Illumina Unusual Options Activity For May 07

Author: Benzinga Insights | May 07, 2024 12:45pm

Investors with a lot of money to spend have taken a bearish stance on Illumina (NASDAQ:ILMN).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether this is an institution or just a wealthy individual, we don't know. But when something this big happens with ILMN, it often means somebody knows something is about to happen.

Today, Benzinga's options scanner spotted 8 options trades for Illumina.

This isn't normal.

The overall sentiment of these big-money traders is split between 12% bullish and 75%, bearish.

Out of all of the options we uncovered, 7 are puts, for a total amount of $430,138, and there was 1 call, for a total amount of $30,450.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $110.0 to $150.0 for Illumina during the past quarter.

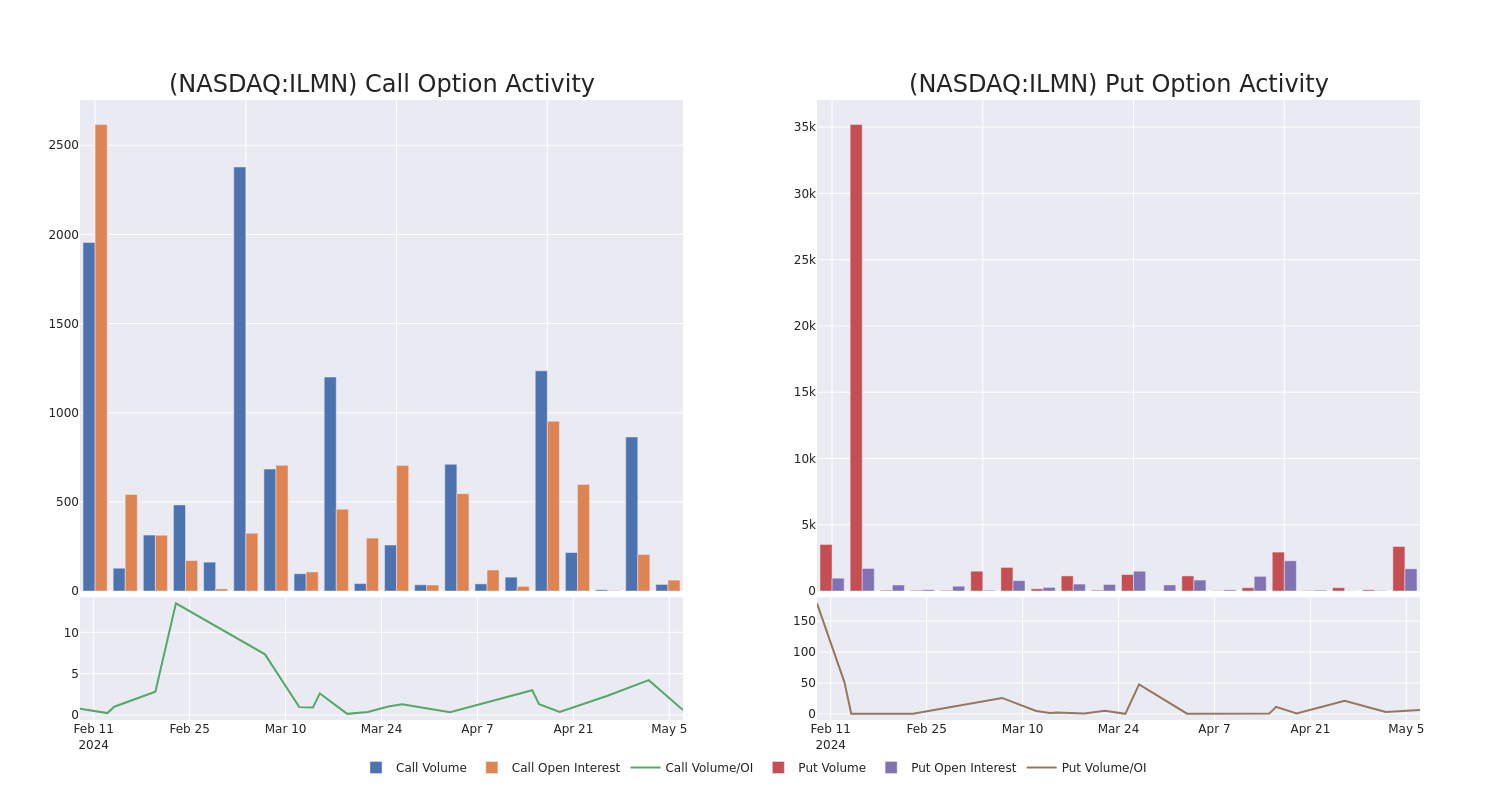

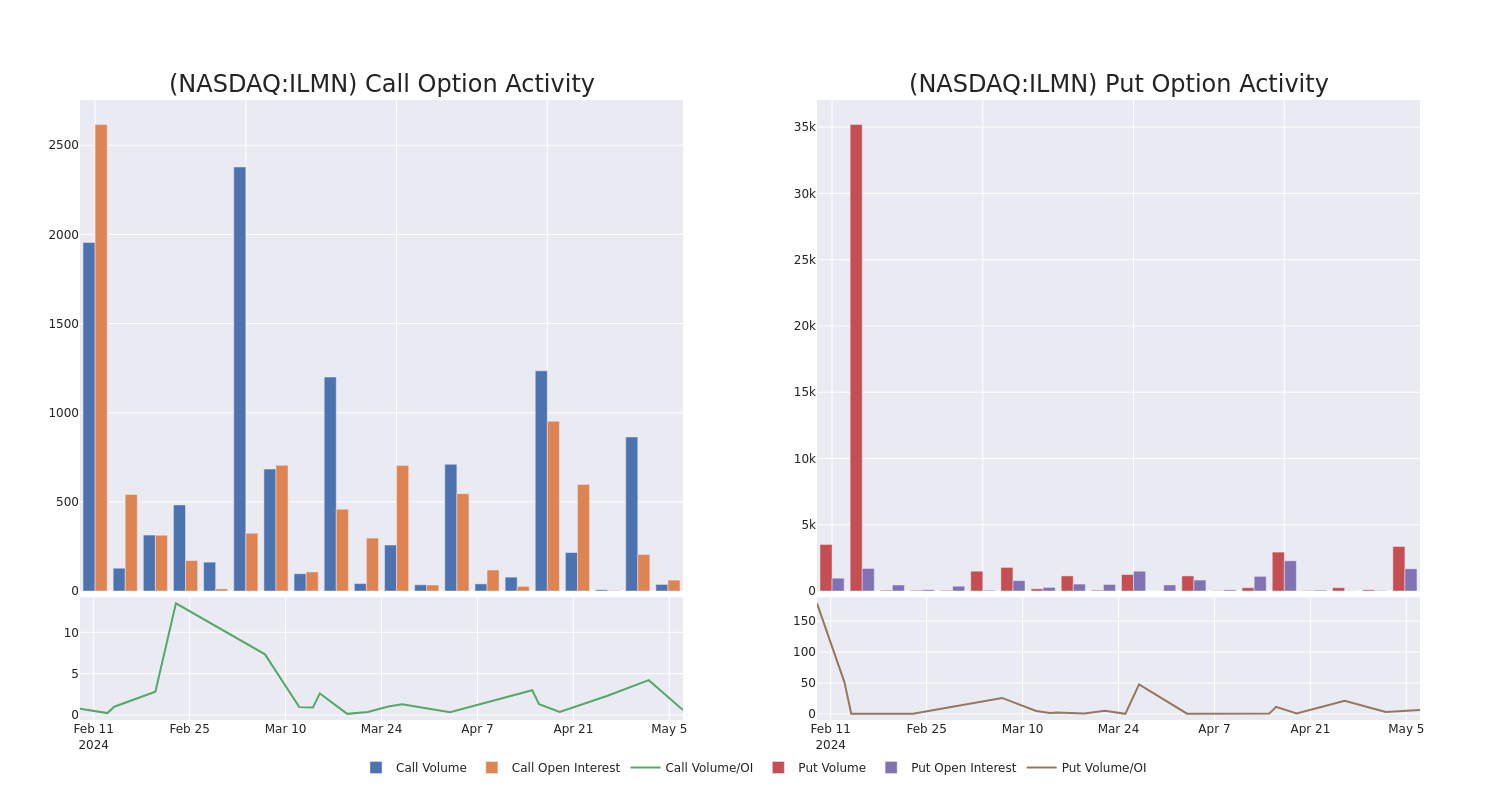

Analyzing Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Illumina's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Illumina's significant trades, within a strike price range of $110.0 to $150.0, over the past month.

Illumina 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| ILMN |

PUT |

SWEEP |

BEARISH |

05/17/24 |

$2.1 |

$2.1 |

$2.1 |

$112.00 |

$87.1K |

863 |

16 |

| ILMN |

PUT |

SWEEP |

NEUTRAL |

05/10/24 |

$2.55 |

$2.25 |

$2.4 |

$115.00 |

$75.3K |

140 |

330 |

| ILMN |

PUT |

SWEEP |

BEARISH |

05/17/24 |

$2.6 |

$2.6 |

$2.6 |

$112.00 |

$63.4K |

863 |

1.0K |

| ILMN |

PUT |

SWEEP |

BEARISH |

05/17/24 |

$2.45 |

$1.35 |

$2.45 |

$112.00 |

$61.9K |

863 |

1.0K |

| ILMN |

PUT |

SWEEP |

BEARISH |

05/17/24 |

$2.5 |

$2.1 |

$2.4 |

$112.00 |

$57.7K |

863 |

771 |

