A Closer Look at CVS Health's Options Market Dynamics

Author: Benzinga Insights | May 15, 2024 01:32pm

Deep-pocketed investors have adopted a bullish approach towards CVS Health (NYSE:CVS), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in CVS usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 23 extraordinary options activities for CVS Health. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 43% leaning bullish and 43% bearish. Among these notable options, 3 are puts, totaling $303,435, and 20 are calls, amounting to $1,197,815.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $40.0 to $80.0 for CVS Health over the recent three months.

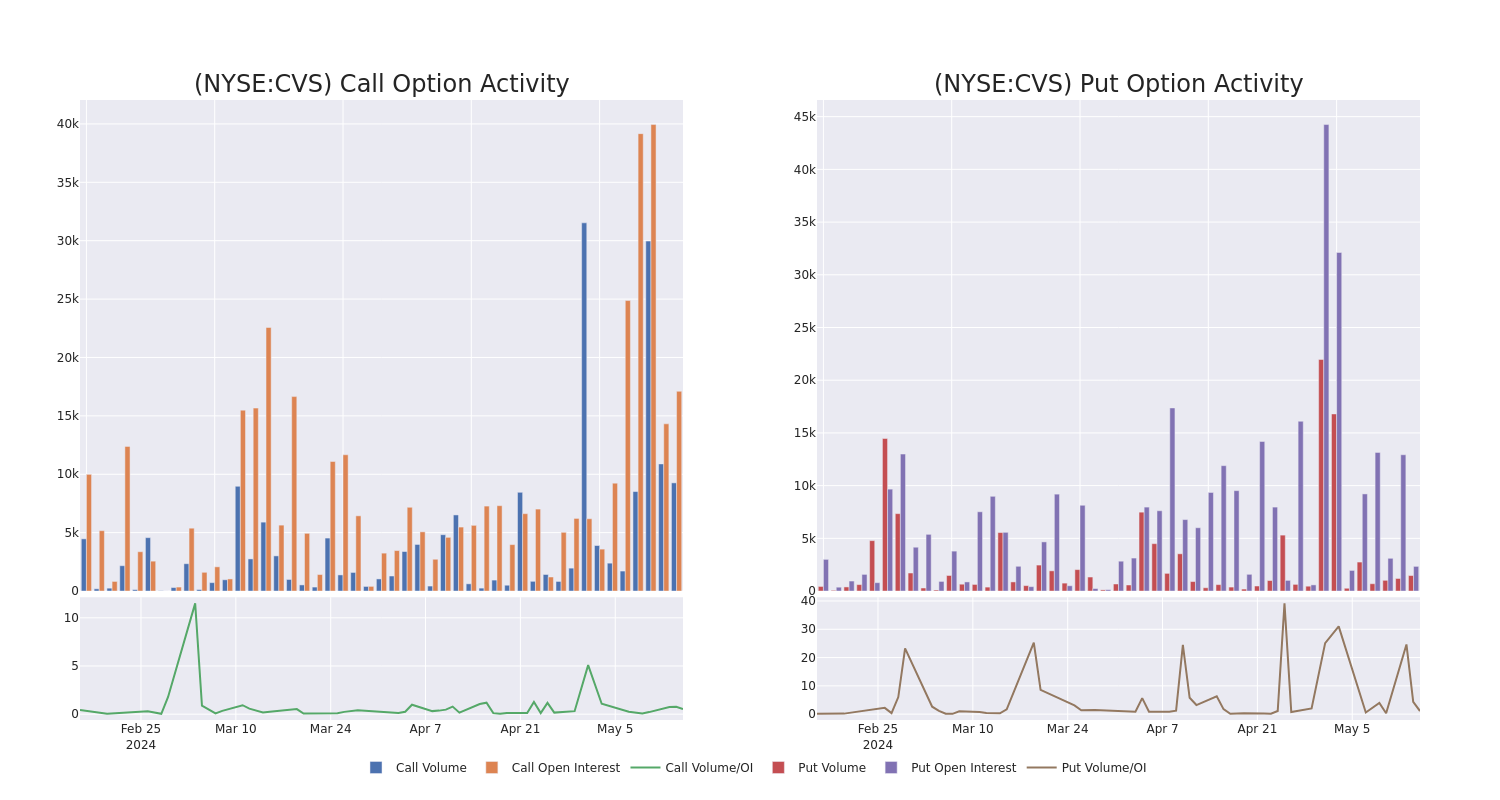

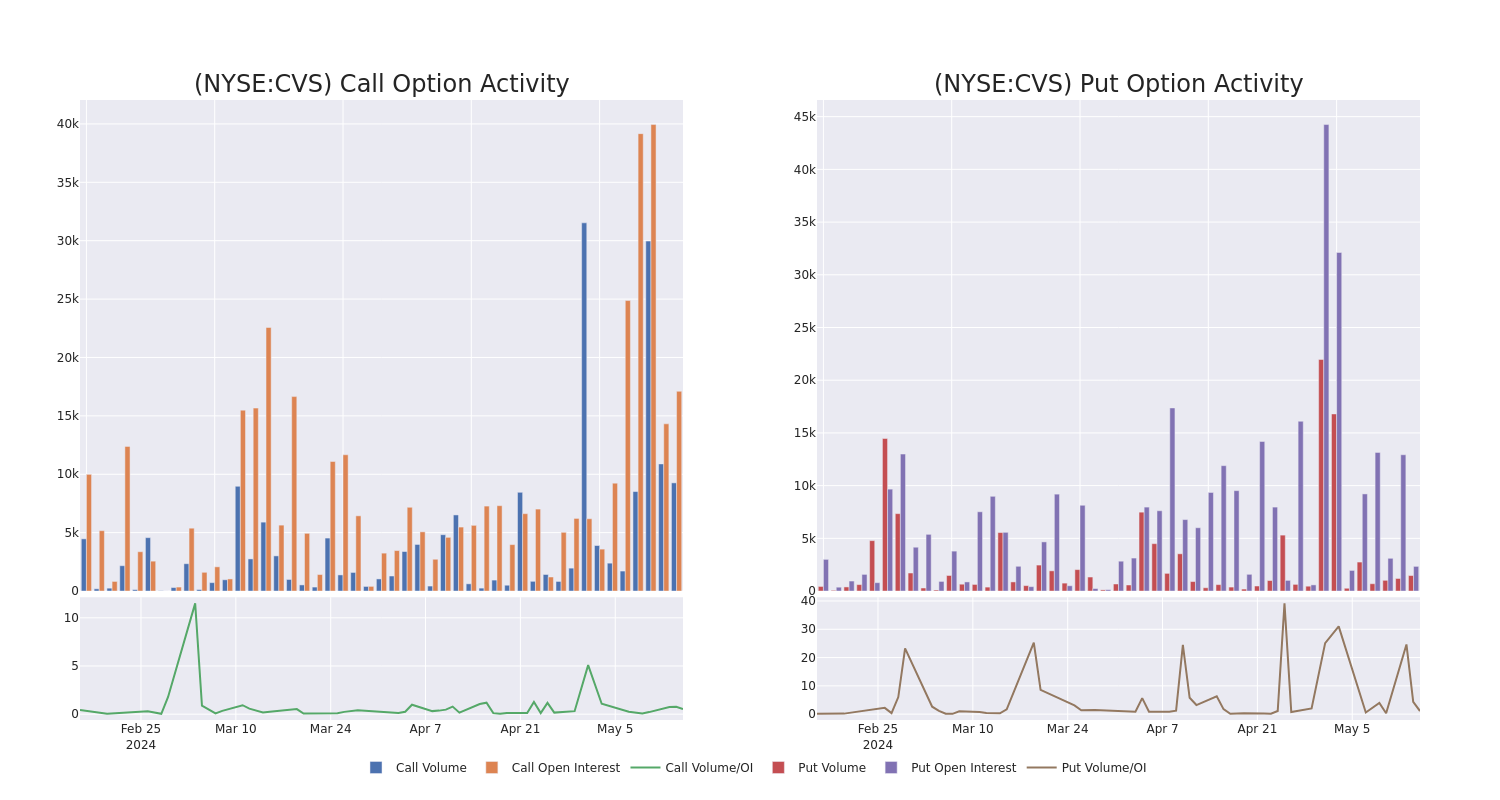

Insights into Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for CVS Health's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across CVS Health's significant trades, within a strike price range of $40.0 to $80.0, over the past month.

CVS Health 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| CVS |

CALL |

TRADE |

BULLISH |

01/17/25 |

$2.36 |

$2.1 |

$2.36 |

$65.00 |

$236.0K |

3.2K |

6 |

| CVS |

PUT |

SWEEP |

BEARISH |

11/15/24 |

$8.45 |

$8.35 |

$8.45 |

$62.50 |

$141.1K |

914 |

170 |

| CVS |

CALL |

SWEEP |

BEARISH |

01/16/26 |

$2.13 |

$2.09 |

$2.09 |

$80.00 |

$139.6K |

1.7K |

1.0K |

| CVS |

PUT |

TRADE |

NEUTRAL |

03/21/25 |

$1.06 |

$0.95 |

$1.01 |

$40.00 |

$131.3K |

1.4K |

1.3K |

| CVS |

CALL |

SWEEP |

BULLISH |

03/21/25 |

$3.55 |

$3.45 |

$3.55 |

$62.50 |

$92.3K |

1.5K |

1 |

About CVS Health

