Check Out What Whales Are Doing With CLSK

Author: Benzinga Insights | May 07, 2024 01:31pm

Financial giants have made a conspicuous bullish move on Cleanspark. Our analysis of options history for Cleanspark (NASDAQ:CLSK) revealed 18 unusual trades.

Delving into the details, we found 44% of traders were bullish, while 44% showed bearish tendencies. Out of all the trades we spotted, 12 were puts, with a value of $1,862,636, and 6 were calls, valued at $388,264.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $12.0 to $35.0 for Cleanspark over the recent three months.

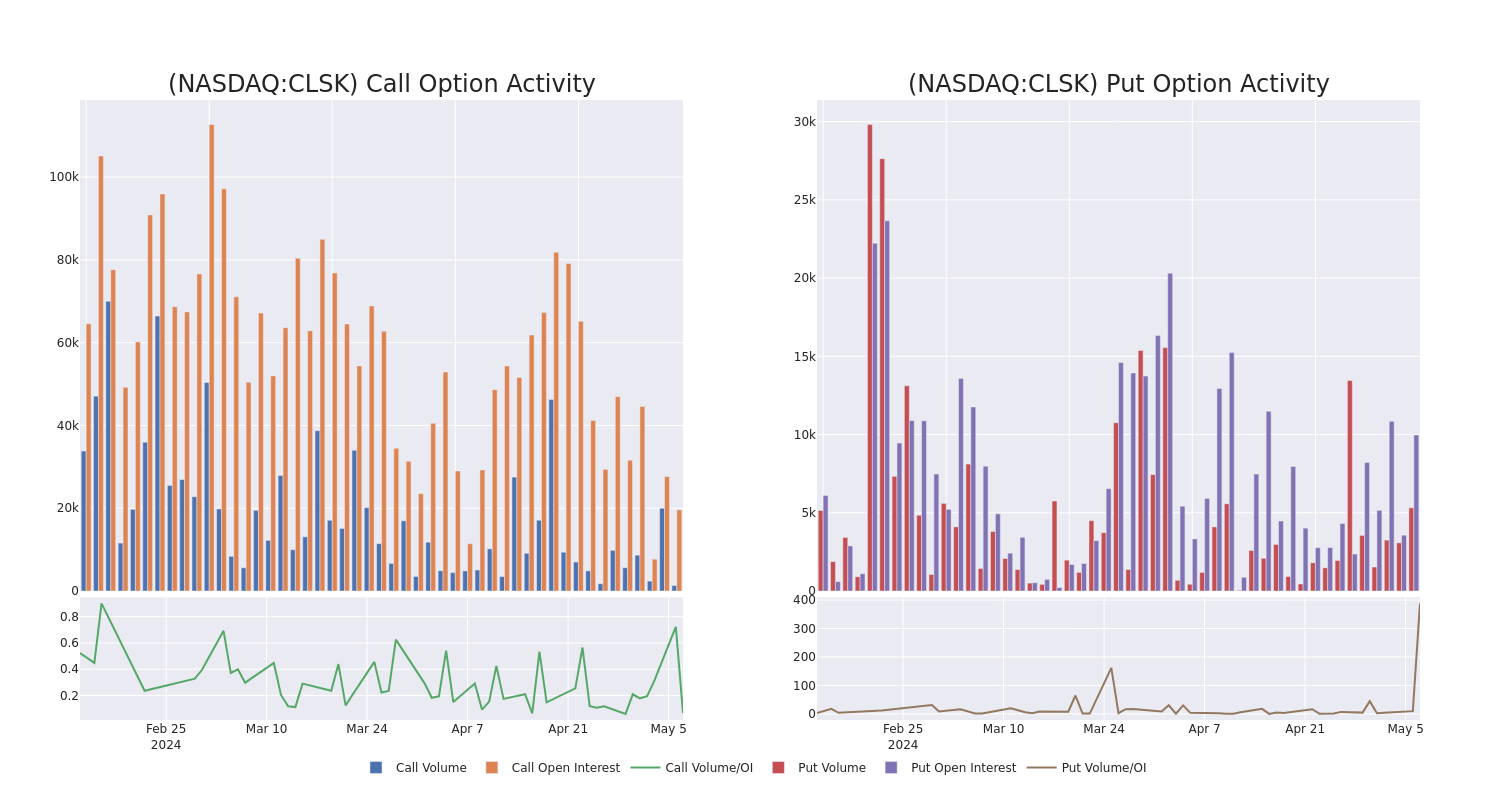

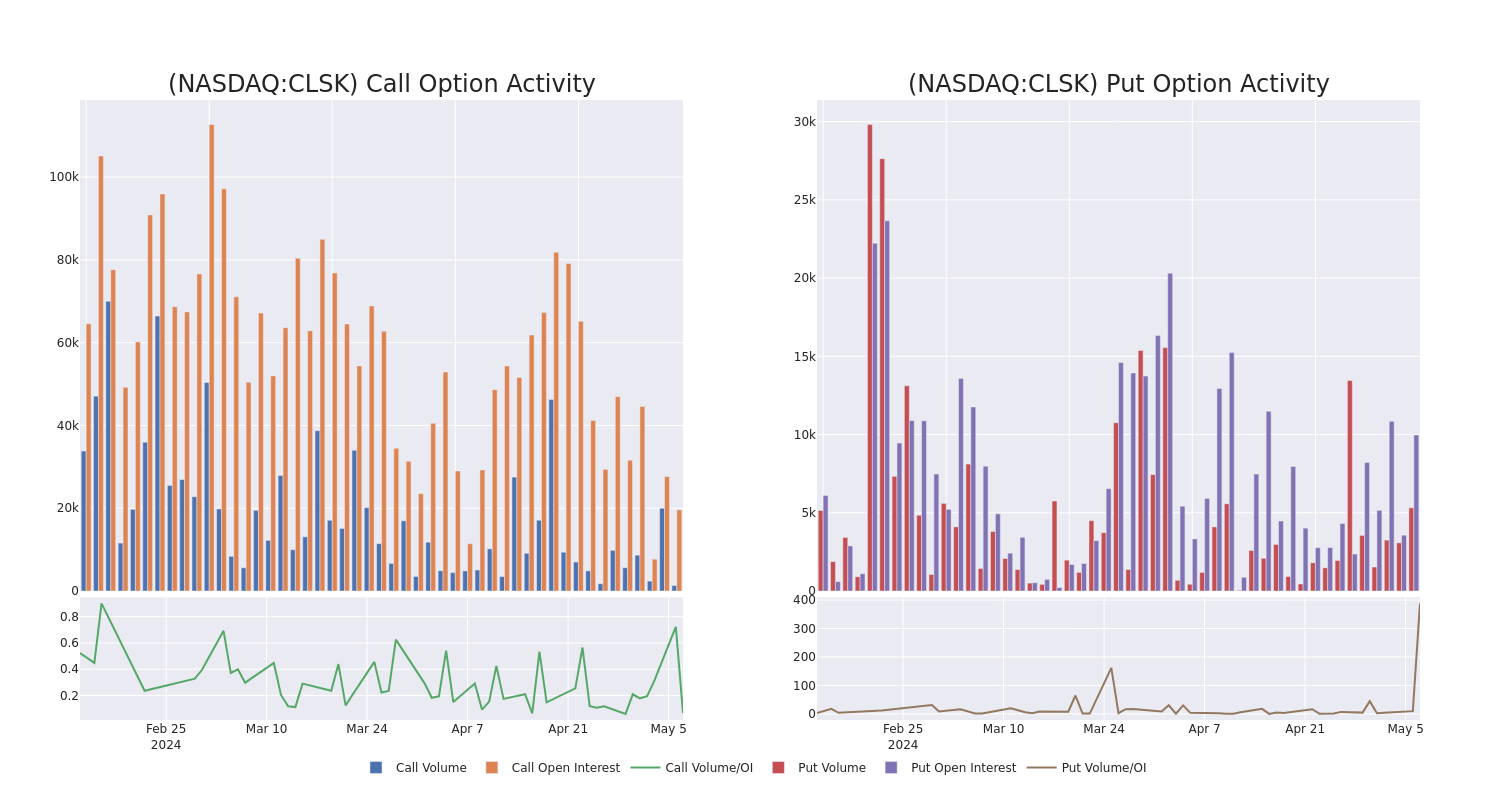

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Cleanspark's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Cleanspark's significant trades, within a strike price range of $12.0 to $35.0, over the past month.

Cleanspark Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| CLSK |

PUT |

SWEEP |

BULLISH |

09/20/24 |

$3.5 |

$3.4 |

$3.5 |

$15.00 |

$595.1K |

1.4K |

6 |

| CLSK |

PUT |

TRADE |

BULLISH |

07/18/25 |

$18.5 |

$18.2 |

$18.3 |

$30.00 |

$364.1K |

2 |

200 |

| CLSK |

PUT |

SWEEP |

BULLISH |

07/18/25 |

$22.6 |

$22.4 |

$22.5 |

$35.00 |

$272.2K |

1 |

7 |

| CLSK |

PUT |

SWEEP |

BULLISH |

