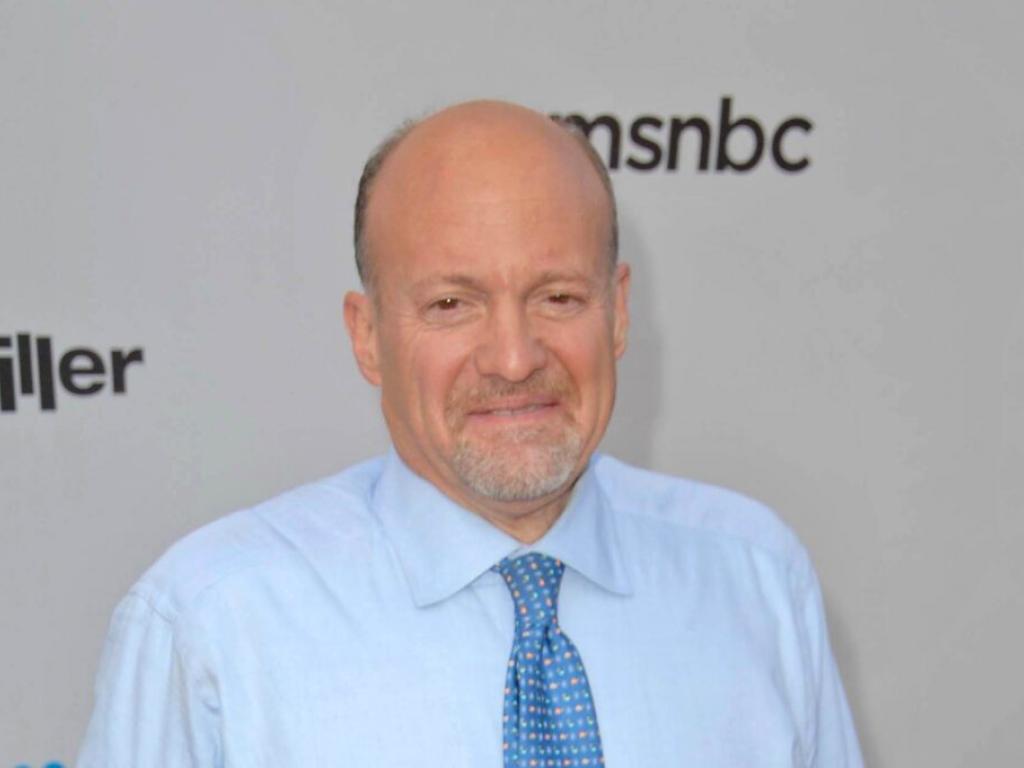

Jim Cramer Slams Analysts Over 'Getting China Wrong About Apple For Two Decades:' 'That's Why I Am Always Trashing You!'

Author: Benzinga Neuro | May 03, 2024 07:16am

Jim Cramer, host of CNBC “Mad Money,” has criticized analysts for their consistent misinterpretation of Apple’s (NASDAQ:AAPL) performance in the Chinese market.

What Happened: Cramer took to X on Friday to express his frustration with analysts.

“I am seeing stories about how analysts are wondering how they got China wrong for Apple,” he wrote.

“My answer: you have been getting China wrong about Apple for two decades. That’s why I am always trashing you!”

See Also: Smart Money Is Betting Big In BABA Options

Why It Matters: His post comes in the wake of Apple reporting underwhelming quarterly results, largely attributed to a drop in demand in China and stiff competition from Huawei Technologies. The company’s revenue fell to $90.75 billion for the quarter ending March 30, primarily driven by a 10.5% drop in iPhone sales.

Earlier, Cramer had reacted strongly to data revealing a 19.1% drop in Apple’s iPhone sales in China in the first three months of 2024, terming it “another dump on Apple iPhone day.”

Cramer’s criticism of analysts comes amid a broader discussion about Apple’s struggles in China. Despite the overall decline in sales, Apple CEO Tim Cook highlighted that iPhone sales in Mainland China had actually grown.

Furthermore, Cramer had previously pointed out the disproportionate coverage of Apple “losing leadership” compared to Google and Microsoft’s post their “spectacular quarters.”

Price Action: On Thursday, Apple’s stock closed at $173.03 as per Benzinga Pro.

Read Next: Bitcoin’s Historical Data Suggests A Potential 99% Surge, Says Crypto Analyst: ‘Time To Buy The Dip!’

Image via Shutterstock

Engineered by Benzinga Neuro, Edited by

Pooja Rajkumari

The GPT-4-based Benzinga Neuro content generation system exploits the extensive Benzinga Ecosystem, including native data, APIs, and more to create comprehensive and timely stories for you.

Learn more.

Posted In: AAPL