Looking At C3.ai's Recent Unusual Options Activity

Author: Benzinga Insights | May 02, 2024 11:47am

Investors with a lot of money to spend have taken a bearish stance on C3.ai (NYSE:AI).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with AI, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 10 uncommon options trades for C3.ai.

This isn't normal.

The overall sentiment of these big-money traders is split between 10% bullish and 50%, bearish.

Out of all of the special options we uncovered, 4 are puts, for a total amount of $193,624, and 6 are calls, for a total amount of $234,880.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $17.5 and $35.0 for C3.ai, spanning the last three months.

Analyzing Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for C3.ai's options for a given strike price.

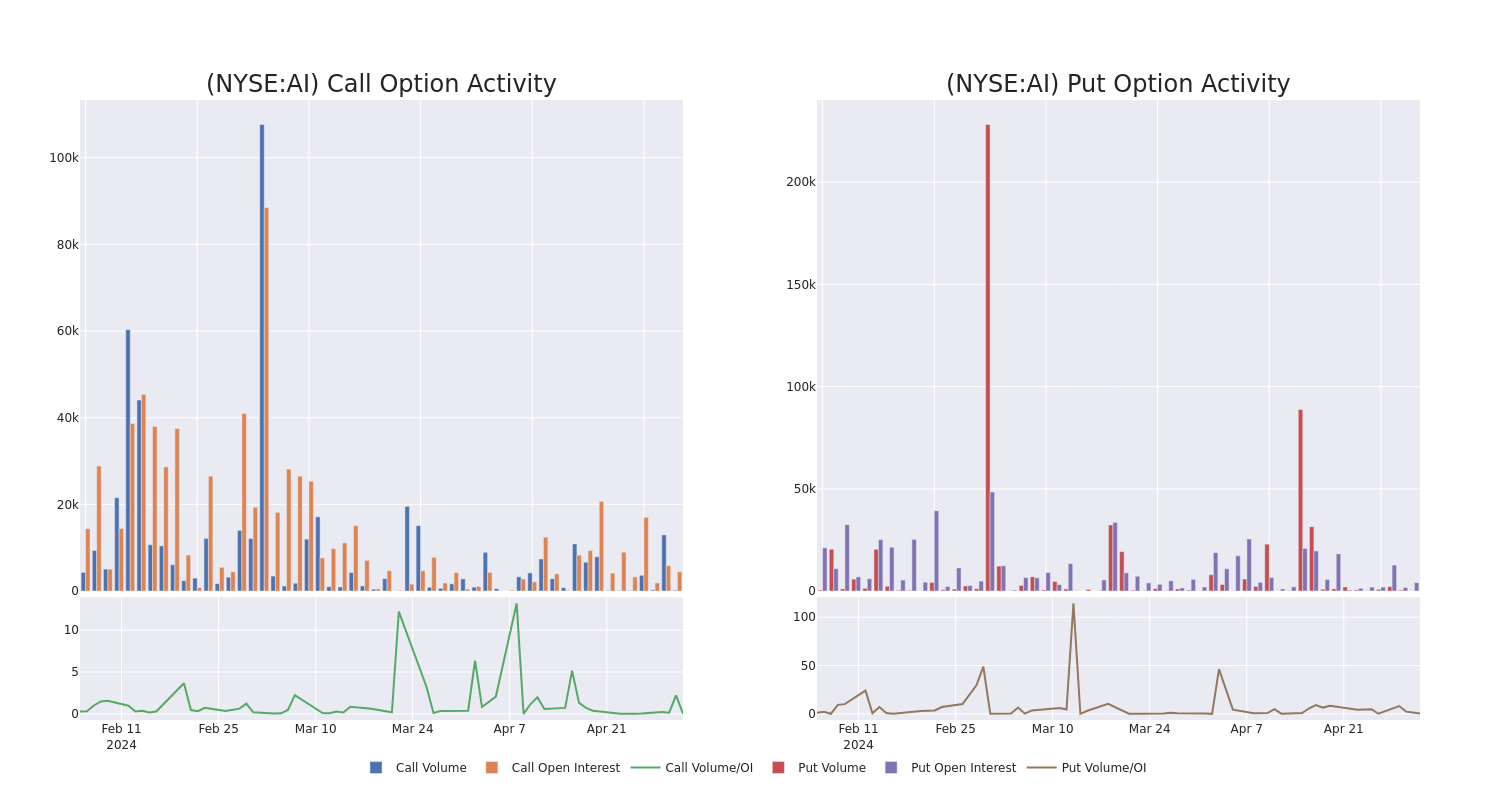

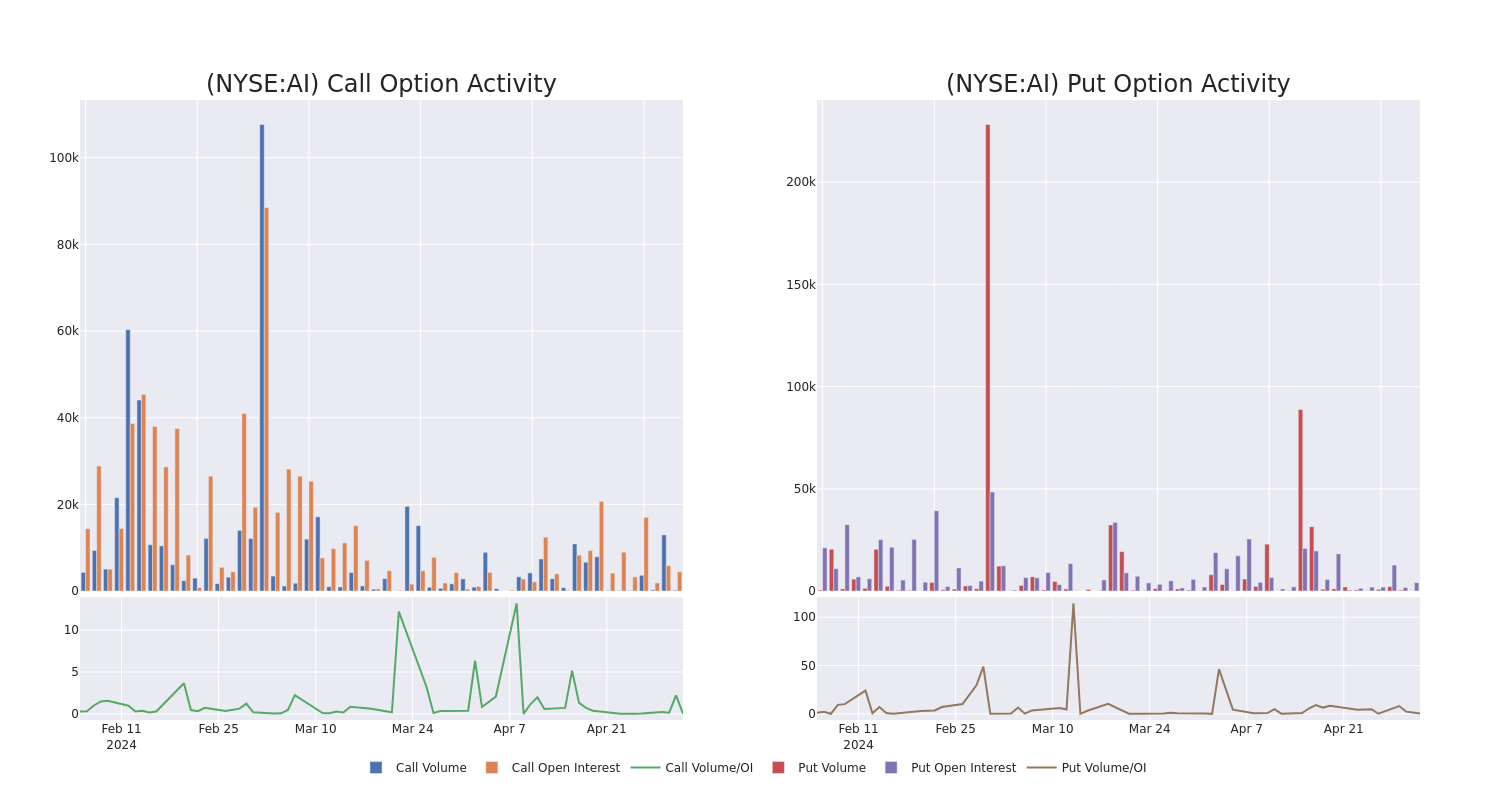

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of C3.ai's whale activity within a strike price range from $17.5 to $35.0 in the last 30 days.

C3.ai Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| AI |

PUT |

TRADE |

BEARISH |

06/21/24 |

$12.75 |

$12.75 |

$12.75 |

$35.00 |

$70.1K |

325 |

0 |

| AI |

CALL |

TRADE |

BEARISH |

01/17/25 |

$6.55 |

$6.3 |

$6.3 |

$20.00 |

$63.0K |

2.7K |

100 |

| AI |

PUT |

SWEEP |