12/20/24 |

$3.7 |

$3.4 |

$3.5 |

$13.00 |

$225.0K |

5 |

643 |

| CLSK |

CALL |

SWEEP |

BEARISH |

09/20/24 |

$2.65 |

$2.55 |

$2.55 |

$30.00 |

$127.5K |

3.1K |

20 |

About Cleanspark

Cleanspark Inc is a bitcoin mining company. Through CleanSpark, Inc., and the Company's wholly owned subsidiaries, the company mines bitcoin. The company entered the bitcoin mining industry through its acquisition of ATL. Bitcoin mining is the sole reportable segment of the company.

Following our analysis of the options activities associated with Cleanspark, we pivot to a closer look at the company's own performance.

Where Is Cleanspark Standing Right Now?

- With a volume of 13,049,656, the price of CLSK is down -1.32% at $17.2.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 2 days.

What Analysts Are Saying About Cleanspark

2 market experts have recently issued ratings for this stock, with a consensus target price of $21.0.

- In a cautious move, an analyst from HC Wainwright & Co. downgraded its rating to Buy, setting a price target of $27.

- An analyst from JP Morgan has decided to maintain their Neutral rating on Cleanspark, which currently sits at a price target of $15.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Cleanspark with Benzinga Pro for real-time alerts.

Posted In: CLSK