A Closer Look at MicroStrategy's Options Market Dynamics

Author: Benzinga Insights | May 03, 2024 09:46am

Whales with a lot of money to spend have taken a noticeably bearish stance on MicroStrategy.

Looking at options history for MicroStrategy (NASDAQ:MSTR) we detected 34 trades.

If we consider the specifics of each trade, it is accurate to state that 32% of the investors opened trades with bullish expectations and 41% with bearish.

From the overall spotted trades, 7 are puts, for a total amount of $372,650 and 27, calls, for a total amount of $2,822,667.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $800.0 and $3150.0 for MicroStrategy, spanning the last three months.

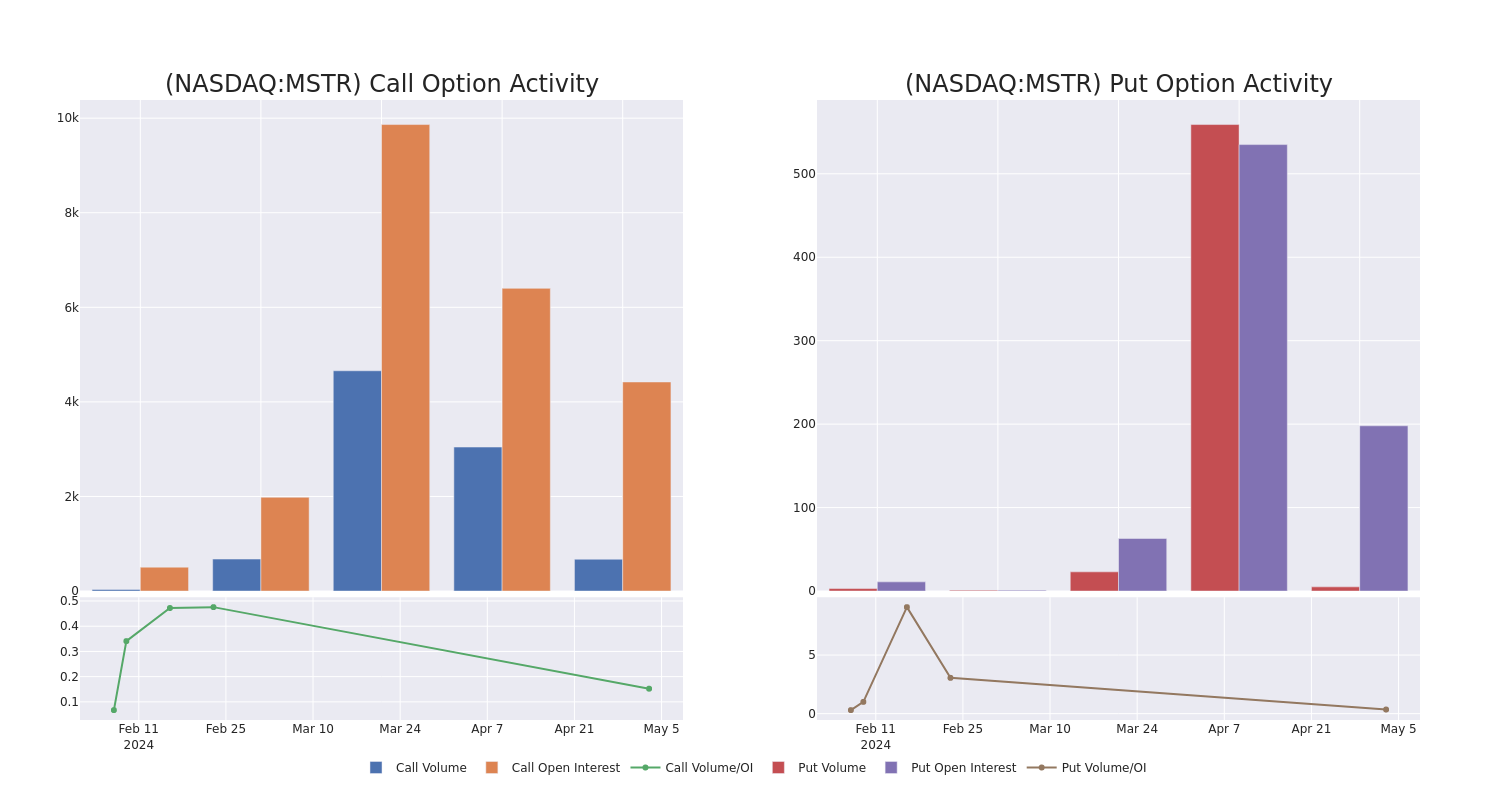

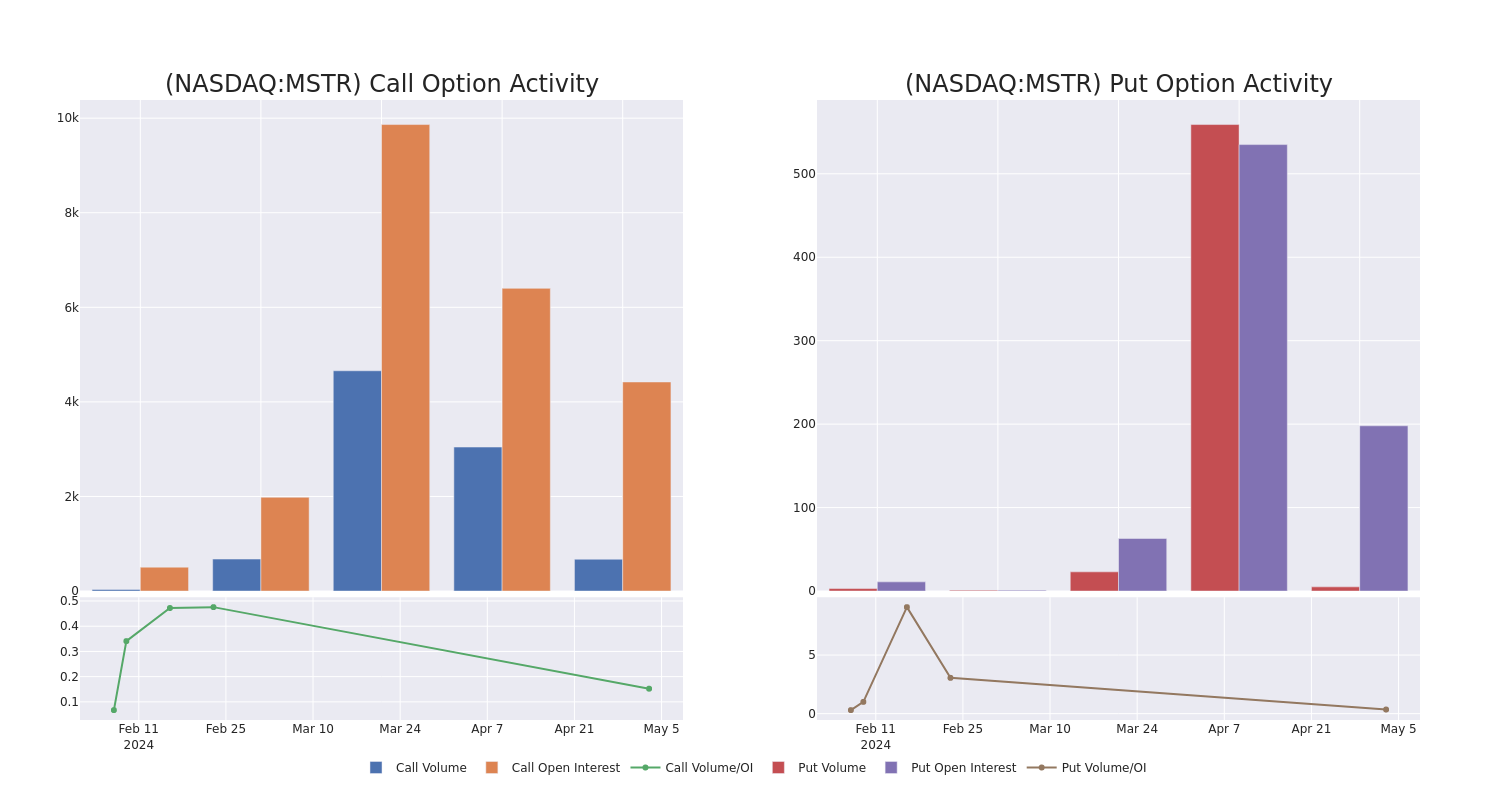

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for MicroStrategy's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of MicroStrategy's whale activity within a strike price range from $800.0 to $3150.0 in the last 30 days.

MicroStrategy 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| MSTR |

CALL |

SWEEP |

NEUTRAL |

07/19/24 |

$356.95 |

$349.65 |

$353.3 |

$1000.00 |

$388.4K |

1.0K |

60 |

| MSTR |

CALL |

SWEEP |

NEUTRAL |

05/03/24 |

$15.8 |

$12.65 |

$12.6 |

$1200.00 |

$375.0K |

1.5K |

448 |

| MSTR |

CALL |

SWEEP |

NEUTRAL |

07/19/24 |

$263.2 |

$251.35 |

$257.7 |

$1200.00 |

$283.3K |

82 |

66 |

| MSTR |

CALL |

TRADE |

BEARISH |

01/17/25 |

$509.7 |

$505.9 |

$505.9 |

$1000.00 |

$252.9K |

672 |

5 |

| MSTR |

CALL |

TRADE |

NEUTRAL |

05/24/24 |

$89.8 |

$77.5 |

$84.22 |

$1350.00 |

$210.5K |

84 |

1 |

About MicroStrategy

