Lyft's Options Frenzy: What You Need to Know

Author: Benzinga Insights | May 06, 2024 02:01pm

Whales with a lot of money to spend have taken a noticeably bullish stance on Lyft.

Looking at options history for Lyft (NASDAQ:LYFT) we detected 14 trades.

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 50% with bearish.

From the overall spotted trades, 5 are puts, for a total amount of $206,089 and 9, calls, for a total amount of $484,135.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $16.0 and $22.0 for Lyft, spanning the last three months.

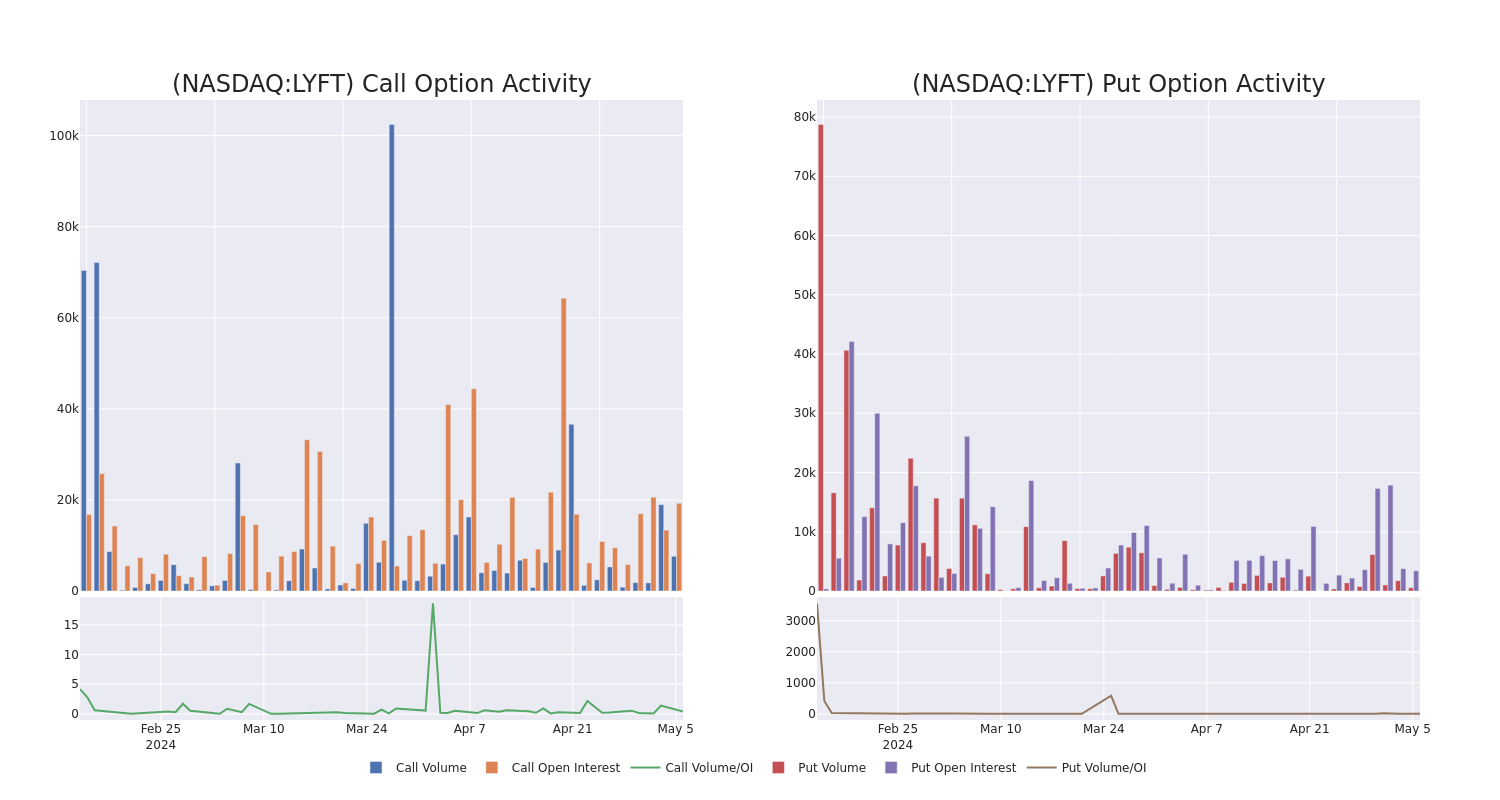

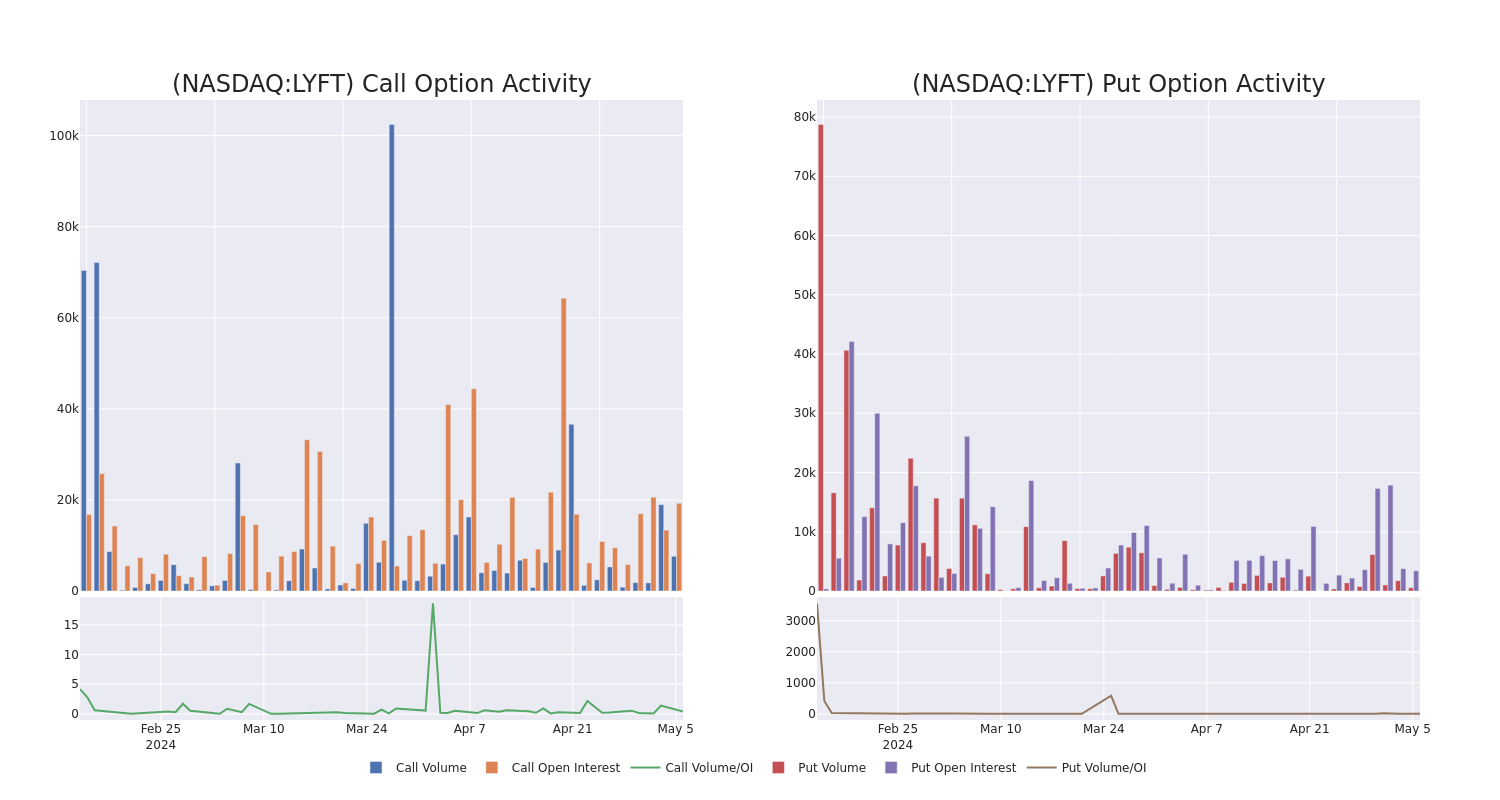

Analyzing Volume & Open Interest

In today's trading context, the average open interest for options of Lyft stands at 1621.43, with a total volume reaching 8,186.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Lyft, situated within the strike price corridor from $16.0 to $22.0, throughout the last 30 days.

Lyft Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| LYFT |

CALL |

TRADE |

BEARISH |

05/10/24 |

$0.81 |

$0.78 |

$0.78 |

$19.50 |

$172.1K |

2.8K |

2.5K |

| LYFT |

CALL |

SWEEP |

BEARISH |

05/10/24 |

$0.35 |

$0.3 |

$0.3 |

$22.00 |

$58.4K |

288 |

2.3K |

| LYFT |

CALL |

SWEEP |

BEARISH |

05/17/24 |

$0.64 |

$0.63 |

$0.63 |

$20.50 |

$54.5K |

47 |

864 |

| LYFT |

PUT |

TRADE |

BULLISH |

08/16/24 |

$3.15 |

