IBM's Options: A Look at What the Big Money is Thinking

Author: Benzinga Insights | April 30, 2024 12:01pm

Investors with a lot of money to spend have taken a bullish stance on IBM (NYSE:IBM).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with IBM, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 12 uncommon options trades for IBM.

This isn't normal.

The overall sentiment of these big-money traders is split between 58% bullish and 41%, bearish.

Out of all of the special options we uncovered, 2 are puts, for a total amount of $58,927, and 10 are calls, for a total amount of $743,327.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $110.0 to $200.0 for IBM over the last 3 months.

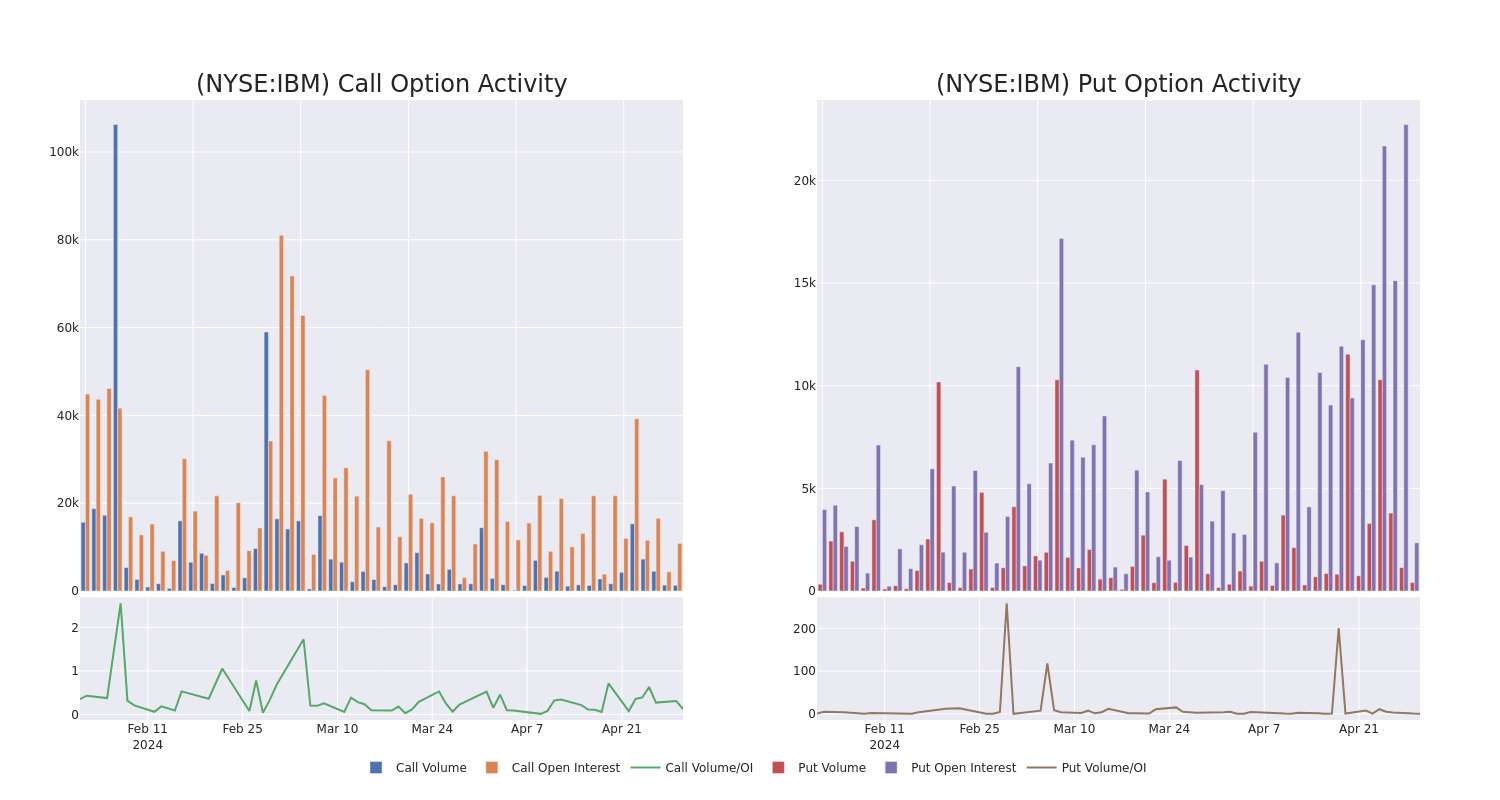

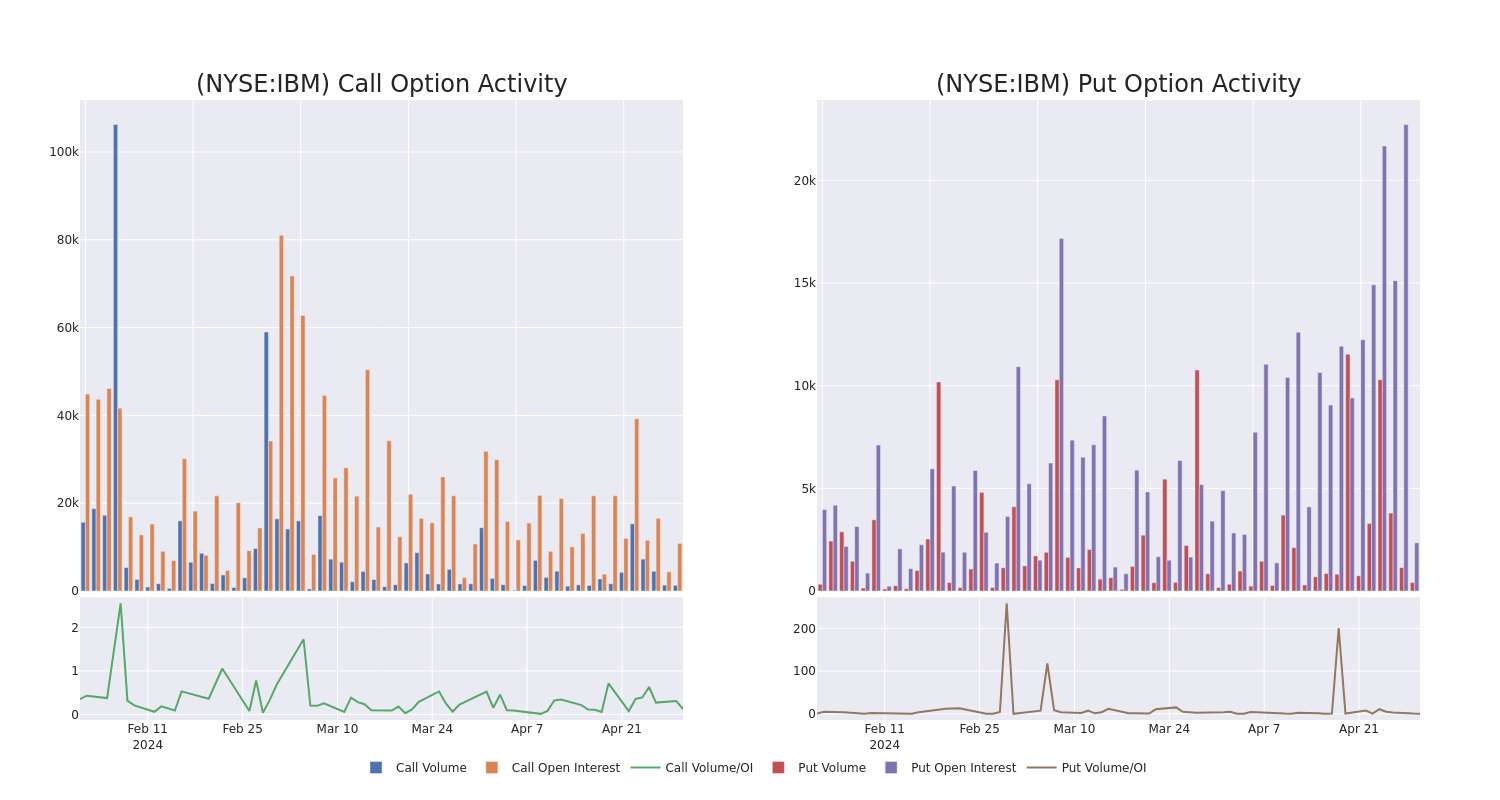

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in IBM's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to IBM's substantial trades, within a strike price spectrum from $110.0 to $200.0 over the preceding 30 days.

IBM 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| IBM |

CALL |

TRADE |

BULLISH |

10/18/24 |

$1.55 |

$1.48 |

$1.55 |

$200.00 |

$310.0K |

5.4K |

3 |

| IBM |

CALL |

TRADE |

BULLISH |

01/17/25 |

$56.2 |

$55.6 |

$56.2 |

$110.00 |

$84.3K |

96 |

15 |

| IBM |

CALL |

SWEEP |

BULLISH |

10/18/24 |

$5.0 |

$4.95 |

$5.0 |

$180.00 |

$72.0K |

251 |

166 |

| IBM |

CALL |

SWEEP |

BEARISH |

01/17/25 |

$11.8 |

$11.75 |

$11.8 |

$170.00 |

$53.2K |

2.8K |

37 |

| IBM |

CALL |

SWEEP |

BULLISH |

06/07/24 |

$1.31 |

$1.05 |

$1.05 |

$175.00 |

$50.5K |

516 |

732 |

About IBM