CVS Health offers a diverse set of healthcare services. Its roots are in its retail pharmacy operations, where it operates over 9,000 stores primarily in the us. CVS is also a large pharmacy benefit manager (acquired through Caremark), processing about 2 billion adjusted claims annually. It also operates a top-tier health insurer (acquired through Aetna) where it serves about 26 million medical members. The company's recent acquisition of Oak Street adds primary care services to the mix, which could have significant synergies with all its existing business lines.

After a thorough review of the options trading surrounding CVS Health, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of CVS Health

- Currently trading with a volume of 8,372,377, the CVS's price is down by -0.28%, now at $55.84.

- RSI readings suggest the stock is currently may be oversold.

- Anticipated earnings release is in 77 days.

What The Experts Say On CVS Health

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $67.2.

- Reflecting concerns, an analyst from TD Cowen lowers its rating to Hold with a new price target of $59.

- An analyst from Leerink Partners downgraded its action to Market Perform with a price target of $60.

- An analyst from Argus Research has decided to maintain their Buy rating on CVS Health, which currently sits at a price target of $80.

- An analyst from Barclays has decided to maintain their Equal-Weight rating on CVS Health, which currently sits at a price target of $63.

- An analyst from Goldman Sachs has decided to maintain their Buy rating on CVS Health, which currently sits at a price target of $74.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for CVS Health, Benzinga Pro gives you real-time options trades alerts.

Posted In: CVS