Smart Money Is Betting Big In XOM Options

Author: Benzinga Insights | May 14, 2024 11:45am

High-rolling investors have positioned themselves bullish on Exxon Mobil (NYSE:XOM), and it's important for retail traders to take note.

\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in XOM often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 15 options trades for Exxon Mobil. This is not a typical pattern.

The sentiment among these major traders is split, with 46% bullish and 20% bearish. Among all the options we identified, there was one put, amounting to $29,360, and 14 calls, totaling $730,442.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $70.0 to $135.0 for Exxon Mobil over the last 3 months.

Analyzing Volume & Open Interest

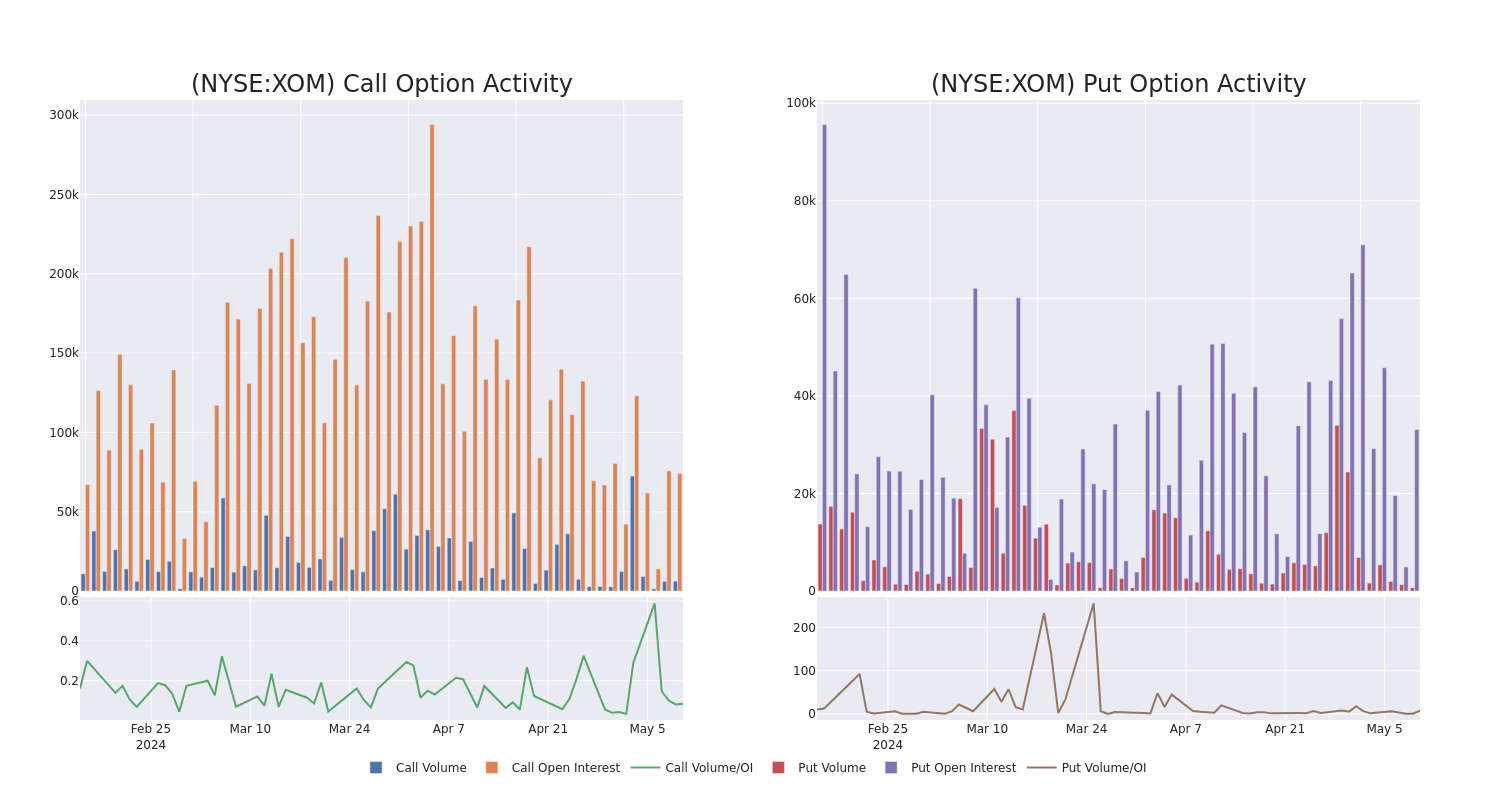

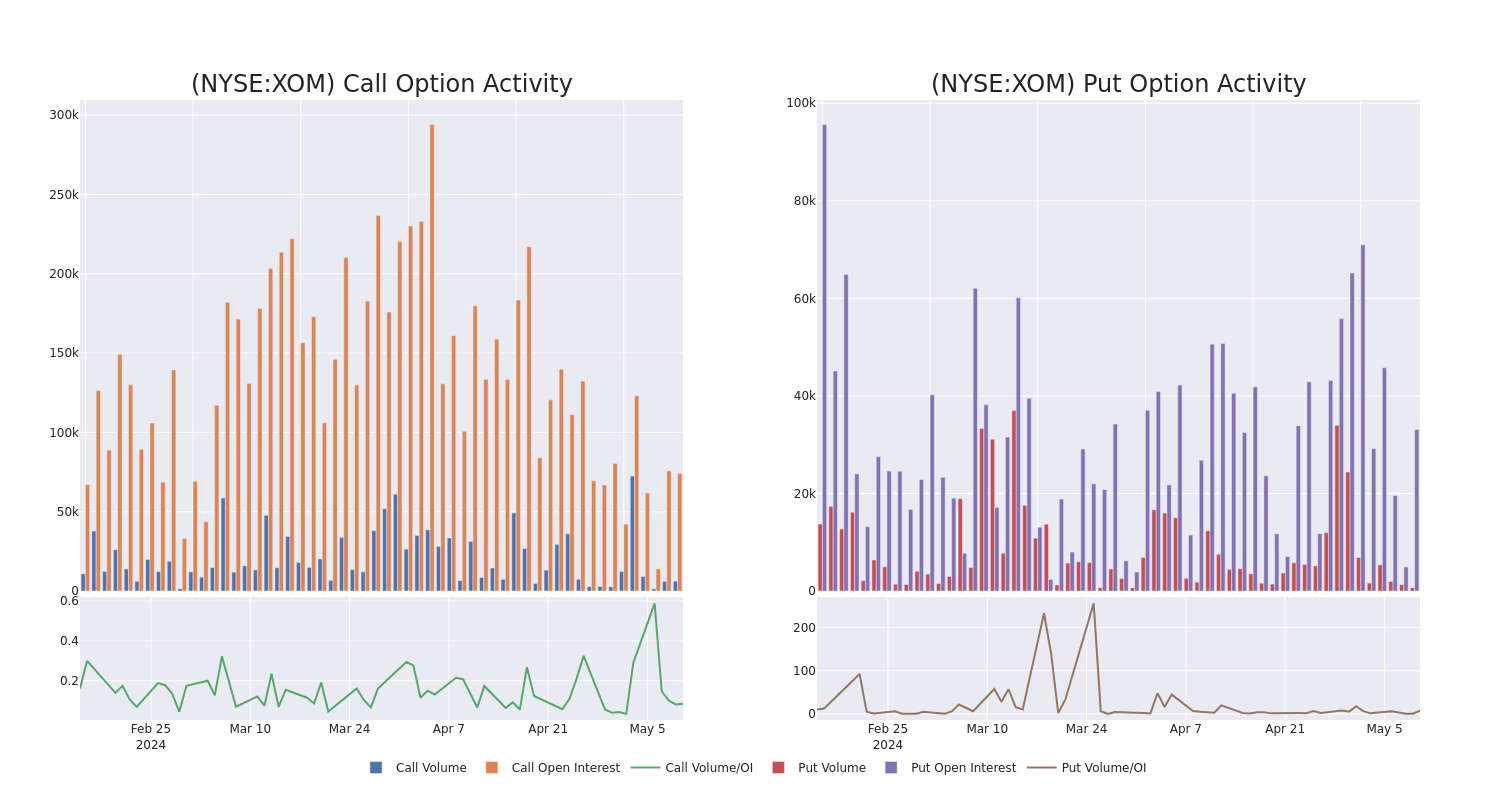

In today's trading context, the average open interest for options of Exxon Mobil stands at 4004.67, with a total volume reaching 3,412.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Exxon Mobil, situated within the strike price corridor from $70.0 to $135.0, throughout the last 30 days.

Exxon Mobil Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| XOM |

CALL |

SWEEP |

BULLISH |

05/17/24 |

$7.25 |

$6.3 |

$7.21 |

$110.00 |

$136.9K |

163 |

251 |

| XOM |

CALL |

TRADE |

BULLISH |

05/17/24 |

$1.46 |

$1.4 |

$1.44 |

$116.00 |

$69.5K |

3.8K |

512 |

| XOM |

CALL |

TRADE |

NEUTRAL |

05/17/24 |

$1.46 |

$1.4 |

$1.43 |

$116.00 |

$69.0K |

3.8K |

1.0K |

| XOM |

CALL |

SWEEP |

BEARISH |

06/21/24 |

$20.35 |

$20.15 |

$20.22 |

$97.50 |

$58.6K |

271 |

80 |

| XOM |

CALL |

TRADE |

NEUTRAL |

06/21/24 |

$20.3 |

$20.0 |

$20.15 |

$97.50 |

$58.4K |

271 |

