Spotlight on Johnson & Johnson: Analyzing the Surge in Options Activity

Author: Benzinga Insights | April 30, 2024 02:46pm

Investors with a lot of money to spend have taken a bearish stance on Johnson & Johnson (NYSE:JNJ).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether this is an institution or just a wealthy individual, we don't know. But when something this big happens with JNJ, it often means somebody knows something is about to happen.

Today, Benzinga's options scanner spotted 8 options trades for Johnson & Johnson.

This isn't normal.

The overall sentiment of these big-money traders is split between 25% bullish and 62%, bearish.

Out of all of the options we uncovered, 7 are puts, for a total amount of $452,590, and there was 1 call, for a total amount of $33,460.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $145.0 to $155.0 for Johnson & Johnson over the recent three months.

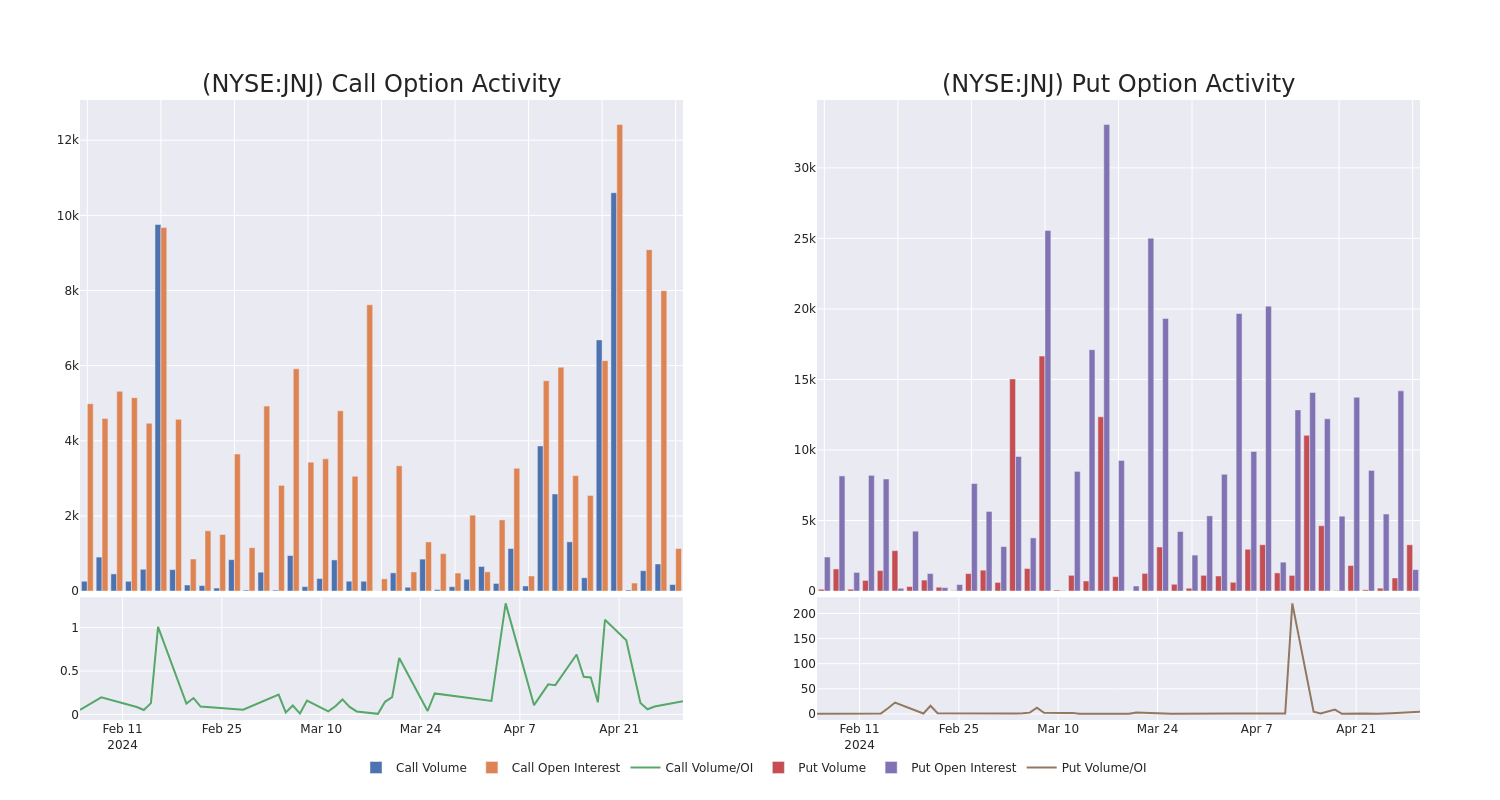

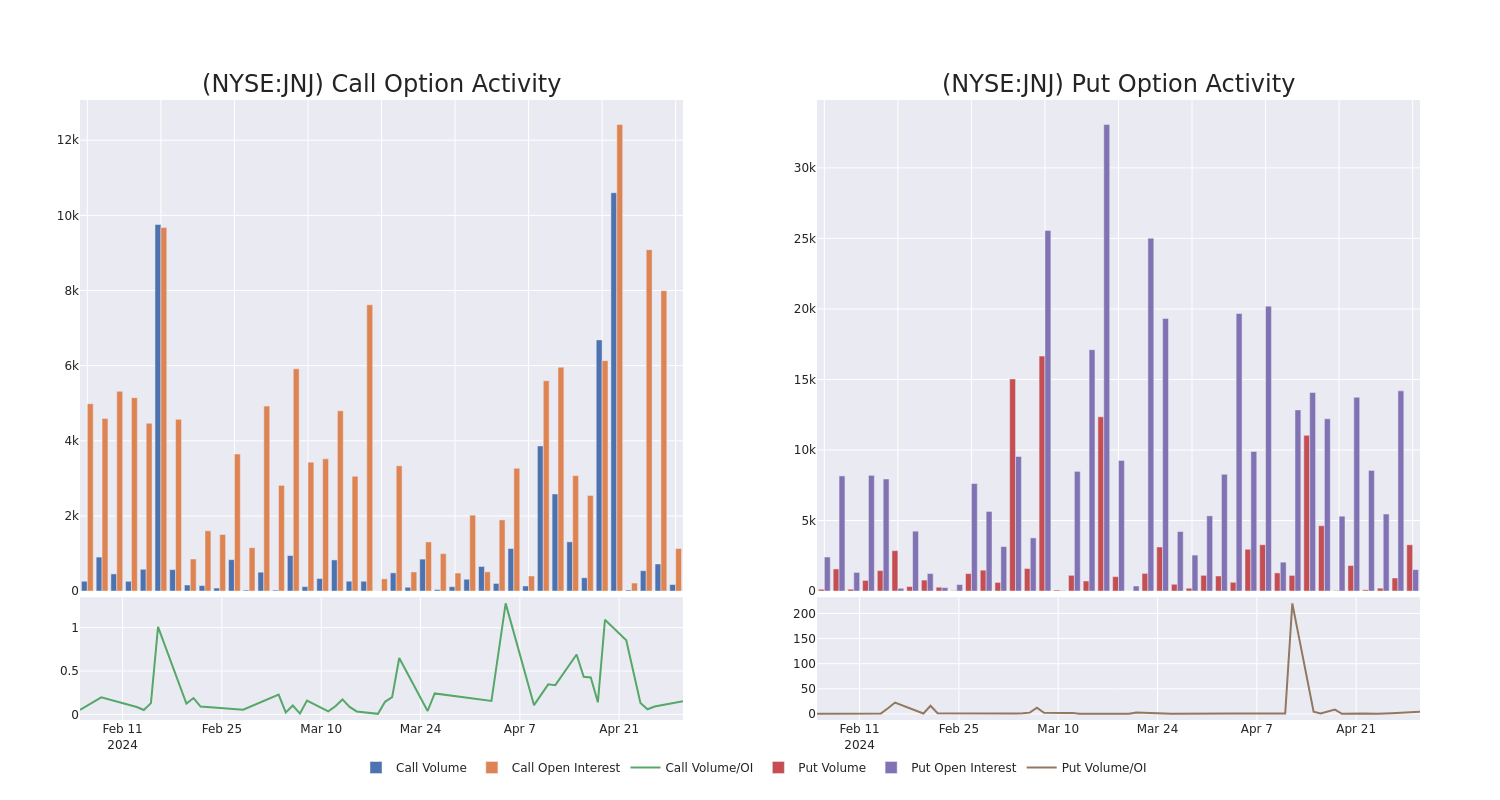

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Johnson & Johnson's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Johnson & Johnson's substantial trades, within a strike price spectrum from $145.0 to $155.0 over the preceding 30 days.

Johnson & Johnson 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| JNJ |

PUT |

SWEEP |

BEARISH |

10/18/24 |

$5.95 |

$5.8 |

$5.95 |

$145.00 |

$119.0K |

805 |

707 |

| JNJ |

PUT |

TRADE |

NEUTRAL |

10/18/24 |

$5.95 |

$5.8 |

$5.88 |

$145.00 |

$117.6K |

805 |

507 |

| JNJ |

PUT |

TRADE |

BEARISH |

10/18/24 |

$5.95 |

$5.8 |

$5.92 |

$145.00 |

$59.2K |

805 |

307 |

| JNJ |

PUT |

TRADE |

BULLISH |

10/18/24 |

$6.0 |

$5.95 |

$5.95 |

$145.00 |

$47.6K |

805 |

127 |

| JNJ |

PUT |

TRADE |

BEARISH |

10/18/24 |

$5.8 |

$5.6 |

$5.76 |

$145.00 |

$40.3K |

805 |

779 |

About Johnson & Johnson

