Expert Outlook: Emerson Electric Through The Eyes Of 9 Analysts

Author: Benzinga Insights | May 10, 2024 05:00pm

Emerson Electric (NYSE:EMR) underwent analysis by 9 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

5 |

0 |

4 |

0 |

0 |

| Last 30D |

0 |

0 |

1 |

0 |

0 |

| 1M Ago |

2 |

0 |

1 |

0 |

0 |

| 2M Ago |

1 |

0 |

2 |

0 |

0 |

| 3M Ago |

2 |

0 |

0 |

0 |

0 |

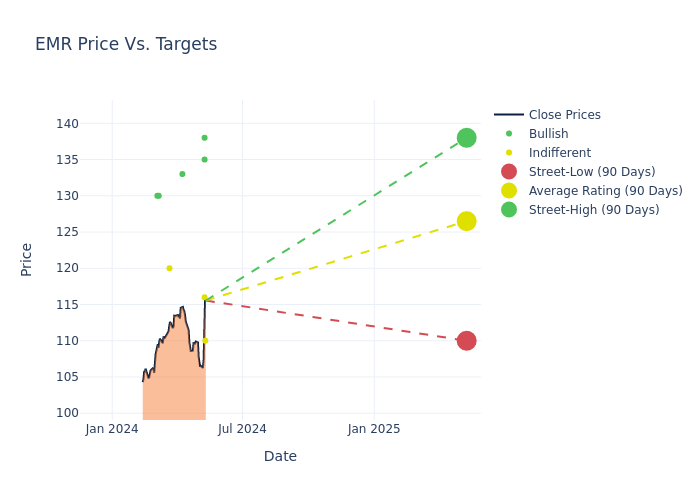

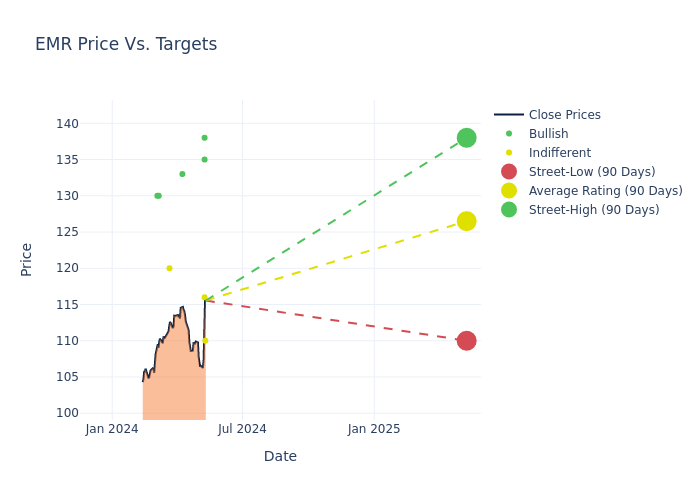

Insights from analysts' 12-month price targets are revealed, presenting an average target of $124.11, a high estimate of $138.00, and a low estimate of $105.00. Marking an increase of 10.81%, the current average surpasses the previous average price target of $112.00.

Understanding Analyst Ratings: A Comprehensive Breakdown

The standing of Emerson Electric among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Julian Mitchell |

Barclays |

Raises |

Equal-Weight |

$110.00 |

$105.00 |

| Brett Linzey |

Mizuho |

Raises |

Buy |

$135.00 |

$130.00 |

| Michael Halloran |

Baird |

Lowers |

Neutral |

$116.00 |

$120.00 |

| Nicole Deblase |

Deutsche Bank |

Raises |

Buy |

$138.00 |

$123.00 |

| Andrew Kaplowitz |

Citigroup |

Raises |

Buy |

$133.00 |

$120.00 |

| Julian Mitchell |

Barclays |

Raises |

Equal-Weight |

$105.00 |

$95.00 |

| Chris Snyder |

UBS |

Raises |

Neutral |

$120.00 |

$95.00 |

| Philip Buller |

Berenberg |

Raises |

Buy |

$130.00 |

$100.00 |

| Andrew Obin |

B of A Securities |

Raises |

Buy |

$130.00 |

$120.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Emerson Electric. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Emerson Electric compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Emerson Electric's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

For valuable insights into Emerson Electric's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Emerson Electric analyst ratings.

Get to Know Emerson Electric Better

Emerson Electric sells automation equipment and services under two segments: intelligent devices and software control. Within software and control, it also holds a majority interest in AspenTech, an industrial software business, and owns a test and measurement business that was formerly National Instruments. Intelligent devices also holds Emerson's tools business, which boasts several household brands, like Ridgid. Emerson's automation business is most known for its process manufacturing solutions, which consists of measurement and analytical instrumentation, as well as control valves and actuators, among other products and services. Nearly half of the firm's geographic sales come from the Americas.

Key Indicators: Emerson Electric's Financial Health

Market Capitalization: Boasting an elevated market capitalization, the company surpasses industry averages. This signals substantial size and strong market recognition.

Positive Revenue Trend: Examining Emerson Electric's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 16.51% as of 31 March, 2024, showcasing a substantial increase in top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Industrials sector.

Net Margin: Emerson Electric's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 11.45%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Emerson Electric's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 2.41%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Emerson Electric's ROA stands out, surpassing industry averages. With an impressive ROA of 1.08%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Emerson Electric's debt-to-equity ratio is below the industry average at 0.55, reflecting a lower dependency on debt financing and a more conservative financial approach.

How Are Analyst Ratings Determined?

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: EMR