51 |

About Exxon Mobil

ExxonMobil is an integrated oil and gas company that explores for, produces, and refines oil around the world. In 2023, it produced 2.4 million barrels of liquids and 7.7 billion cubic feet of natural gas per day. At the end of 2023, reserves were 16.9 billion barrels of oil equivalent, 66% of which were liquids. The company is one the world's largest refiners with a total global refining capacity of 4.5 million barrels of oil per day and is one of the world's largest manufacturers of commodity and specialty chemicals.

Following our analysis of the options activities associated with Exxon Mobil, we pivot to a closer look at the company's own performance.

Current Position of Exxon Mobil

- Trading volume stands at 4,220,208, with XOM's price down by -0.31%, positioned at $116.6.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 73 days.

What The Experts Say On Exxon Mobil

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $137.4.

- Maintaining their stance, an analyst from UBS continues to hold a Buy rating for Exxon Mobil, targeting a price of $152.

- Consistent in their evaluation, an analyst from Mizuho keeps a Neutral rating on Exxon Mobil with a target price of $128.

- An analyst from HSBC persists with their Hold rating on Exxon Mobil, maintaining a target price of $120.

- Maintaining their stance, an analyst from Piper Sandler continues to hold a Overweight rating for Exxon Mobil, targeting a price of $145.

- Consistent in their evaluation, an analyst from Wells Fargo keeps a Overweight rating on Exxon Mobil with a target price of $142.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Exxon Mobil options trades with real-time alerts from Benzinga Pro.

Posted In: XOM