Expert Outlook: Sutro Biopharma Through The Eyes Of 10 Analysts

Author: Benzinga Insights | May 08, 2024 09:00am

Sutro Biopharma (NASDAQ:STRO) underwent analysis by 10 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

3 |

7 |

0 |

0 |

0 |

| Last 30D |

1 |

0 |

0 |

0 |

0 |

| 1M Ago |

0 |

0 |

0 |

0 |

0 |

| 2M Ago |

2 |

7 |

0 |

0 |

0 |

| 3M Ago |

0 |

0 |

0 |

0 |

0 |

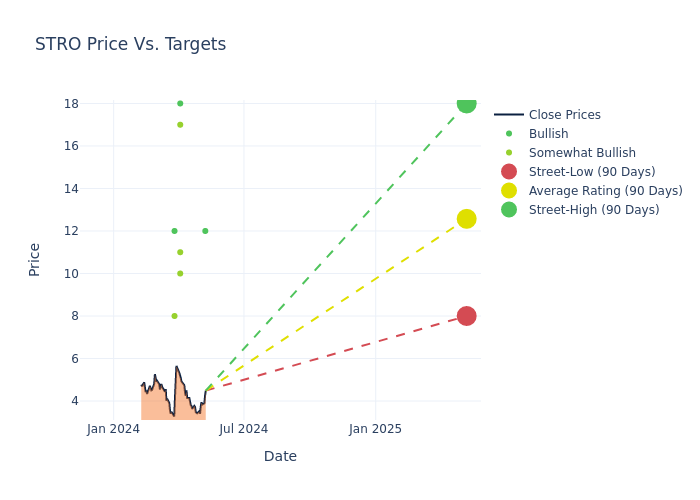

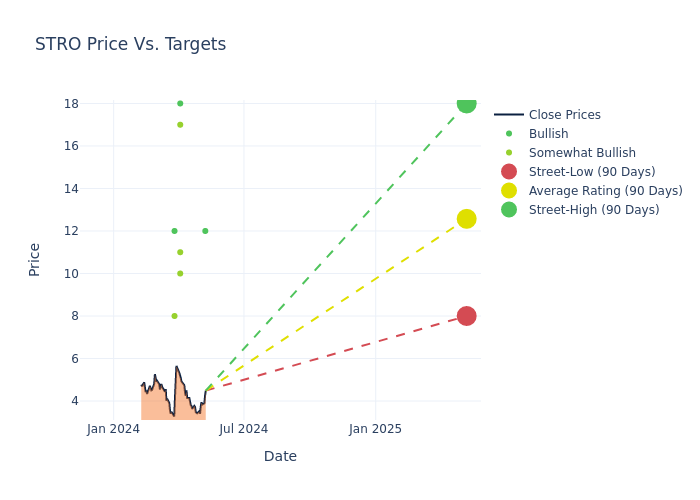

Insights from analysts' 12-month price targets are revealed, presenting an average target of $12.5, a high estimate of $18.00, and a low estimate of $8.00. This current average has decreased by 11.79% from the previous average price target of $14.17.

Analyzing Analyst Ratings: A Detailed Breakdown

A comprehensive examination of how financial experts perceive Sutro Biopharma is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Tazeen Ahmad |

B of A Securities |

Announces |

Buy |

$12.00 |

- |

| Edward Tenthoff |

Piper Sandler |

Lowers |

Overweight |

$11.00 |

$12.00 |

| Jay Olson |

Oppenheimer |

Maintains |

Outperform |

$10.00 |

$10.00 |

| Asthika Goonewardene |

Truist Securities |

Lowers |

Buy |

$18.00 |

$25.00 |

| Reni Benjamin |

JMP Securities |

Maintains |

Market Outperform |

$17.00 |

- |

| Jay Olson |

Oppenheimer |

Maintains |

Outperform |

$10.00 |

- |

| Jay Olson |

Oppenheimer |

Maintains |

Outperform |

$10.00 |

$10.00 |

| David Nierengarten |

Wedbush |

Lowers |

Outperform |

$8.00 |

$12.00 |

| Reni Benjamin |

JMP Securities |

Maintains |

Market Outperform |

$17.00 |

- |

| Andrew Fein |

HC Wainwright & Co. |

Lowers |

Buy |

$12.00 |

$16.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Sutro Biopharma. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Sutro Biopharma compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Sutro Biopharma's stock. This analysis reveals shifts in analysts' expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Sutro Biopharma's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Sutro Biopharma analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

About Sutro Biopharma

Sutro Biopharma Inc is a clinical-stage drug discovery, development, and manufacturing company. It is mainly engaged in the development of biopharmaceutical products. The company manufactures next-generation protein therapeutics for cancer and autoimmune disorders through its proprietary integrated cell-free protein synthesis platform, XpressCF. Products offered by the company include STRO-001 for patients with multiple myeloma and non-Hodgkin lymphoma and STRO-002 for the treatment of ovarian and endometrial cancers.

Sutro Biopharma's Financial Performance

Market Capitalization: Exceeding industry standards, the company's market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Revenue Growth: Over the 3 months period, Sutro Biopharma showcased positive performance, achieving a revenue growth rate of 1217.44% as of 31 December, 2023. This reflects a substantial increase in the company's top-line earnings. When compared to others in the Health Care sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Sutro Biopharma's net margin excels beyond industry benchmarks, reaching 27.32%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Sutro Biopharma's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 23.71%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Sutro Biopharma's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 6.88% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 0.22, caution is advised due to increased financial risk.

How Are Analyst Ratings Determined?

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: STRO