A Glimpse Into The Expert Outlook On Ramaco Resources Through 5 Analysts

Author: Benzinga Insights | May 10, 2024 11:00am

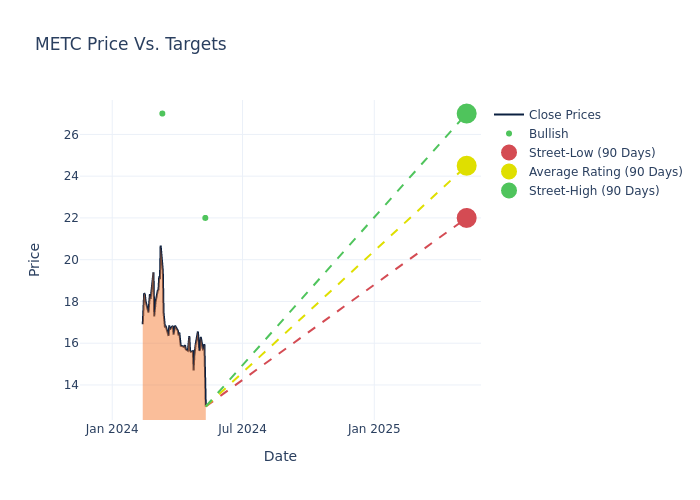

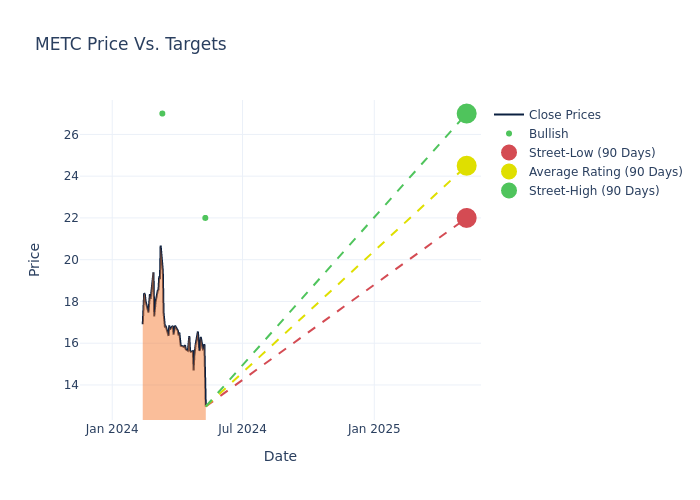

During the last three months, 5 analysts shared their evaluations of Ramaco Resources (NASDAQ:METC), revealing diverse outlooks from bullish to bearish.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

5 |

0 |

0 |

0 |

0 |

| Last 30D |

1 |

0 |

0 |

0 |

0 |

| 1M Ago |

1 |

0 |

0 |

0 |

0 |

| 2M Ago |

2 |

0 |

0 |

0 |

0 |

| 3M Ago |

1 |

0 |

0 |

0 |

0 |

In the assessment of 12-month price targets, analysts unveil insights for Ramaco Resources, presenting an average target of $26.0, a high estimate of $32.00, and a low estimate of $22.00. A decline of 2.26% from the prior average price target is evident in the current average.

Exploring Analyst Ratings: An In-Depth Overview

An in-depth analysis of recent analyst actions unveils how financial experts perceive Ramaco Resources. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Lucas Pipes |

B. Riley Securities |

Lowers |

Buy |

$22.00 |

$24.00 |

| Lucas Pipes |

B. Riley Securities |

Lowers |

Buy |

$24.00 |

$25.00 |

| Lucas Pipes |

B. Riley Securities |

Lowers |

Buy |

$25.00 |

$32.00 |

| Nathan Martin |

Benchmark |

Raises |

Buy |

$27.00 |

$20.00 |

| Lucas Pipes |

B. Riley Securities |

Maintains |

Buy |

$32.00 |

$32.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Ramaco Resources. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Ramaco Resources compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Ramaco Resources's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Ramaco Resources's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Ramaco Resources analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Delving into Ramaco Resources's Background

Ramaco Resources Inc is a United States-based company that operates as a pure-play metallurgical coal company with operations in southern West Virginia and southwestern Virginia. Its portfolio includes high-quality metallurgical coal reserves and resources, with a focus on properties such as Elk Creek, Berwind, Knox Creek, and Maben. These properties are strategically located to serve North American blast furnace steel mill and coke plants, as well as international metallurgical coal consumers. Additionally, the company controls mineral deposits in Sheridan, Wyoming, exploring potential opportunities in rare earth elements and coal-to-carbon-based products. Operations are concentrated in the Appalachian basin, with active mines at Elk Creek, Berwind, Knox Creek, and Maben mining complexes.

Ramaco Resources: Delving into Financials

Market Capitalization Analysis: Falling below industry benchmarks, the company's market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Negative Revenue Trend: Examining Ramaco Resources's financials over 3 months reveals challenges. As of 31 March, 2024, the company experienced a decline of approximately -14.82% in revenue growth, reflecting a decrease in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Materials sector.

Net Margin: Ramaco Resources's net margin is below industry averages, indicating potential challenges in maintaining strong profitability. With a net margin of 1.18%, the company may face hurdles in effective cost management.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 0.55%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Ramaco Resources's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of 0.3%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: With a below-average debt-to-equity ratio of 0.28, Ramaco Resources adopts a prudent financial strategy, indicating a balanced approach to debt management.

How Are Analyst Ratings Determined?

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: METC