Breaking Down PaySign: 5 Analysts Share Their Views

Author: Benzinga Insights | April 30, 2024 02:01pm

In the preceding three months, 5 analysts have released ratings for PaySign (NASDAQ:PAYS), presenting a wide array of perspectives from bullish to bearish.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

3 |

2 |

0 |

0 |

0 |

| Last 30D |

1 |

0 |

0 |

0 |

0 |

| 1M Ago |

1 |

0 |

0 |

0 |

0 |

| 2M Ago |

1 |

2 |

0 |

0 |

0 |

| 3M Ago |

0 |

0 |

0 |

0 |

0 |

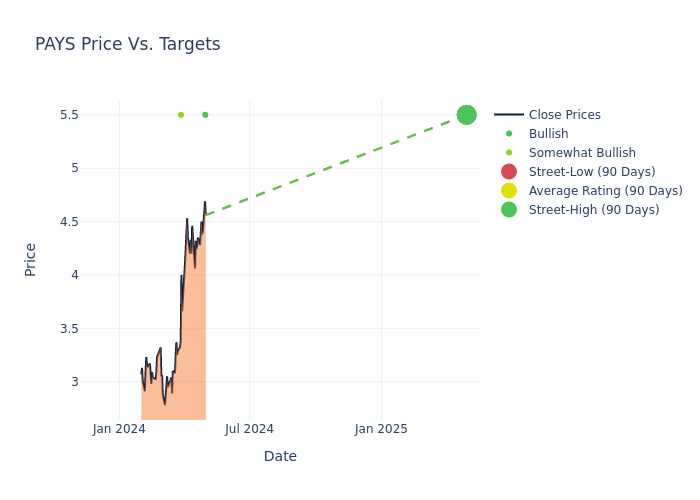

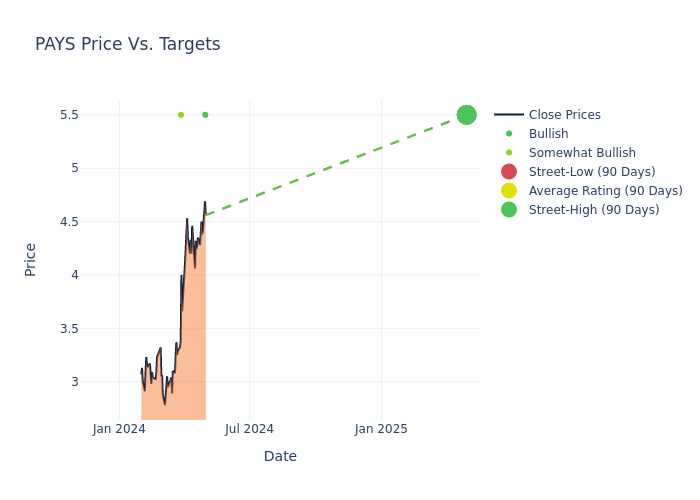

The 12-month price targets, analyzed by analysts, offer insights with an average target of $5.0, a high estimate of $5.50, and a low estimate of $4.00. This current average has increased by 17.65% from the previous average price target of $4.25.

Exploring Analyst Ratings: An In-Depth Overview

A comprehensive examination of how financial experts perceive PaySign is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Peter Heckmann |

DA Davidson |

Raises |

Buy |

$5.50 |

$4.50 |

| Peter Heckmann |

DA Davidson |

Raises |

Buy |

$4.50 |

$4.00 |

| Gary Prestopino |

Barrington Research |

Maintains |

Outperform |

$5.50 |

$5.50 |

| Peter Heckmann |

DA Davidson |

Raises |

Buy |

$4.00 |

$3.00 |

| Gary Prestopino |

Barrington Research |

Maintains |

Outperform |

$5.50 |

- |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to PaySign. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of PaySign compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of PaySign's stock. This comparison reveals trends in analysts' expectations over time.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into PaySign's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on PaySign analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Discovering PaySign: A Closer Look

PaySign Inc is a provider of prepaid card programs, comprehensive patient affordability offerings, digital banking services, and integrated payment processing designed for businesses, consumers, and government institutions. The Company creates customized, payment solutions for clients across industries, including pharmaceutical, healthcare, hospitality, and retail. The company's revenues include fees generated from cardholder fees, interchange, card program management fees, transaction claims processing fees, and settlement income.

PaySign: Financial Performance Dissected

Market Capitalization: Indicating a reduced size compared to industry averages, the company's market capitalization poses unique challenges.

Positive Revenue Trend: Examining PaySign's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 28.93% as of 31 December, 2023, showcasing a substantial increase in top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Financials sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 41.07%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): PaySign's ROE excels beyond industry benchmarks, reaching 26.36%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): PaySign's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 4.36%, the company showcases efficient use of assets and strong financial health.

Debt Management: PaySign's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.14.

What Are Analyst Ratings?

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: PAYS