Behind the Scenes of Vertiv Hldgs's Latest Options Trends

Author: Benzinga Insights | May 03, 2024 02:01pm

Whales with a lot of money to spend have taken a noticeably bullish stance on Vertiv Hldgs.

Looking at options history for Vertiv Hldgs (NYSE:VRT) we detected 14 trades.

If we consider the specifics of each trade, it is accurate to state that 64% of the investors opened trades with bullish expectations and 21% with bearish.

From the overall spotted trades, 4 are puts, for a total amount of $797,980 and 10, calls, for a total amount of $1,638,620.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $70.0 and $125.0 for Vertiv Hldgs, spanning the last three months.

Insights into Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Vertiv Hldgs options trades today is 1928.0 with a total volume of 3,586.00.

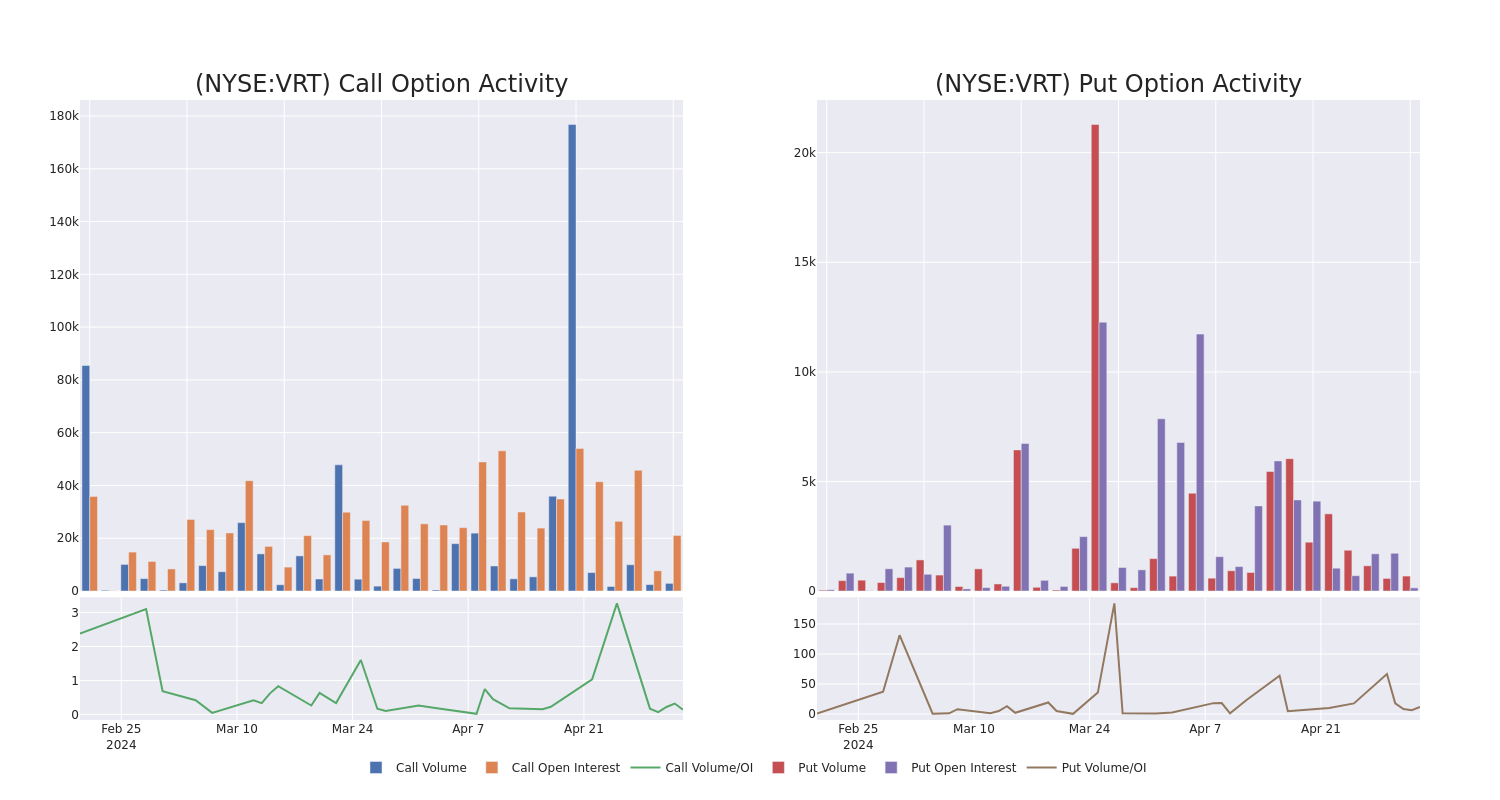

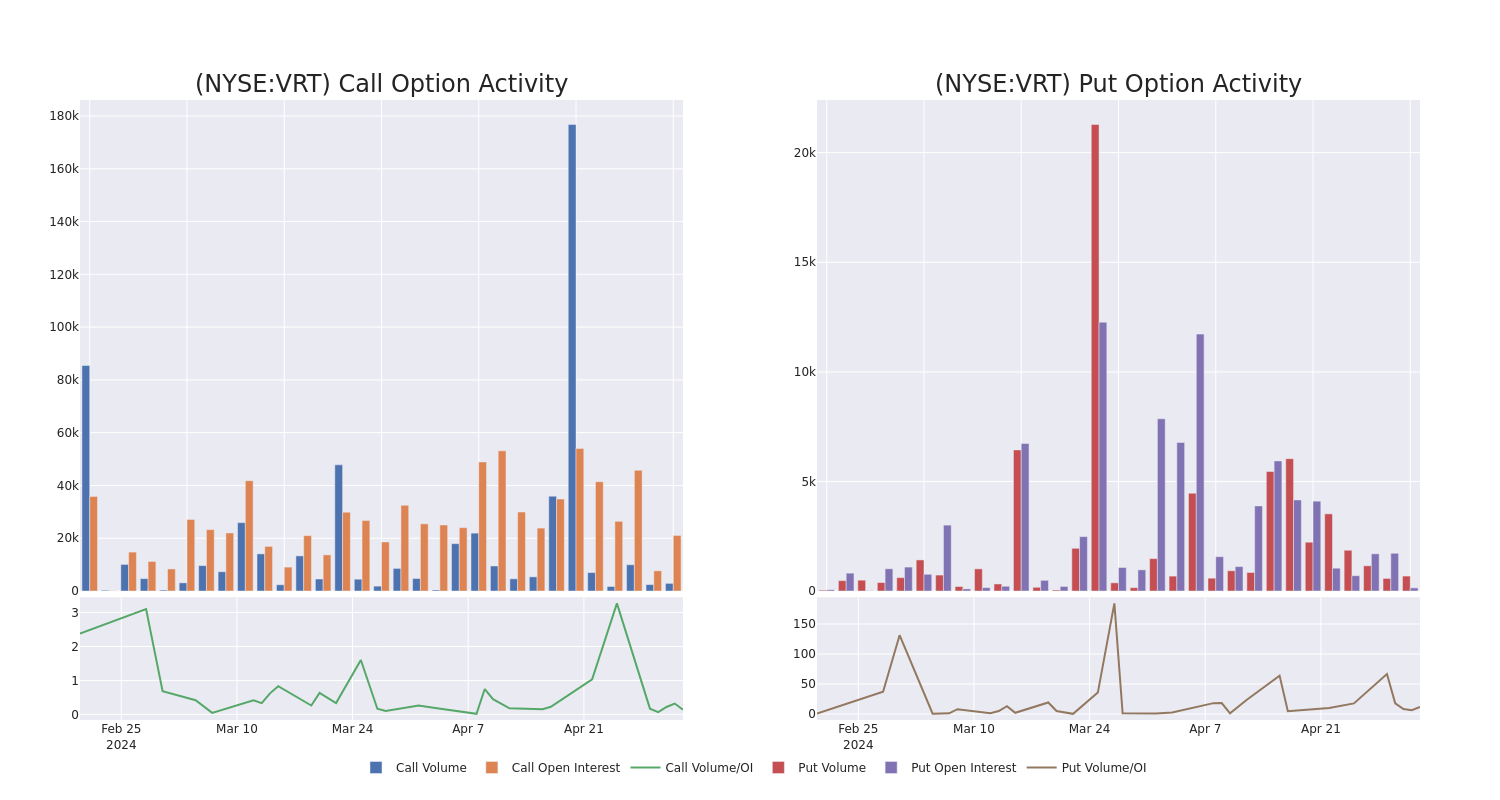

In the following chart, we are able to follow the development of volume and open interest of call and put options for Vertiv Hldgs's big money trades within a strike price range of $70.0 to $125.0 over the last 30 days.

Vertiv Hldgs Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| VRT |

CALL |

SWEEP |

BULLISH |

05/17/24 |

$6.1 |

$5.8 |

$6.05 |

$90.00 |

$602.0K |

3.8K |

1.0K |

| VRT |

CALL |

SWEEP |

BULLISH |

07/18/25 |

$36.7 |

$34.8 |

$36.37 |

$70.00 |

$550.0K |

942 |

171 |

| VRT |

PUT |

SWEEP |

BULLISH |

11/15/24 |

$12.5 |

$12.3 |

$12.3 |

$90.00 |

$526.4K |

140 |

266 |

| VRT |

CALL |

TRADE |

BEARISH |

05/17/24 |

$6.2 |

$6.1 |

$6.1 |

$90.00 |

$222.6K |

3.8K |

1.4K |

| VRT |

PUT |

SWEEP |

BULLISH |

11/15/24 |

$12.5 |

$12.4 |

$12.4 |

$90.00 |

$152.5K |

140 |

170 |

About Vertiv Hldgs

