Unpacking the Latest Options Trading Trends in KLA

Author: Benzinga Insights | May 09, 2024 02:32pm

Deep-pocketed investors have adopted a bearish approach towards KLA (NASDAQ:KLAC), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in KLAC usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 8 extraordinary options activities for KLA. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 37% leaning bullish and 50% bearish. Among these notable options, 3 are puts, totaling $158,850, and 5 are calls, amounting to $398,410.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $480.0 to $740.0 for KLA during the past quarter.

Analyzing Volume & Open Interest

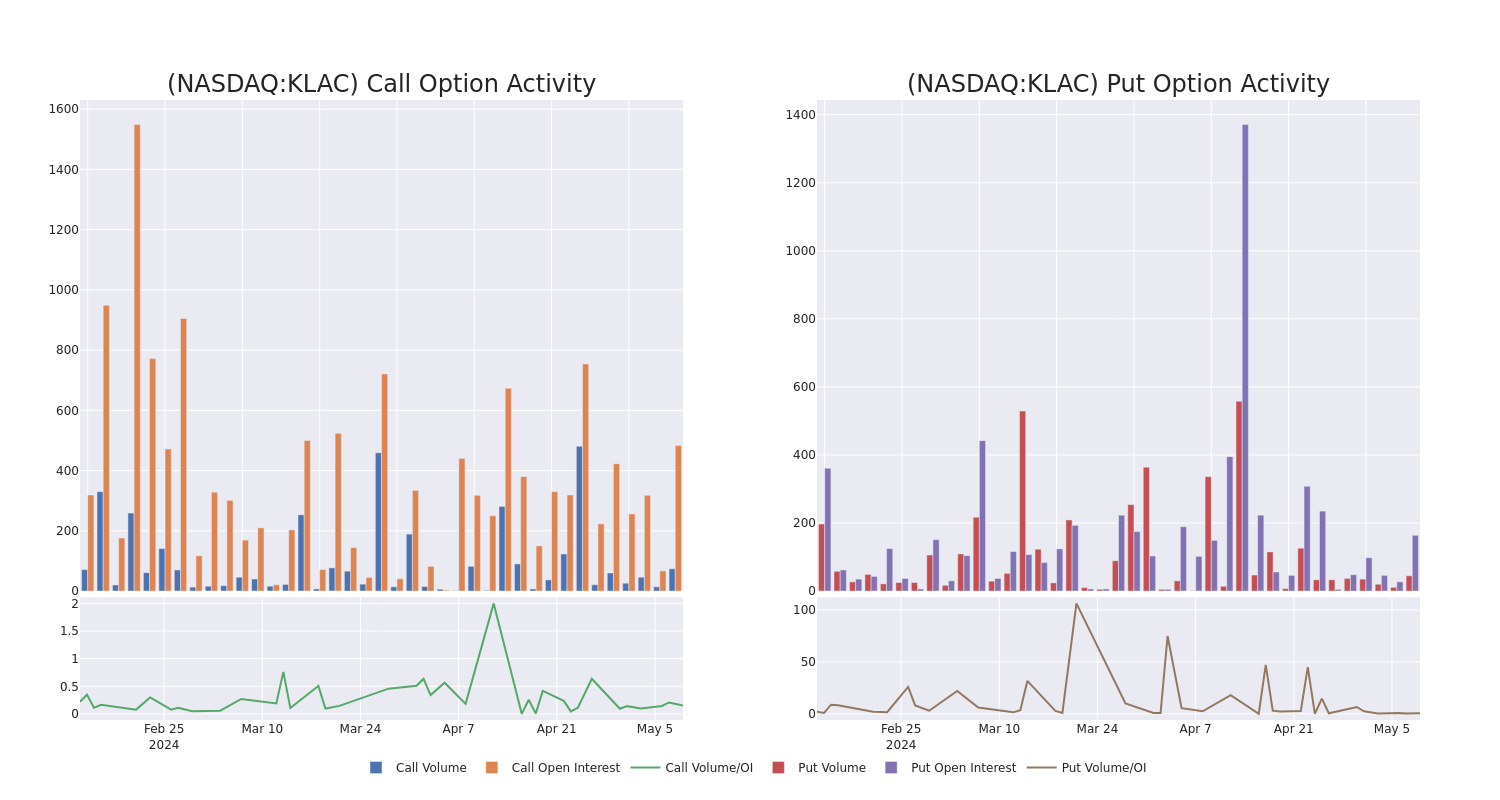

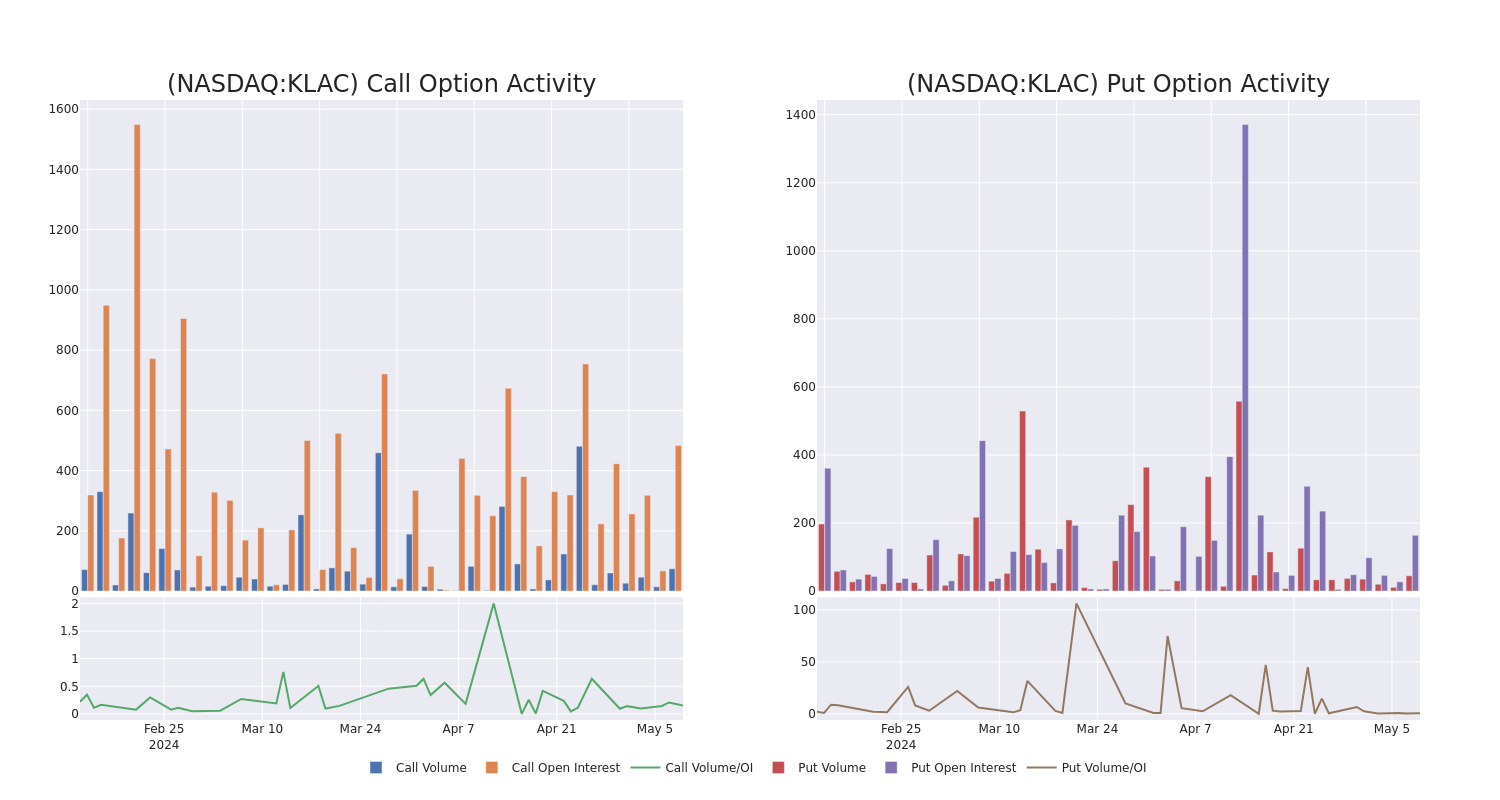

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for KLA's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across KLA's significant trades, within a strike price range of $480.0 to $740.0, over the past month.

KLA Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| KLAC |

CALL |

TRADE |

BEARISH |

09/20/24 |

$60.0 |

$58.8 |

$59.0 |

$720.00 |

$118.0K |

74 |

30 |

| KLAC |

CALL |

TRADE |

NEUTRAL |

01/17/25 |

$208.7 |

$201.7 |

$205.0 |

$540.00 |

$102.5K |

132 |

0 |

| KLAC |

CALL |

TRADE |

BULLISH |

01/17/25 |

$204.3 |

$201.7 |

$204.3 |

$540.00 |

$102.1K |

132 |

10 |

| KLAC |

PUT |

SWEEP |

BEARISH |

01/17/25 |

$84.3 |

$82.9 |

$84.3 |

$740.00 |

$84.3K |

56 |

10 |

| KLAC |

CALL |

TRADE |

BEARISH |

06/21/24 |

$239.5 |

$234.8 |

$234.8 |

$480.00 |

$46.9K |

66 |

7 |

About KLA

KLA is one of the largest semiconductor wafer fabrication equipment, or WFE, manufacturers in the world. It specializes in the market segment of semiconductor process control, wherein machines inspect semiconductor wafers during research and development and manufacturing for defects and verify precise measurements. In this section of the market, KLA holds a majority share. It also has a small exposure to the etch and deposition segments of the WFE market. It counts as top customers the largest chipmakers in the world, including TSMC and Samsung.

Following our analysis of the options activities associated with KLA, we pivot to a closer look at the company's own performance.

Where Is KLA Standing Right Now?

- Currently trading with a volume of 126,726, the KLAC's price is down by -0.64%, now at $712.54.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 77 days.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest KLA options trades with real-time alerts from Benzinga Pro.

Posted In: KLAC