Johnson & Johnson is the world's largest and most diverse healthcare firm. Three divisions make up the firm: pharmaceutical, medical devices and diagnostics, and consumer. The drug and device groups represent close to 80% of sales and drive the majority of cash flows for the firm. The drug division focuses on the following therapeutic areas: immunology, oncology, neurology, pulmonary, cardiology, and metabolic diseases. The device segment focuses on orthopedics, surgery tools, vision care, and a few smaller areas. The last segment of consumer focuses on baby care, beauty, oral care, over-the-counter drugs, and women's health. The consumer group is being divested in 2023 under the new name Kenvue. Geographically, just over half of total revenue is generated in the United States.

Current Position of Johnson & Johnson

- With a volume of 4,066,464, the price of JNJ is down -1.09% at $145.22.

- RSI indicators hint that the underlying stock may be oversold.

- Next earnings are expected to be released in 79 days.

What The Experts Say On Johnson & Johnson

5 market experts have recently issued ratings for this stock, with a consensus target price of $179.4.

- An analyst from B of A Securities has decided to maintain their Neutral rating on Johnson & Johnson, which currently sits at a price target of $170.

- Consistent in their evaluation, an analyst from RBC Capital keeps a Outperform rating on Johnson & Johnson with a target price of $175.

- An analyst from HSBC upgraded its action to Buy with a price target of $170.

- An analyst from Morgan Stanley persists with their Equal-Weight rating on Johnson & Johnson, maintaining a target price of $167.

- Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Overweight with a new price target of $215.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Johnson & Johnson, Benzinga Pro gives you real-time options trades alerts.

Posted In: JNJ