IBM looks to be a part of every aspect of an enterprise's IT needs. The company primarily sells software, IT services, consulting, and hardware. IBM operates in 175 countries and employs approximately 350,000 people. The company has a robust roster of 80,000 business partners to service 5,200 clients—which includes 95% of all Fortune 500. While IBM is a B2B company, IBM's outward impact is substantial. For example, IBM manages 90% of all credit card transactions globally and is responsible for 50% of all wireless connections in the world.

In light of the recent options history for IBM, it's now appropriate to focus on the company itself. We aim to explore its current performance.

IBM's Current Market Status

- Trading volume stands at 1,356,341, with IBM's price down by -1.18%, positioned at $165.45.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 78 days.

Professional Analyst Ratings for IBM

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $173.8.

- An analyst from UBS persists with their Sell rating on IBM, maintaining a target price of $130.

- Consistent in their evaluation, an analyst from Morgan Stanley keeps a Equal-Weight rating on IBM with a target price of $179.

- Maintaining their stance, an analyst from Wedbush continues to hold a Neutral rating for IBM, targeting a price of $160.

- An analyst from Jefferies persists with their Hold rating on IBM, maintaining a target price of $210.

- An analyst from Stifel has decided to maintain their Buy rating on IBM, which currently sits at a price target of $190.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest IBM options trades with real-time alerts from Benzinga Pro.

Posted In: IBM