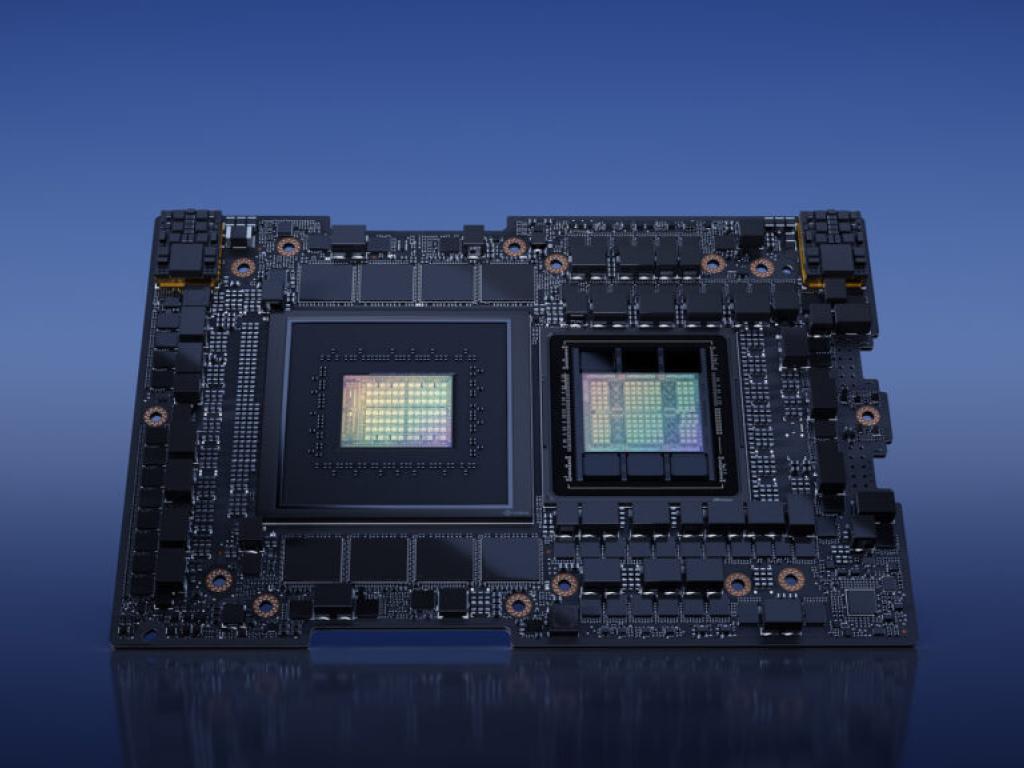

Shares accelerated to the upside late Wednesday after Huang revealed on the conference call that production for Nvidia’s recently launched Blackwell chips has started. He also noted that the company anticipates “a lot of Blackwell revenue” this year. Nvidia shares were up more than 7% at the time of writing.

Following the company’s quarterly results, several analysts raised price targets on the stock ranging from $1,140 to $1,320 per share. Rosenblatt also maintained its price target of $1,400, per Benzinga Pro.

Check This Out: Jensen Huang Says ‘Other Blackwells Coming’ Even As Nvidia Gears Up For ‘Lot Of Blackwell Revenue’ This Year: ‘It’s Going To Be Terrific’

Micron is one of the largest chip companies in the world, specializing in memory and storage. Micron delivers a rich portfolio of high-performance DRAM, NAND and NOR memory and storage products. Micron shares were up 4.53% at last check.

Broadcom designs, develops and supplies a broad range of semiconductor, enterprise software and security solutions. Broadcom shares were up 2.62% Thursday morning.

Lam Research is a global supplier of innovative wafer fabrication equipment and services to the semiconductor industry. Lam Research shares were up 2.96% at last check, according to Benzinga Pro.

Photo: courtesy of Nvidia.

Posted In: AVGO LRCX MU NVDA