MicroStrategy Inc is a provider of enterprise analytics and mobility software. It offers MicroStrategy Analytics platform that delivers reports and dashboards and enables users to conduct ad hoc analysis and share insights through mobile devices or the Web; MicroStrategy Server, which provides analytical processing and job management. The company's reportable operating segment is engaged in the design, development, marketing, and sales of its software platform through licensing arrangements and cloud-based subscriptions and related services.

After a thorough review of the options trading surrounding MicroStrategy, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

MicroStrategy's Current Market Status

- With a trading volume of 154,494, the price of MSTR is up by 5.04%, reaching $1186.37.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 88 days from now.

Expert Opinions on MicroStrategy

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $1803.0.

- Consistent in their evaluation, an analyst from Benchmark keeps a Buy rating on MicroStrategy with a target price of $1875.

- In a cautious move, an analyst from Benchmark downgraded its rating to Buy, setting a price target of $1875.

- An analyst from BTIG persists with their Buy rating on MicroStrategy, maintaining a target price of $1800.

- Consistent in their evaluation, an analyst from Canaccord Genuity keeps a Buy rating on MicroStrategy with a target price of $1590.

- An analyst from Benchmark has revised its rating downward to Buy, adjusting the price target to $1875.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest MicroStrategy options trades with real-time alerts from Benzinga Pro.

Posted In: MSTR