Lam Research's Options Frenzy: What You Need to Know

Author: Benzinga Insights | May 10, 2024 04:18pm

Financial giants have made a conspicuous bullish move on Lam Research. Our analysis of options history for Lam Research (NASDAQ:LRCX) revealed 9 unusual trades.

Delving into the details, we found 55% of traders were bullish, while 44% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $200,899, and 6 were calls, valued at $390,582.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $900.0 to $985.0 for Lam Research over the recent three months.

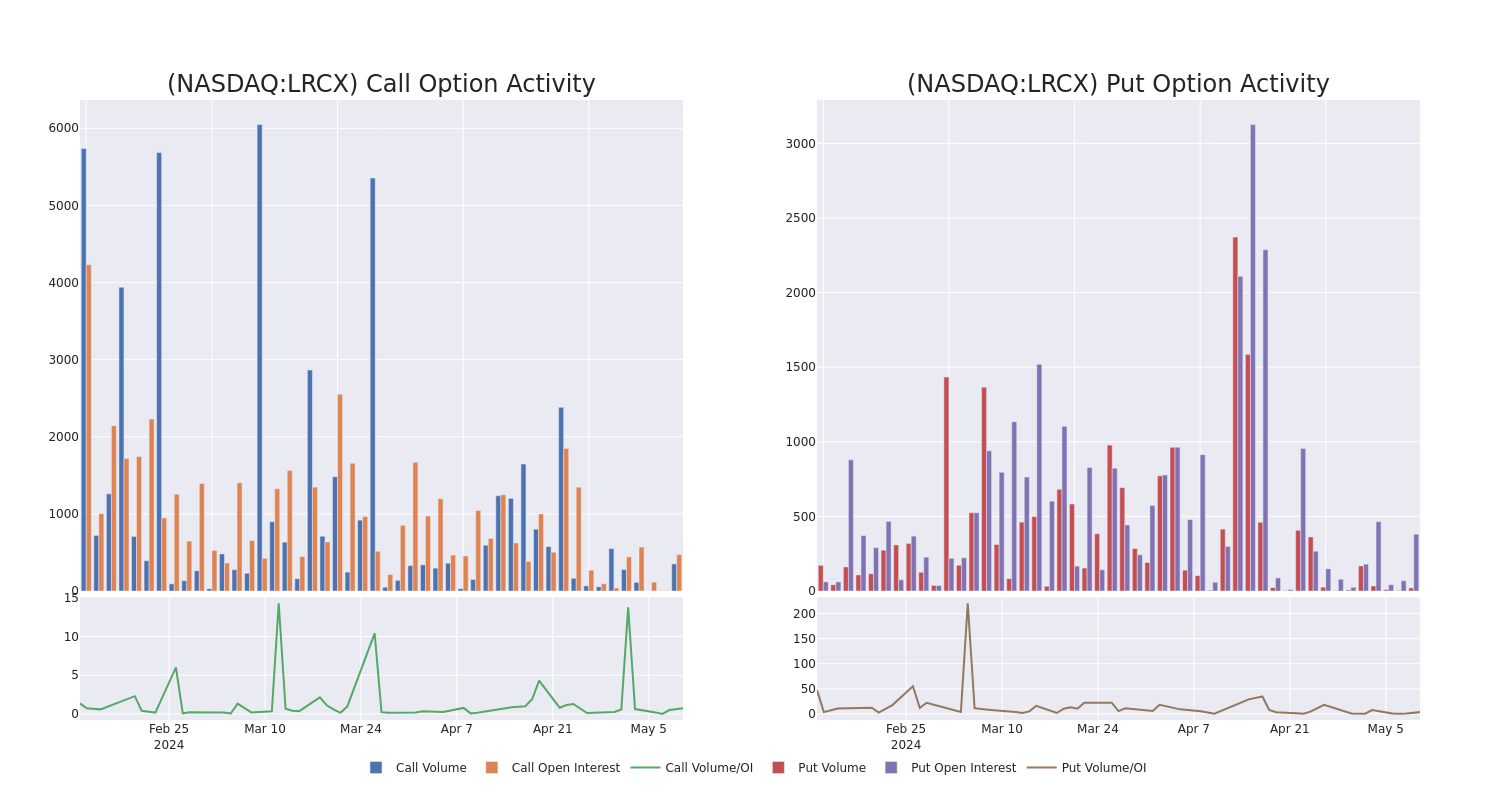

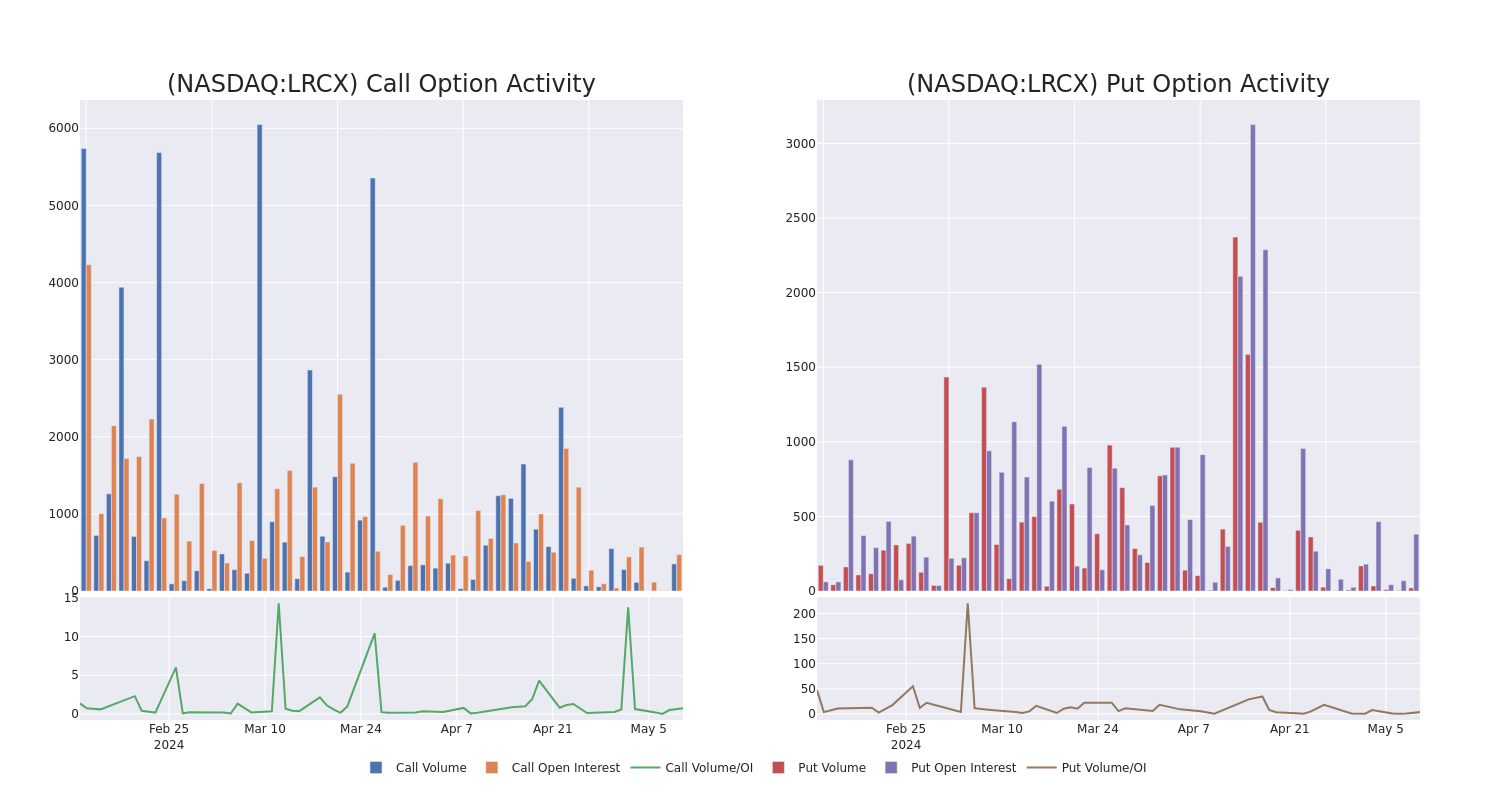

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Lam Research's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Lam Research's substantial trades, within a strike price spectrum from $900.0 to $985.0 over the preceding 30 days.

Lam Research Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| LRCX |

PUT |

SWEEP |

BULLISH |

03/21/25 |

$131.15 |

$128.4 |

$128.4 |

$960.00 |

$128.4K |

6 |

0 |

| LRCX |

CALL |

SWEEP |

BULLISH |

05/17/24 |

$2.63 |

$2.25 |

$2.63 |

$985.00 |

$105.6K |

103 |

4 |

| LRCX |

CALL |

SWEEP |

BEARISH |

07/19/24 |

$50.6 |

$50.0 |

$50.0 |

$930.00 |

$95.0K |

59 |

19 |

| LRCX |

CALL |

SWEEP |

BEARISH |

06/21/24 |

$39.65 |

$39.6 |

$39.6 |

$915.00 |

$59.3K |

28 |

34 |

| LRCX |

CALL |

TRADE |

BULLISH |

06/20/25 |

$173.0 |

$165.05 |

$173.0 |

$900.00 |

$51.9K |

35 |

0 |

About Lam Research

