Looking At Constellation Energy's Recent Unusual Options Activity

Author: Benzinga Insights | May 08, 2024 12:31pm

Benzinga's options scanner just detected over 17 options trades for Constellation Energy (NASDAQ:CEG) summing a total amount of $849,543.

At the same time, our algo caught 5 for a total amount of 221,914.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $165.0 and $270.0 for Constellation Energy, spanning the last three months.

Volume & Open Interest Development

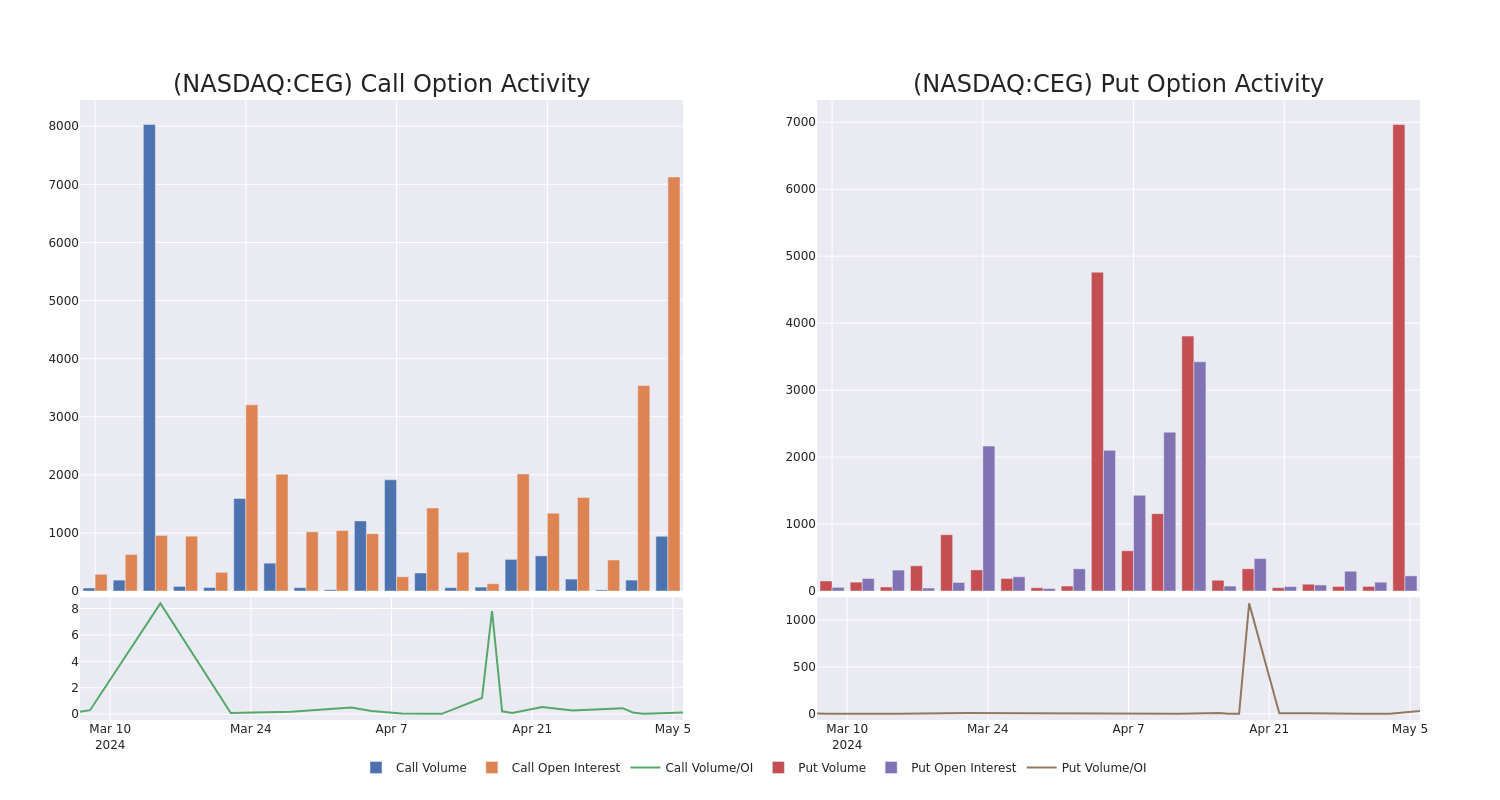

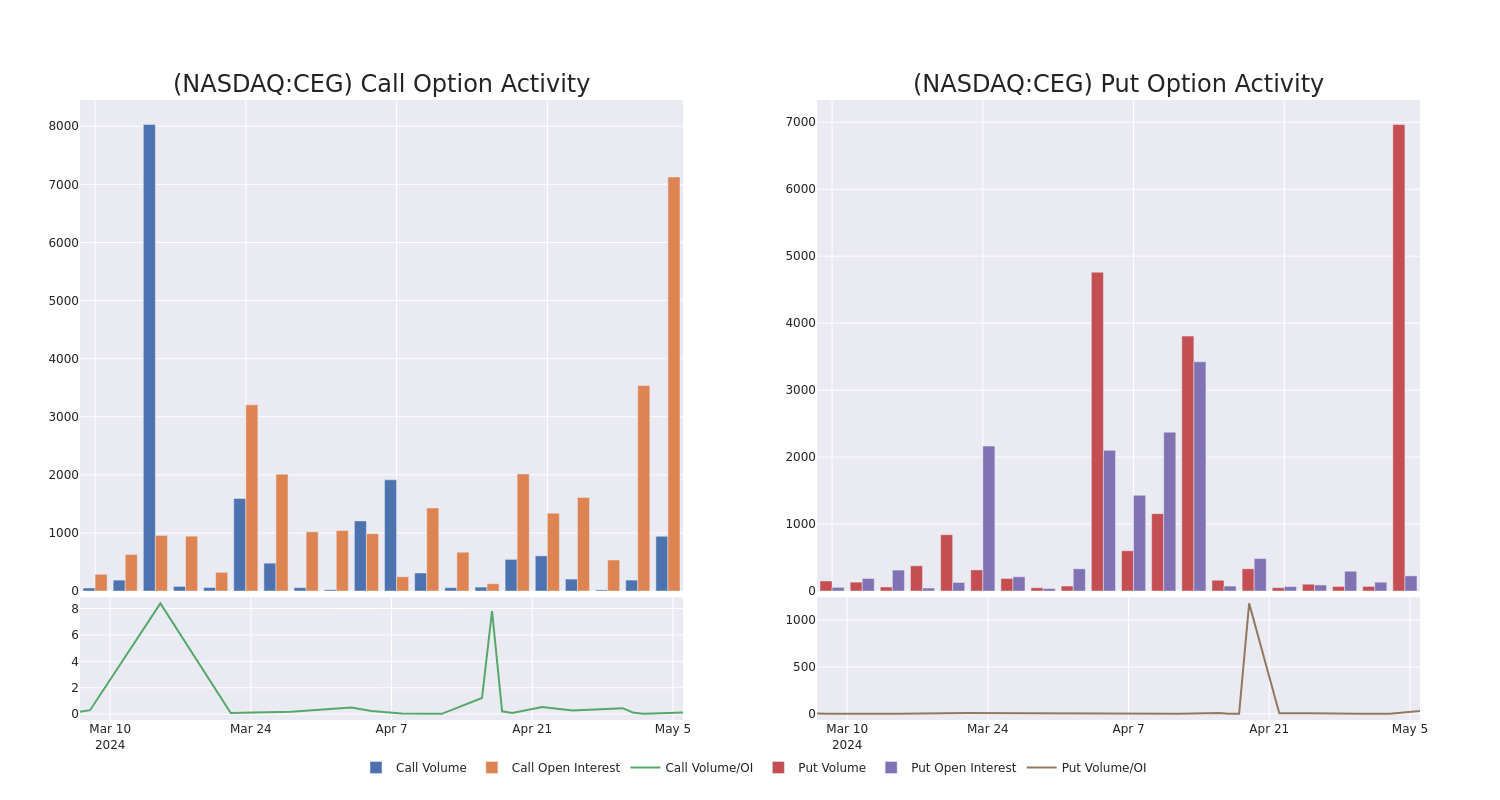

In terms of liquidity and interest, the mean open interest for Constellation Energy options trades today is 356.0 with a total volume of 3,391.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Constellation Energy's big money trades within a strike price range of $165.0 to $270.0 over the last 30 days.

Constellation Energy 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| CEG |

CALL |

SWEEP |

BULLISH |

05/17/24 |

$13.0 |

$12.7 |

$13.0 |

$195.00 |

$101.4K |

1.9K |

75 |

| CEG |

CALL |

SWEEP |

BULLISH |

05/17/24 |

$14.4 |

$13.7 |

$14.4 |

$195.00 |

$92.1K |

1.9K |

391 |

| CEG |

CALL |

SWEEP |

BULLISH |

05/17/24 |

$12.9 |

$12.8 |

$12.9 |

$195.00 |

$85.1K |

1.9K |

153 |

| CEG |

PUT |

TRADE |

BULLISH |

08/16/24 |

$24.5 |

$24.1 |

$24.1 |

$220.00 |

$67.4K |

0 |

0 |

| CEG |

CALL |

TRADE |

BULLISH |

01/16/26 |

$25.3 |

$23.9 |

$25.3 |

$270.00 |

$63.2K |

57 |

0 |

About Constellation Energy

Constellation Energy Corp offers energy solutions. It provides clean energy and sustainable solutions to homes, businesses, the public sector, community aggregations, and a range of wholesale customers (such as municipalities, cooperatives, and other strategics). The company offers comprehensive energy solutions and a variety of pricing options for electric, natural gas, and renewable energy products for companies of any size.

Having examined the options trading patterns of Constellation Energy, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Constellation Energy Standing Right Now?

- Trading volume stands at 1,481,726, with CEG's price up by 1.67%, positioned at $203.91.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 1 days.

Expert Opinions on Constellation Energy

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $211.0.

- An analyst from RBC Capital has decided to maintain their Sector Perform rating on Constellation Energy, which currently sits at a price target of $211.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Constellation Energy options trades with real-time alerts from Benzinga Pro.

Posted In: CEG