Market Analysis: Super Micro Computer And Competitors In Technology Hardware, Storage & Peripherals Industry

Author: Benzinga Insights | May 16, 2024 11:00am

In today's rapidly changing and fiercely competitive business landscape, it is essential for investors and industry enthusiasts to thoroughly analyze companies. In this article, we will conduct a comprehensive industry comparison, evaluating Super Micro Computer (NASDAQ:SMCI) against its key competitors in the Technology Hardware, Storage & Peripherals industry. By examining key financial metrics, market position, and growth prospects, we aim to provide valuable insights for investors and shed light on company's performance within the industry.

Super Micro Computer Background

Super Micro Computer Inc provides high-performance server technology services to cloud computing, data center, Big Data, high-performance computing, and "Internet of Things" embedded markets. Its solutions include server, storage, blade and workstations to full racks, networking devices, and server management software. The firm follows a modular architectural approach, which provides flexibility to deliver customized solutions. The Company operates in one operating segment that develops and provides high-performance server solutions based upon an innovative, modular and open-standard architecture. More than half of the firm's revenue is generated in the United States, with the rest coming from Europe, Asia, and other regions.

| Company |

P/E |

P/B |

P/S |

ROE |

EBITDA (in billions) |

Gross Profit (in billions) |

Revenue Growth |

| Super Micro Computer Inc |

53.03 |

10.95 |

4.70 |

9.85% |

$0.4 |

$0.6 |

200.01% |

| Apple Inc |

29.51 |

39.21 |

7.77 |

31.88% |

$30.74 |

$42.27 |

-4.31% |

| Hewlett Packard Enterprise Co |

12.39 |

1.09 |

0.84 |

1.82% |

$1.23 |

$2.46 |

-13.5% |

| NetApp Inc |

25.20 |

22.97 |

3.83 |

35.49% |

$0.46 |

$1.15 |

5.24% |

| Pure Storage Inc |

313.63 |

15.25 |

7 |

5.41% |

$0.11 |

$0.57 |

-2.52% |

| Eastman Kodak Co |

7.49 |

0.42 |

0.42 |

2.66% |

$0.06 |

$0.05 |

-10.43% |

| AstroNova Inc |

28.10 |

1.52 |

0.90 |

3.06% |

$0.01 |

$0.01 |

-0.65% |

| Transact Technologies Inc |

62.92 |

0.98 |

0.62 |

-2.66% |

$-0.0 |

$0.01 |

-19.43% |

| Average |

68.46 |

11.63 |

3.05 |

11.09% |

$4.66 |

$6.65 |

-6.51% |

By analyzing Super Micro Computer, we can infer the following trends:

-

At 53.03, the stock's Price to Earnings ratio is 0.77x less than the industry average, suggesting favorable growth potential.

-

The current Price to Book ratio of 10.95, which is 0.94x the industry average, is substantially lower than the industry average, indicating potential undervaluation.

-

With a relatively high Price to Sales ratio of 4.7, which is 1.54x the industry average, the stock might be considered overvalued based on sales performance.

-

With a Return on Equity (ROE) of 9.85% that is 1.24% below the industry average, it appears that the company exhibits potential inefficiency in utilizing equity to generate profits.

-

The company has lower Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) of $400 Million, which is 0.09x below the industry average. This potentially indicates lower profitability or financial challenges.

-

Compared to its industry, the company has lower gross profit of $600 Million, which indicates 0.09x below the industry average, potentially indicating lower revenue after accounting for production costs.

-

With a revenue growth of 200.01%, which surpasses the industry average of -6.51%, the company is demonstrating robust sales expansion and gaining market share.

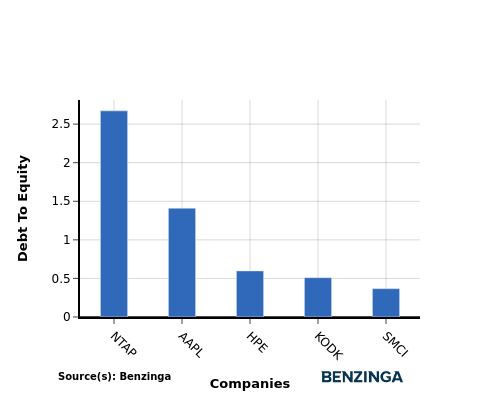

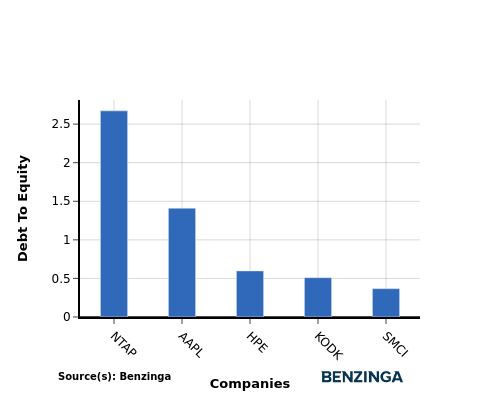

Debt To Equity Ratio

The debt-to-equity (D/E) ratio measures the financial leverage of a company by evaluating its debt relative to its equity.

Considering the debt-to-equity ratio in industry comparisons allows for a concise evaluation of a company's financial health and risk profile, aiding in informed decision-making.

In light of the Debt-to-Equity ratio, a comparison between Super Micro Computer and its top 4 peers reveals the following information:

-

Among its top 4 peers, Super Micro Computer has a stronger financial position with a lower debt-to-equity ratio of 0.37.

-

This indicates that the company relies less on debt financing and maintains a more favorable balance between debt and equity, which can be viewed positively by investors.

Key Takeaways

The PE, PB, and PS ratios for Super Micro Computer indicate that it is undervalued compared to its peers in the Technology Hardware, Storage & Peripherals industry. However, the low ROE, EBITDA, and gross profit suggest that the company may be facing operational challenges. On the other hand, the high revenue growth rate implies potential for future expansion and market share gains.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: SMCI