Lam Research is one of the largest semiconductor wafer fabrication equipment, or WFE, manufacturers in the world. It specializes in the market segments of deposition and etch, which entail the buildup of layers on a semiconductor and the subsequent selective removal of patterns from each layer. Lam holds the top market share in etch and holds the clear cut second share in deposition. It is more exposed to memory chipmakers for DRAM and NAND chips. It counts as top customers the largest chipmakers in the world, including TSMC, Samsung, Intel, and Micron.

After a thorough review of the options trading surrounding Lam Research, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Lam Research's Current Market Status

- Trading volume stands at 497,322, with LRCX's price up by 0.87%, positioned at $915.42.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 75 days.

Expert Opinions on Lam Research

In the last month, 5 experts released ratings on this stock with an average target price of $1009.0.

- Reflecting concerns, an analyst from Needham lowers its rating to Buy with a new price target of $1030.

- An analyst from JP Morgan persists with their Overweight rating on Lam Research, maintaining a target price of $950.

- In a cautious move, an analyst from Evercore ISI Group downgraded its rating to Outperform, setting a price target of $1200.

- An analyst from TD Cowen persists with their Buy rating on Lam Research, maintaining a target price of $1000.

- An analyst from Barclays persists with their Equal-Weight rating on Lam Research, maintaining a target price of $865.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Lam Research with Benzinga Pro for real-time alerts.

Posted In: LRCX