Vertiv Holdings Co brings together hardware, software, analytics and ongoing services to ensure its customers vital applications run continuously, perform optimally and grow with their business needs. The company solves the important challenges faced by data centers, communication networks and commercial and industrial facilities with a portfolio of power, cooling and IT infrastructure solutions and services that extends from the cloud to the edge of the network. Its services include critical power, thermal management, racks and enclosures, monitoring and management, and other services. Its three business segments include the Americas, Asia Pacific; and Europe, Middle East & Africa.

In light of the recent options history for Vertiv Hldgs, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is Vertiv Hldgs Standing Right Now?

- With a trading volume of 2,860,712, the price of VRT is up by 2.01%, reaching $94.02.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 89 days from now.

Professional Analyst Ratings for Vertiv Hldgs

5 market experts have recently issued ratings for this stock, with a consensus target price of $98.0.

- An analyst from Mizuho persists with their Neutral rating on Vertiv Hldgs, maintaining a target price of $95.

- An analyst from JP Morgan has decided to maintain their Overweight rating on Vertiv Hldgs, which currently sits at a price target of $100.

- Consistent in their evaluation, an analyst from Citigroup keeps a Buy rating on Vertiv Hldgs with a target price of $110.

- Consistent in their evaluation, an analyst from Evercore ISI Group keeps a Outperform rating on Vertiv Hldgs with a target price of $90.

- An analyst from JP Morgan persists with their Overweight rating on Vertiv Hldgs, maintaining a target price of $95.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Vertiv Hldgs with Benzinga Pro for real-time alerts.

Posted In: VRT