NEUTRAL |

05/17/24 |

$9.9 |

$9.75 |

$9.82 |

$32.50 |

$53.9K |

200 |

80 |

| AI |

CALL |

TRADE |

BULLISH |

09/20/24 |

$4.2 |

$3.3 |

$4.2 |

$22.50 |

$42.0K |

304 |

0 |

| AI |

PUT |

TRADE |

NEUTRAL |

01/17/25 |

$14.3 |

$13.6 |

$13.9 |

$35.00 |

$41.7K |

3.5K |

20 |

About C3.ai

C3.ai Inc is an enterprise artificial intelligence company. The company provides software-as-a-service applications that enable customers to rapidly develop, deploy, and operate large-scale Enterprise AI applications across any infrastructure. It provides solutions under three divisions namely, The C3 AI Suite, is a comprehensive application development and runtime environment that is designed to allow customers to rapidly design, develop, and deploy Enterprise AI applications of any type; C3 AI Applications, include a large and growing family of industry-specific and application-specific turnkey AI solutions that can be immediately installed and deployed; and C3.ai Ex Machina, analytics for applying data science to every-day business decisions.

Where Is C3.ai Standing Right Now?

- With a volume of 1,342,587, the price of AI is up 1.1% at $22.94.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 27 days.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for C3.ai with Benzinga Pro for real-time alerts.

Posted In: AI