Market Whales and Their Recent Bets on GME Options

Author: Benzinga Insights | May 08, 2024 01:15pm

Financial giants have made a conspicuous bullish move on GameStop. Our analysis of options history for GameStop (NYSE:GME) revealed 11 unusual trades.

Delving into the details, we found 45% of traders were bullish, while 36% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $157,669, and 7 were calls, valued at $317,485.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $15.0 to $18.0 for GameStop during the past quarter.

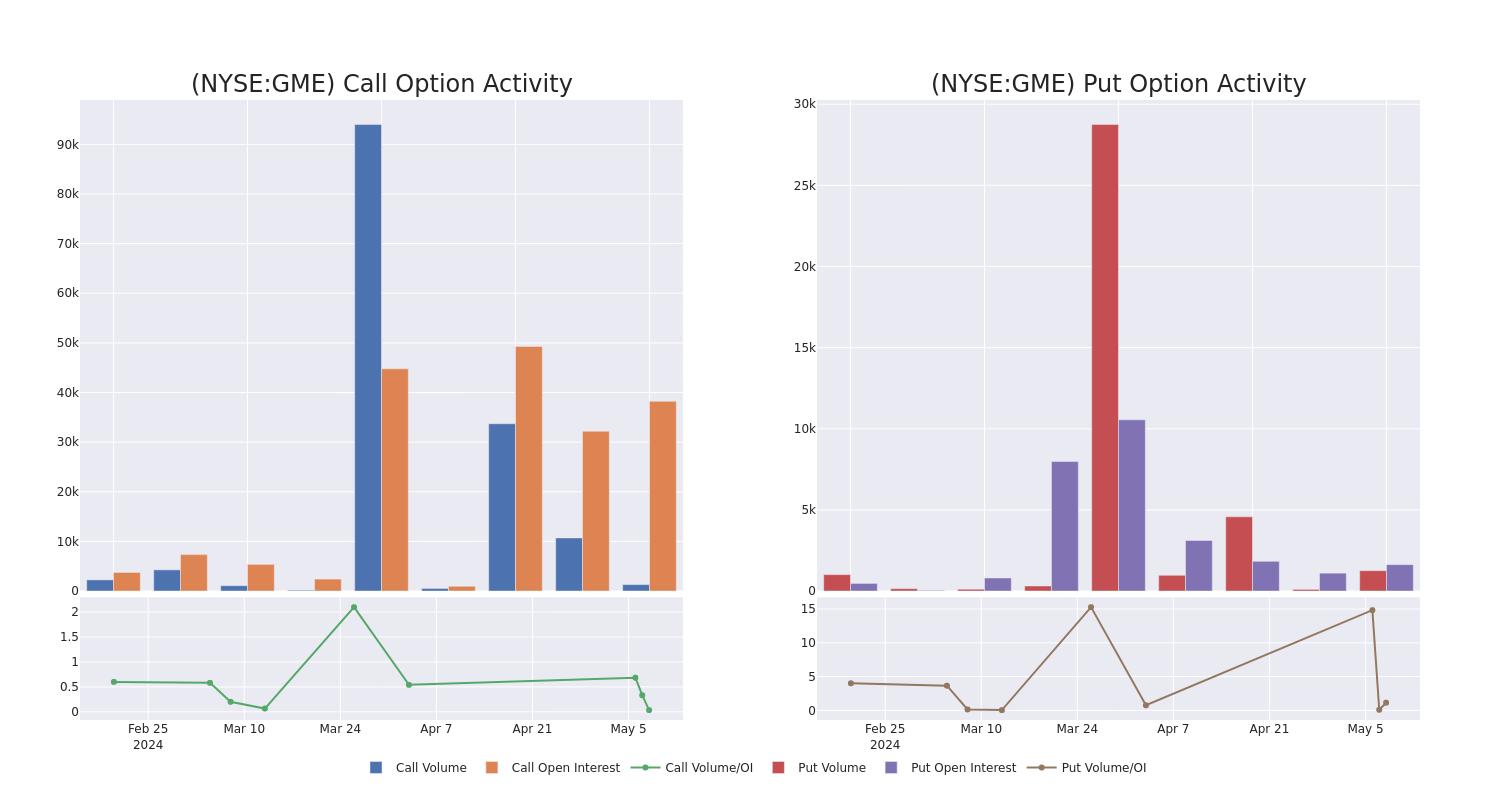

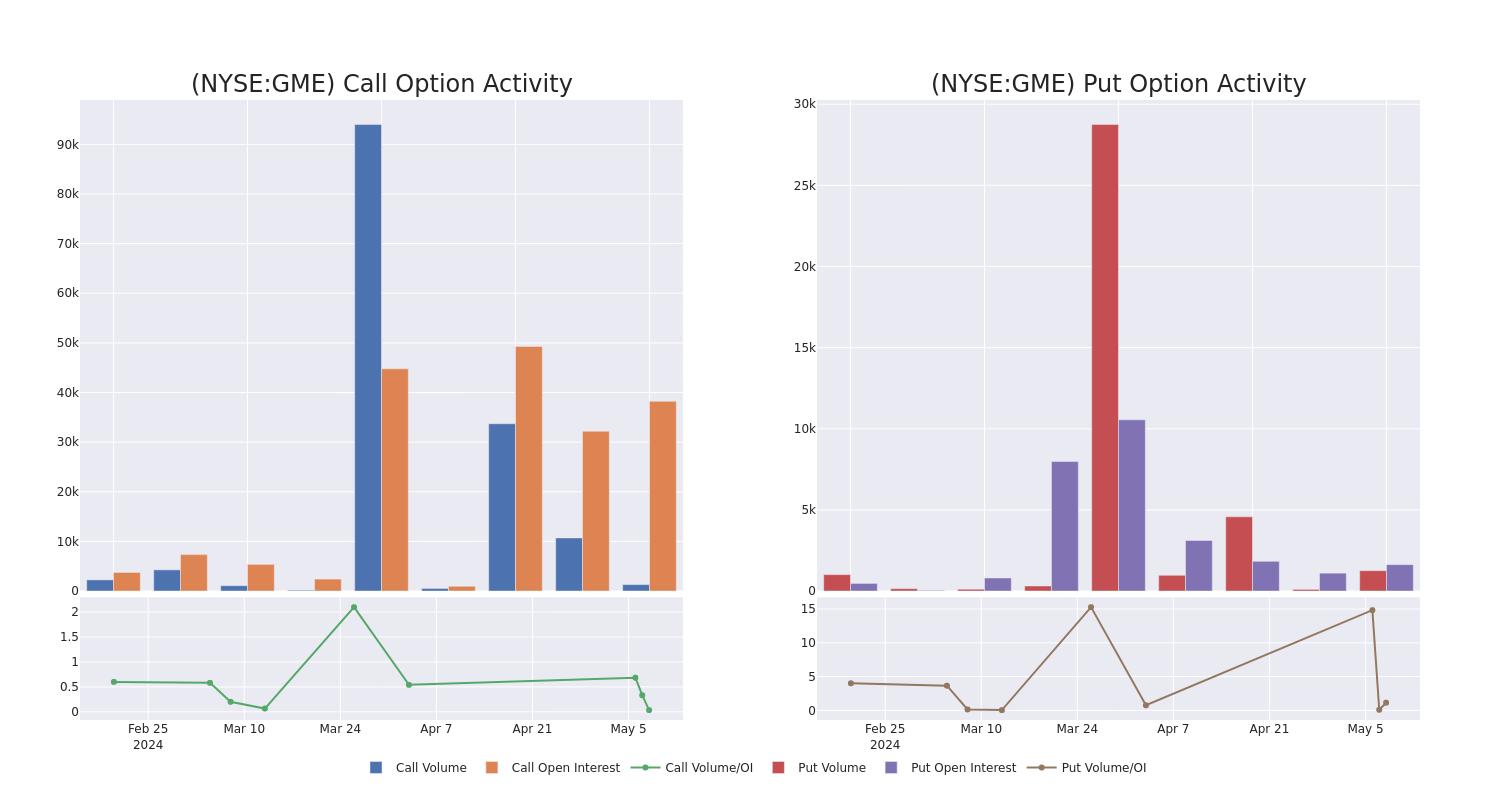

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for GameStop's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of GameStop's whale trades within a strike price range from $15.0 to $18.0 in the last 30 days.

GameStop Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| GME |

CALL |

SWEEP |

BULLISH |

07/19/24 |

$3.95 |

$3.2 |

$4.0 |

$17.00 |

$140.0K |

1.9K |

132 |

| GME |

PUT |

SWEEP |

BEARISH |

05/17/24 |

$2.87 |

$2.84 |

$2.87 |

$17.00 |

$57.4K |

295 |

74 |

| GME |

CALL |

TRADE |

NEUTRAL |

07/19/24 |

$3.35 |

$3.0 |

$3.2 |

$17.00 |

$38.4K |

1.9K |

1 |

| GME |

PUT |

TRADE |

BULLISH |

05/17/24 |

$2.16 |

$1.91 |

$1.98 |

$16.00 |

$35.8K |

1.3K |

663 |

| GME |

PUT |

TRADE |

BULLISH |

05/17/24 |

$2.16 |

$2.04 |

$2.04 |

$16.00 |

$35.4K |

1.3K |

518 |

About GameStop

GameStop Corp is a U.S. multichannel video game, consumer electronics, and services retailer. The company operates across Europe, Canada, Australia, and the United States. GameStop sells new and second-hand video game hardware, physical and digital video game software, and video game accessories, mainly through GameStop, EB Games, and Micromania stores and international e-commerce sites. The majority of sales are from the United States.

After a thorough review of the options trading surrounding GameStop, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

GameStop's Current Market Status

- Trading volume stands at 13,070,454, with GME's price up by 2.21%, positioned at $16.67.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 28 days.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest GameStop options trades with real-time alerts from Benzinga Pro.

Posted In: GME