Netflix Unusual Options Activity

Author: Benzinga Insights | April 30, 2024 10:16am

Investors with a lot of money to spend have taken a bearish stance on Netflix (NASDAQ:NFLX).

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with NFLX, it often means somebody knows something is about to happen.

Today, Benzinga's options scanner spotted 11 options trades for Netflix.

This isn't normal.

The overall sentiment of these big-money traders is split between 36% bullish and 45%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $61,750, and 10, calls, for a total amount of $455,332.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $557.5 and $650.0 for Netflix, spanning the last three months.

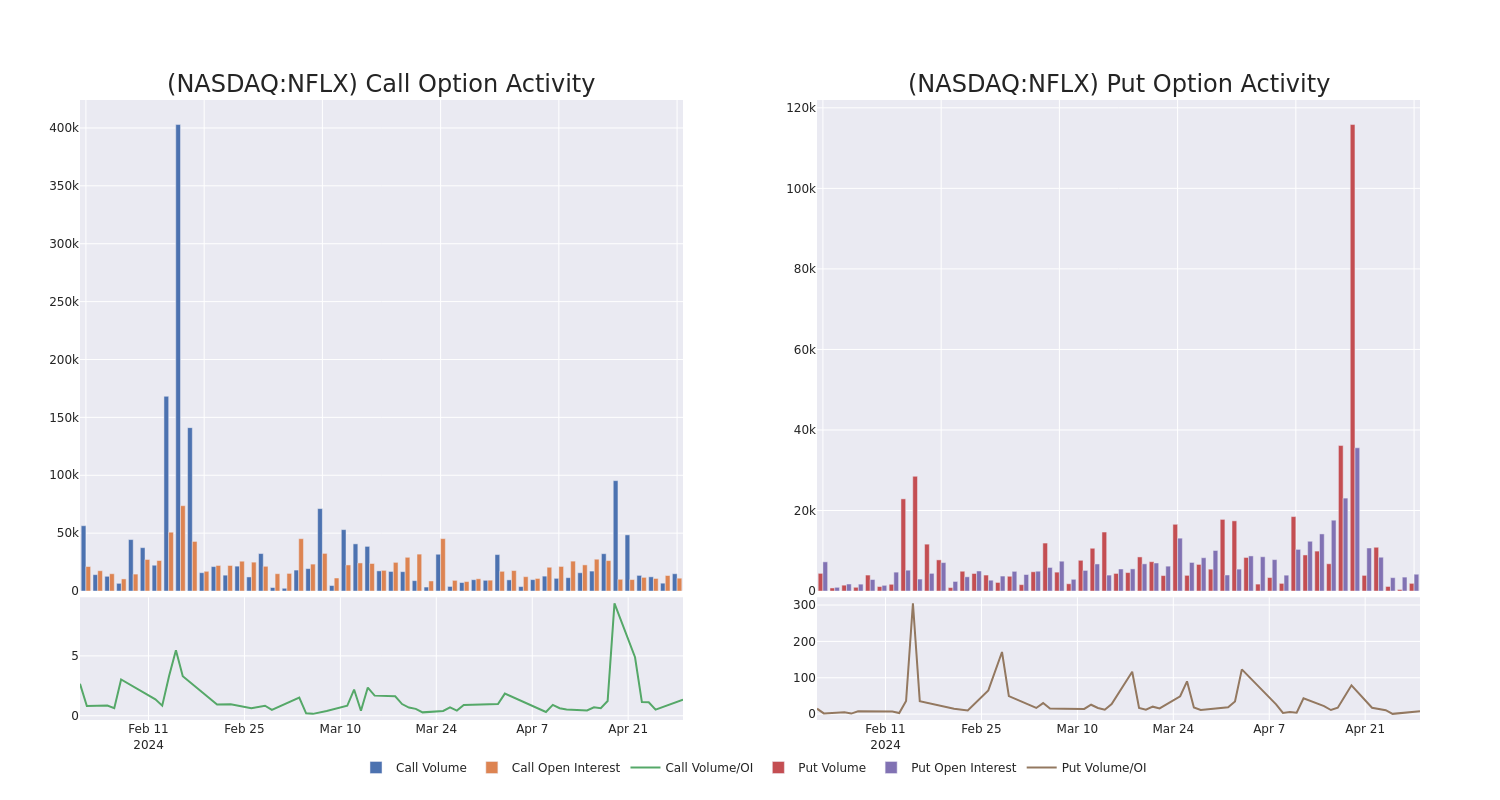

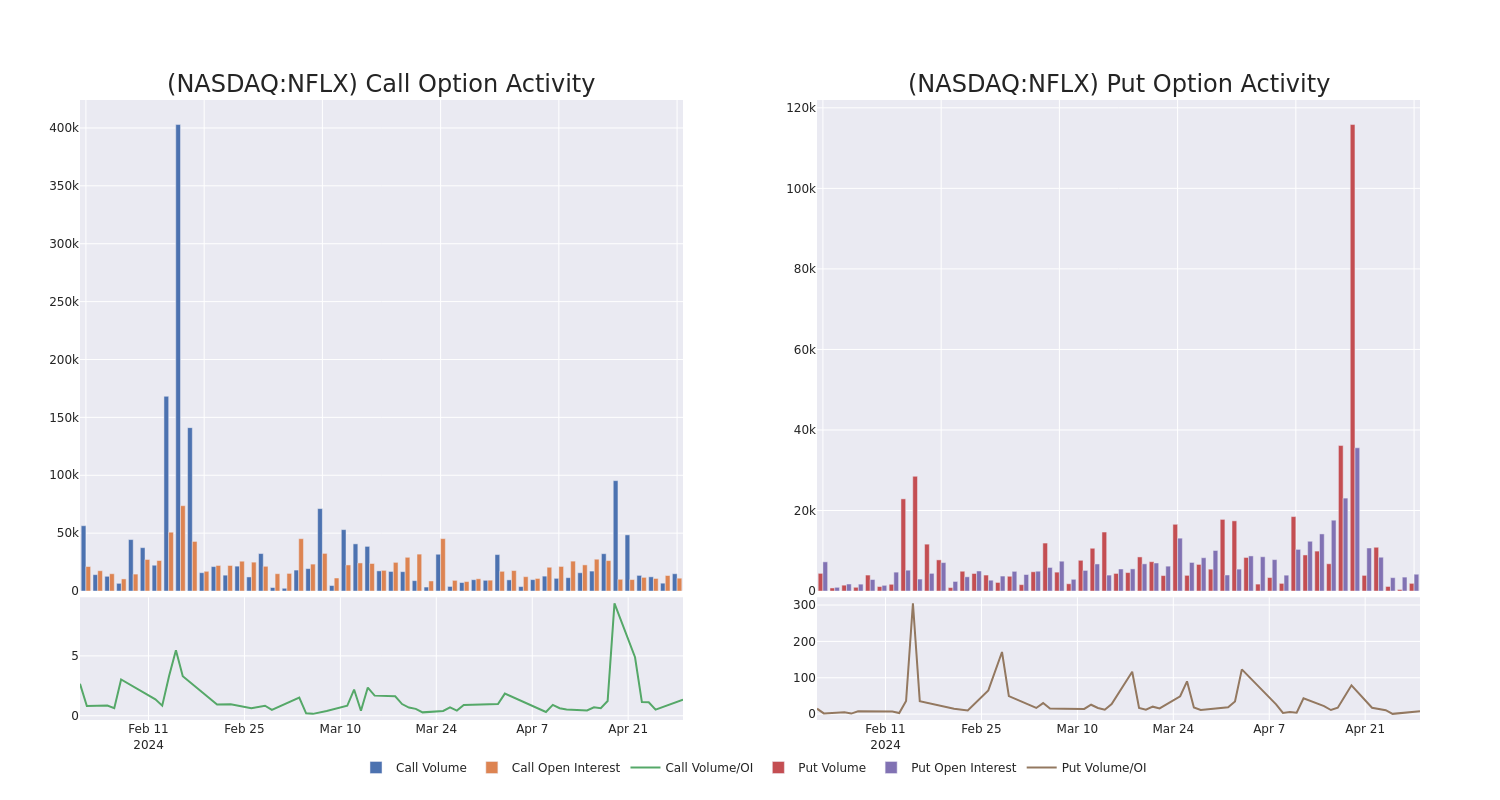

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Netflix's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Netflix's whale trades within a strike price range from $557.5 to $650.0 in the last 30 days.

Netflix Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| NFLX |

CALL |

SWEEP |

BEARISH |

05/17/24 |

$2.81 |

$2.75 |

$2.75 |

$600.00 |

$82.5K |

4.1K |

303 |

| NFLX |

CALL |

TRADE |

BEARISH |

07/19/24 |

$32.25 |

$32.0 |

$32.0 |

$570.00 |

$64.0K |

361 |

3 |

| NFLX |

PUT |

SWEEP |

NEUTRAL |

05/10/24 |

$12.3 |

$9.7 |

$12.4 |

$557.50 |

$61.7K |

94 |

0 |

| NFLX |

CALL |

TRADE |

BULLISH |

05/10/24 |

$10.65 |

$9.6 |

$10.65 |

$560.00 |

$53.2K |

513 |

67 |

| NFLX |

CALL |

TRADE |

BEARISH |

09/20/24 |

$50.45 |

$50.1 |

$50.1 |

$560.00 |

$50.1K |

183 |

0 |

About Netflix