$3.1 |

$3.1 |

$18.00 |

$53.9K |

17 |

1 |

| LYFT |

CALL |

SWEEP |

BULLISH |

05/10/24 |

$1.76 |

$1.75 |

$1.75 |

$17.00 |

$50.5K |

1.4K |

954 |

About Lyft

Lyft is the second-largest ride-sharing service provider in the us and Canada, connecting riders and drivers over the Lyft app. Incorporated in 2013, Lyft offers a variety of rides via private vehicles, including traditional private rides, shared rides, and luxury ones. Besides ride-share, Lyft also has entered the bike- and scooter-share market to bring multimodal transportation options to users.

Lyft's Current Market Status

- With a volume of 6,998,331, the price of LYFT is up 1.42% at $17.45.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 1 days.

Professional Analyst Ratings for Lyft

In the last month, 3 experts released ratings on this stock with an average target price of $18.333333333333332.

- Maintaining their stance, an analyst from Wells Fargo continues to hold a Equal-Weight rating for Lyft, targeting a price of $18.

- An analyst from Morgan Stanley persists with their Equal-Weight rating on Lyft, maintaining a target price of $13.

- An analyst from Tigress Financial has decided to maintain their Buy rating on Lyft, which currently sits at a price target of $24.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Lyft options trades with real-time alerts from Benzinga Pro.

Posted In: LYFT