About Illumina

Illumina provides tools and services to analyze genetic material with life science and clinical lab applications. The company generates over 90% of its revenue from sequencing instruments, consumables, and services. Illumina's high-throughput technology enables whole genome sequencing in humans and other large organisms. Its lower throughput tools enable applications that require smaller data outputs, such as viral and cancer tumor screening. Illumina also sells microarrays (9% of 2023 sales) that enable lower-cost, focused genetic screening with primarily consumer and agricultural applications.

Following our analysis of the options activities associated with Illumina, we pivot to a closer look at the company's own performance.

Present Market Standing of Illumina

- Trading volume stands at 1,415,487, with ILMN's price down by -3.09%, positioned at $115.3.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 92 days.

Expert Opinions on Illumina

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $164.2.

- Reflecting concerns, an analyst from Stephens & Co. lowers its rating to Overweight with a new price target of $170.

- An analyst from Barclays has decided to maintain their Underweight rating on Illumina, which currently sits at a price target of $100.

- Reflecting concerns, an analyst from Stephens & Co. lowers its rating to Overweight with a new price target of $170.

- Reflecting concerns, an analyst from RBC Capital lowers its rating to Outperform with a new price target of $253.

- Consistent in their evaluation, an analyst from Baird keeps a Neutral rating on Illumina with a target price of $128.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Illumina, Benzinga Pro gives you real-time options trades alerts.

Posted In: ILMN