Netflix's relatively simple business model involves only one business, its streaming service. It has the biggest television entertainment subscriber base in both the United States and the collective international market, with almost 250 million subscribers globally. Netflix has exposure to nearly the entire global population outside of China. The firm has traditionally avoided live programming or sports content, instead focusing on on-demand access to episodic television, movies, and documentaries. The firm recently began introducing ad-supported subscription plans, giving the firm exposure to the advertising market in addition to the subscription fees that have historically accounted for nearly all its revenue.

In light of the recent options history for Netflix, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Netflix's Current Market Status

- Currently trading with a volume of 235,142, the NFLX's price is down by -0.4%, now at $557.26.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 78 days.

What The Experts Say On Netflix

In the last month, 5 experts released ratings on this stock with an average target price of $689.6.

- An analyst from Oppenheimer has decided to maintain their Outperform rating on Netflix, which currently sits at a price target of $725.

- An analyst from TD Cowen has decided to maintain their Buy rating on Netflix, which currently sits at a price target of $725.

- An analyst from BMO Capital downgraded its action to Outperform with a price target of $713.

- An analyst from Bernstein has decided to maintain their Market Perform rating on Netflix, which currently sits at a price target of $600.

- Maintaining their stance, an analyst from Macquarie continues to hold a Outperform rating for Netflix, targeting a price of $685.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Netflix with Benzinga Pro for real-time alerts.

Posted In: NFLX